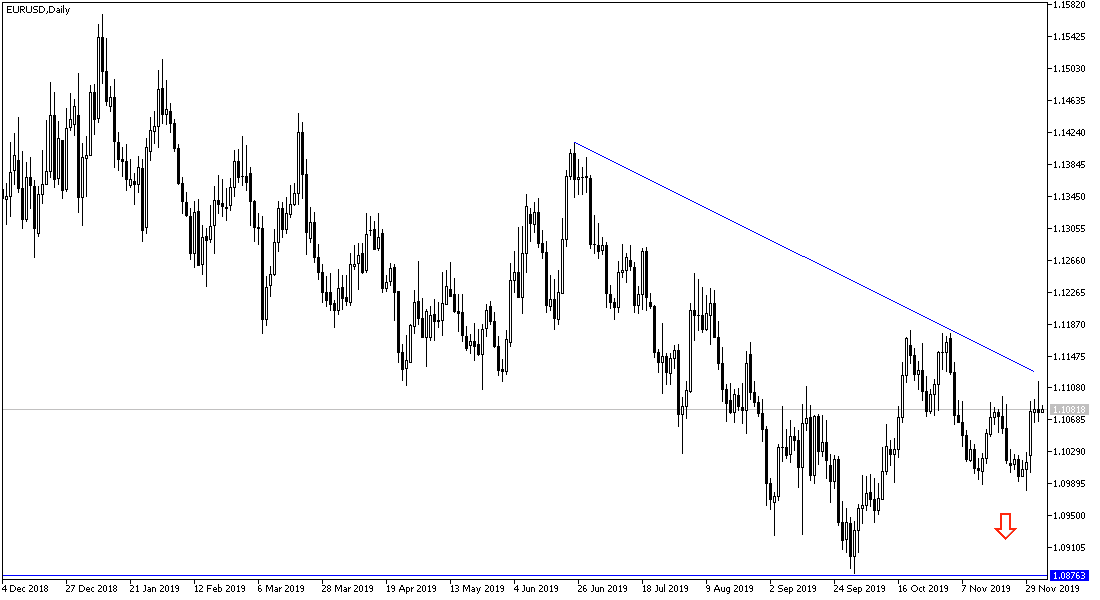

The recent EUR/USD correction attempts were capped by the move towards 1.1116 resistance and the closest to 1.1120 resistance, which gives it the opportunity to break the downtrend as seen on the provided daily chart. However, economic releases from the Eurozone does not help boos investors’ confidence in the Euro. Final IHS Markit survey data showed that private sector growth in the Eurozone remained the lowest in six and a half years in November, indicating modest growth for the fourth quarter of 2019. The composite output index remained flat at 50.6 in November. The reading was slightly higher than expected at 50.3. The services sector again remained the main driver of overall growth. Meanwhile, the manufacturing sector contracted in November.

Supporting the pair's gains, the US economy failed to meet expectations for new jobs, as the economy added a total of 67,000 new jobs in November, while forecasts were for a 140,000 new jobs from 125,000 in October. Details of the jobs report will be released from the US Department of Labor on Tuesday, which includes the change in the number of nonfarm payrolls, average hourly wages and the unemployment rate.

Pressure on the single European currency increased after the US Trade Representative recommended a 100% tariff on French goods worth $ 2.4 billion a year. France is seeking to impose tough taxes on major US companies. There are fears that the trade war will shift from China to the EU, threatening the future of the important European auto sector. The Office of the US Trade Representative sees it as a threat to US national security.

According to the technical analysis of the pair: the EUR/USD is still in an upward correction that needs momentum to overcome the 1.1120 resistance and then to the 1.1200 resistance and higher if confidence in the Euro returned from the improvement of the European economy performance, taking into account that this will take more time. Investors are in a waiting position for further stimulus plans by the ECB under Lagarde. On the downside, the closest support levels are currently at 1.1035, 1.0980 and 1.0900 respectively.

As for the economic calendar data today: German factory orders, GDP, retail sales and employment change for the Eurozone will be released. During the US session, the US trade balance as well as unemployment claims and factory orders will be announced.