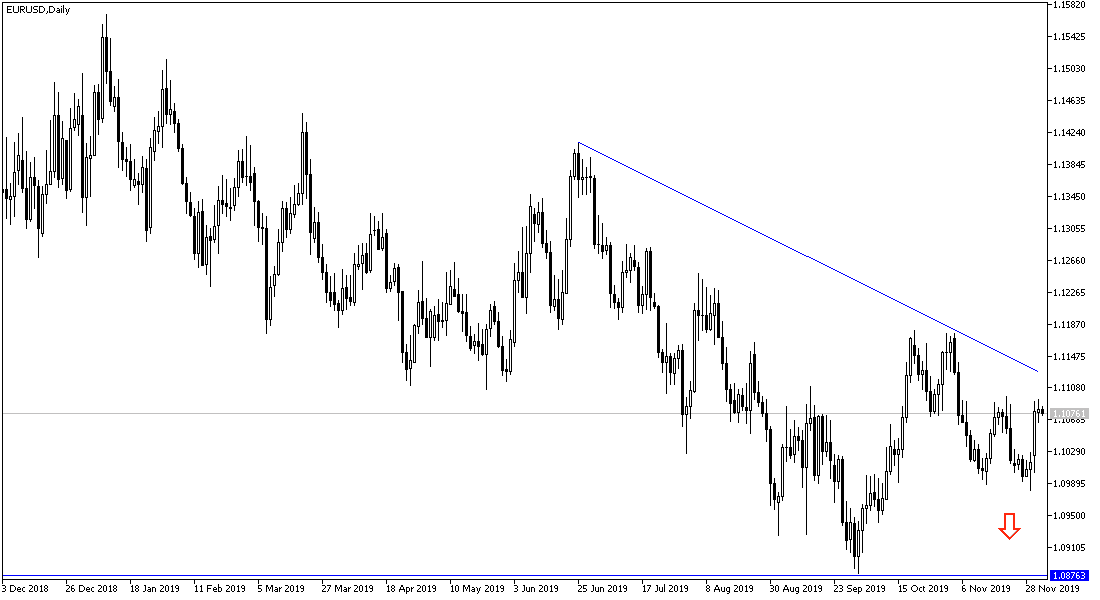

For three trading sessions in a row, the price of the EUR/USD stabilizes above the 1.1000 resistance, which keeps the pair stable from downward pressure. The recent gains have reached the 1.1093 resistance, and the pair is trying hard to breach that resistance for my sessions to have a stronger bullish correction. Gains were supported by the dollar’s decline, and not the strength of the Euro. The single European currency is still suffering from the slowdown in the Eurozone economy and the ECB's determination to continue stimulus plans to revive the block's economy, especially with expectations of a prolonged trade dispute between the United States and China. The Euro's gains were stalled by US retaliation to France's new digital services tax. Thus, the single currency may face new pressure in the coming days.

The Office of the US Trade Representative said late on Monday that France's new tax on online sales discriminated against US companies, ran counter to some international tax agreements and was "extraordinarily heavy" for US companies who implement them.

The trade representative recommended a tariff of up to 100% on French goods worth $ 2.4 billion a year. At the same time, Presidents Donald Trump and Emmanuel Macron expressed confidence at a NATO summit in London that differences over taxes and other issues could be resolved.

US trade officials also said they would now begin the process of increasing current tariff rates on some EU goods and fixing new products for new tariffs. The United States already targeted European exports of agricultural goods and aircraft in October after the World Trade Organization estimated its lost revenue to US companies at about $7.5 billion. The EU said the new WTO decision was not the basis for further US tariffs.

Monday's trade measures followed a mid-November deadline for a US decision on tariffs on EU car exports. President Donald Trump threatened to impose up to 25% duties on unfair European trade policies, which the USTR found to be a threat to US national security, although the deadline passed without announcing any action.

According to the technical analysis of the pair: The EUR/USD is currently ready to complete the correction taking advantage of the decline of the US dollar, but at the same time, will not have enough momentum for the correction to break the current trend, the Euro lacks investor confidence in the economic performance of the Eurozone, and waiting for more stimulus plans By the European Central Bank under the new leadership. In contrast, the US economy remains strong and the Fed will not cut interest rates at least until the end of 2019. Resistance levels supporting the correction strength are currently at 1.1120, 1.1200 and 1.1265 respectively. Any attempt to stabilize below 1.1000 will strengthen the bearish trend again.

As for the economic calendar data today: The Services PMI for the Eurozone economies will be released. The US ADP Non-Farm Payrolls Index will be released, followed by the ISM Services PMI and Crude Oil Inventories.