The dollar returned to the downside, and thus was an opportunity for the EUR/USD pair for an attempt to correct upwards, and gains reached the 1.1091 resistance before settling around the 1.1072 support at the time of writing. Attempts to rebound are still weak as pressure on the single currency continues to weigh due to the continued weak economic performance of the Eurozone led by Germany. Yesterday, the Eurozone Manufacturing PMI improved from an expected reading of 46.6 to 46.9 and 45.9 in October. The German Manufacturing PMI was at 44.1 from the expected 43.8 and the Manufacturing PMI may have reached its lowest level in September at 41.7. The French reading rose to 51.7 from an initial estimate of 51.6 and 50.7 in October. It hit a bottom in July at 49.7.

Italy fell to 47.6 from 47.7. March's low was 47.4. Spain bounced from a low of 46.8 in October to 47.5 in November. Overall, the decline in new orders slowed, and business confidence rose to a five-month high.

A political struggle within Germany is also adversely affecting the performance of the Euro as Angela Merkel's political opposition has increased. The German Social Democrats chose new leaders who were more critical of the alliance with Merkel's Christian Democrats.

It is USA. In a sign of continued weakness in the US manufacturing sector, the Institute for Supply Management released a report showing manufacturing activity contracted for the fourth consecutive month in November. The ISM Manufacturing PMI fell to 48.1 in November from 48.3 in October, and any reading below the 50 level indicates a contraction manufacturing activity. Economists had expected the index to rise to 49.2.

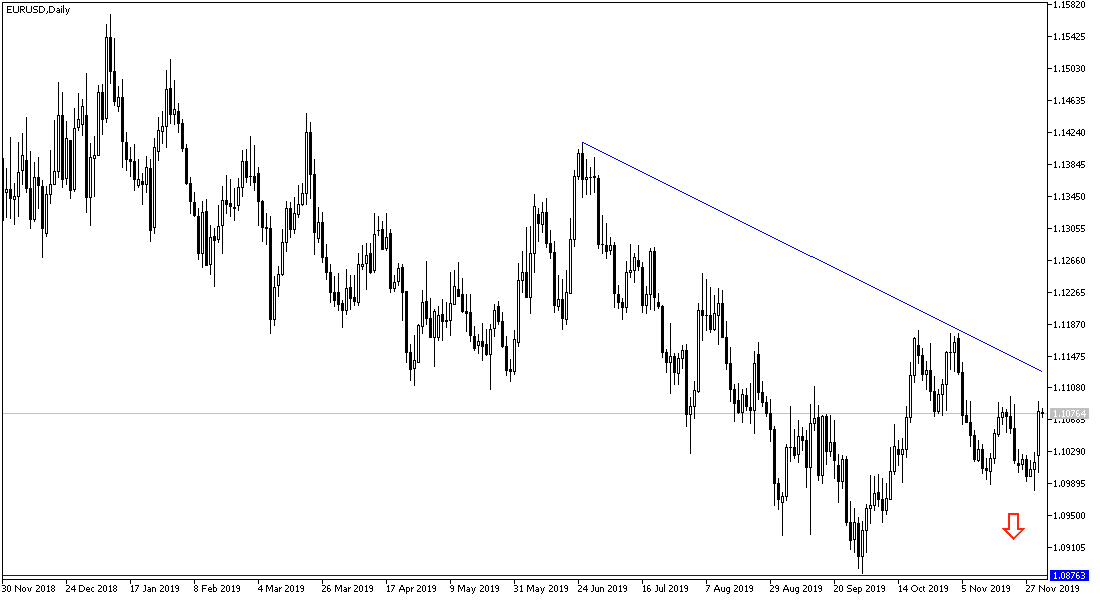

According to the technical analysis of the pair: Despite correction attempts the EUR/USD is still in a downtrend channel, and there will be no chance for a break and change direction without stability above 1.1120 resistance, which paves the way for the next most important resistance at 1.1200, and will be confirmed by a change in the direction of technical indicators. On the downside any return to break below the 1.1000 psychological support will keep bearish strength intact. Markets are cautiously awaiting the official and final signing of the first phase trade agreement between the United States and China.

As for the economic calendar data today: From the Eurozone, we will have the rate of change in Spanish unemployment and the producer price index for the Eurozone. There are no significant US economic releases today.