Financial markets returned to work again after the Christmas holidays, and the price of the EUR/USD pair remained stable around the 1.1086 level at the time of writing. For four consecutive sessions, the US dollar remained stronger against the other major currencies. On the other hand, the Euro is still suffering despite reassurance statements from both sides of the global trade war. US President Donald Trump recently stated via his Twitter account that China has already started "large-scale purchases" of agricultural products it had agreed to make as part of the "Phase 1 deal" that was said to have been made last week and that the celebration is being organized for the official signature on him.

On the other hand. A spokesman of the Chinese Ministry of Commerce told a press conference that the contents of the deal will not be announced until after the signing ceremony.

Confirming Trump’s statement, the White House said China had agreed to make regulatory changes and buy large quantities of agricultural products. Since then, US officials have claimed that agricultural purchases will total $32 billion over two years, and that China's imports will rise by a total of $200 billion. Trump's comments helped push US stock indexes to record highs.

Currency movements may remain calm, limited, and in tight ranges until markets return to normal status next week after the holiday season ends.

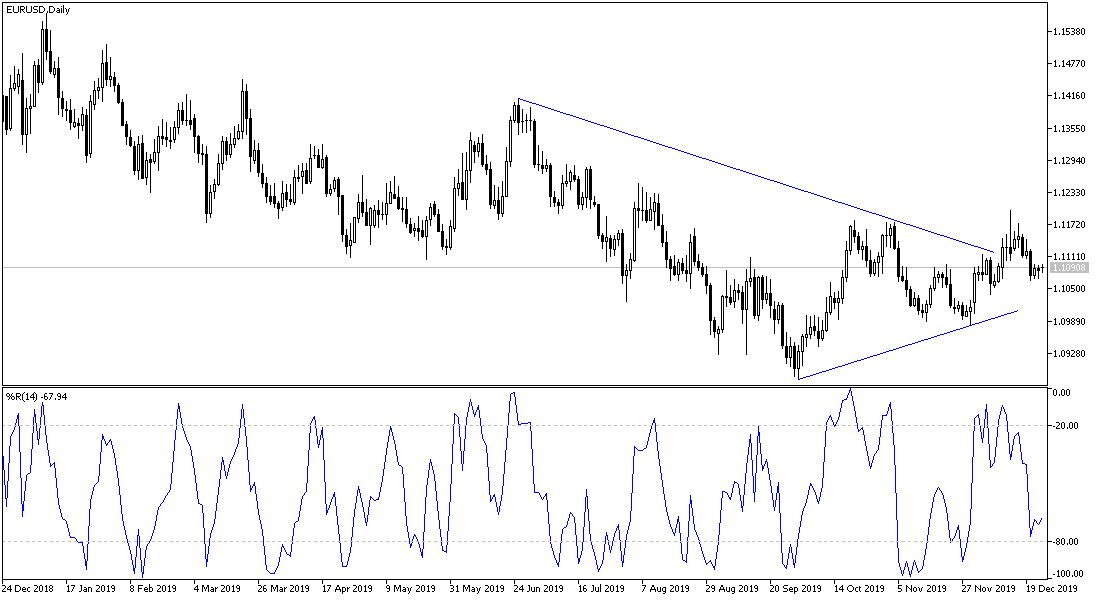

According to the technical analysis of the Pair: There is no significant change in my technical view of the EUR/USD pair, so the upward correction still needs more impetus and the rush back towards 1.1120 and 1.1200 resistance levels will increase the strength of the upward correction. On the other hand, any attempt by the pair to collapse below the 1.1000 support, will collapse the upside expectations and then the pair will start returning to the downward path, which still controls the pair’s performance on the long run.

Today's economic calendar does not have any important economic data from the Eurozone. From the United States of America, only weekly jobless claims will be announced. Tomorrow, the monthly report from the European Central Bank and US crude oil stocks will be announced.