The EUR/USD price of got a new impetus in an attempt for an upward correction with gains pushing it to the 1.1144 resistance, the highest level in more than a month. The pair is trying to stabilize its gains ahead of an important date today; as the results of the first meeting of the European Central Bank under the leadership of Christine Lagarde. The gains in the pair were supported by statements by Federal Reserve Governor Jerome Powell, in which he stressed that the Federal Reserve Board is ready to keep the interest rate at very low levels for at least the next year - and possibly for a longer period.

This prediction is supported by the growing belief of Fed officials that inflation will remain weak, even as the economy continues to grow modestly, and the labor market remains robust. Powell suggested in his press conference that the lowest unemployment rate in half a century - 3.5% - would not necessarily lead to higher inflation as in the past. Yesterday, the Federal Reserve kept interest rates in a low range from 1.5% to 1.75% after having cut it three times this year. Powell previously described those interest rate cuts as "insurance" that would offset the effects of the trade war between the United States and China and the global economic slowdown.

As for today’s expectations from Lagarde, she is not expected to announce any changes to the bank's interest rates nor for the bond stimulus program when she holds her first meeting and press conference to determine the interest rate today. The bank issued a stimulus package last September to push the economy in the face of headwinds such as the trade conflict between the United States and China and Britain's departure from the European Union.

Today's meeting is the first opportunity to hear how Lagarde communicates with markets and the public, a key task for an institution ruler affecting the lives of 342 million people. It is not an easy task; the bank's policy to keep key interest rates below zero has been criticized by the German media as punishing savers, while any inaccurate note from Lagarde could lead to major market moves.

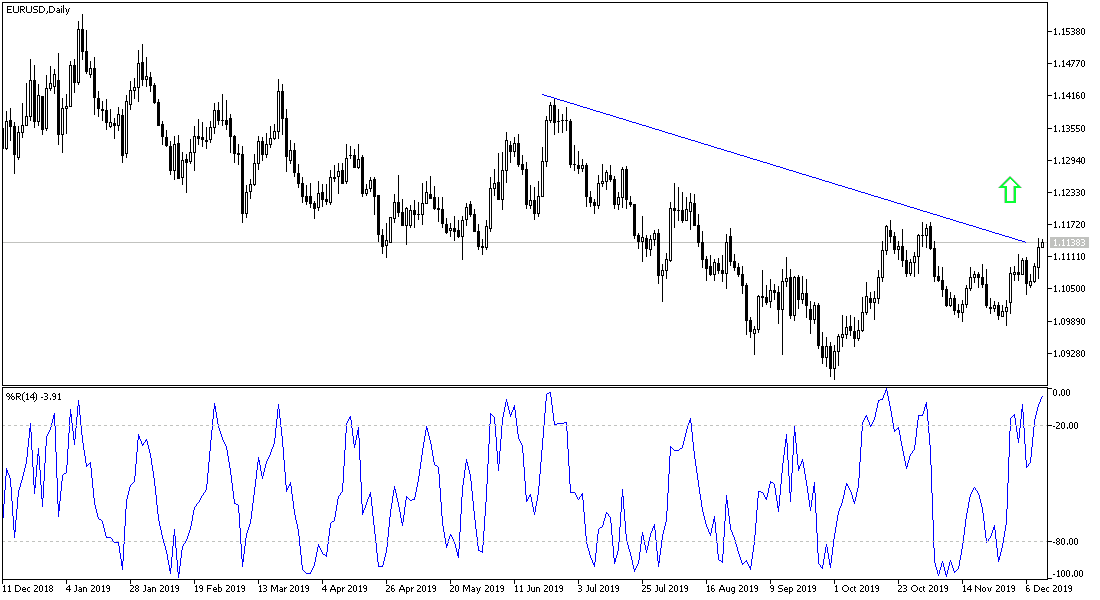

According to the technical analysis of the pair: The price of the EUR/USD pair succeeded in surpassing the 1.1120resistance level, which we stressed that it may support the beginning of breaking the downtrend and for the continuation of reflecting strongly on the pair to move up towards the tops of 1.1185, 1.1265 and 1.1320, respectively, and performance on the daily chart is the best proof. On the downside, the 1.1000 psychological support will remain a confirmation of the continuation of the downtrend. Care must be taken until the important update from Lagarde’s remarks is received today.

As for the economic calendar data today: The Euro’s performance will depend on the results of the European Central Bank’s monetary policy decisions and Lagarde’s statements. The US dollar will be affected by the announcement of the producer price index and the claims of the unemployed.