The price of the EUR/USD will receive the monetary policy decisions of the US Federal Reserve Bank during the trading today, a day before the European Central Bank announces its policy decisions in the first official meeting of the bank under the leadership of Christine Lagarde. The pair tried to rebound with gains that reached 1.1097, where it is stable around at the time of writing, with the support of the better than expected results of the German economic, rising hopes that the German economy is trying to recover from the consequences of the global trade war that paralyzed the euro zone economy.

The US interest rate is expected to remain unchanged. The Fed announced in October that it would buy billions of dollars a month of treasury bills, and such purchases boost banks ’cash reserves and provide more money for short-term lending. The Fed also provided additional liquidity through temporary loans and other short-term loans. Together, operations increased the Federal Reserve's budget by $300 billion.

Powell asserts that these purchases are aimed at improving the performance of the financial system, not lowering prices. This makes it different, he says, from the massive bond purchases made by the Federal Reserve during the Great Recession and its aftermath, when the central bank sought to cut long-term borrowing rates to stimulate spending and economic growth.

In the same context, the European Central Bank - like the US Federal Reserve and several other central banks around the world - has cut interest rates to combat economic weakness amid a trade dispute between the United States and China that threatens to disrupt exports that are essential to the global economy. But some experts question whether more monetary stimulus such as lower interest rates could really help the economy, as rates have remained low for more than a decade since the global financial crisis.

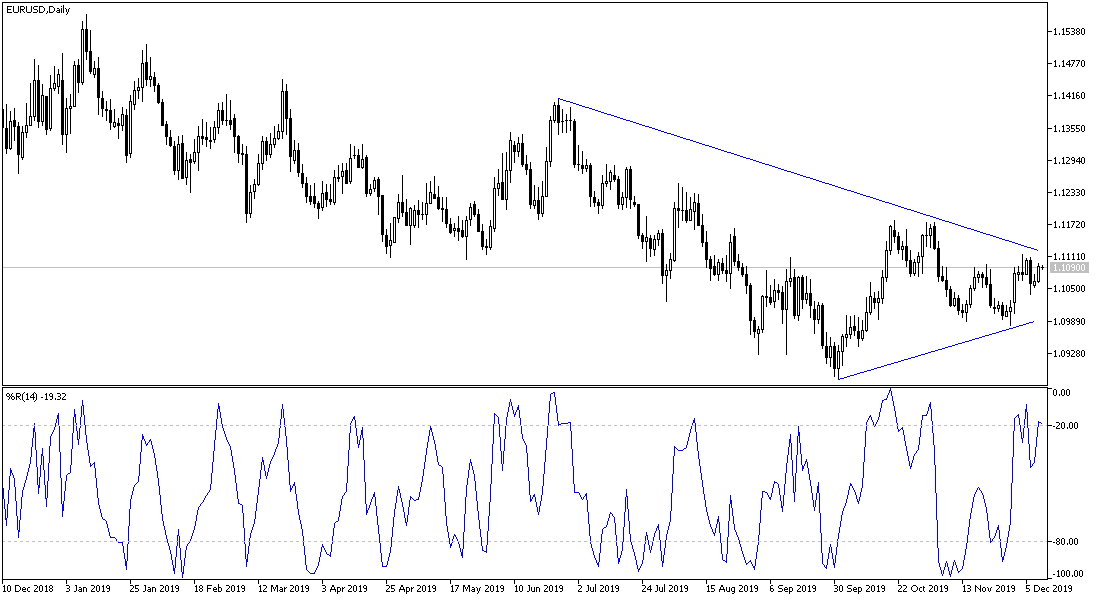

According to the technical analysis of the pair: Despite the recent rebound in the price of the EUR/USD, the pair is still in a long term bearish direction, and the return to the vicinity of the 1.1000 psychological support, and the stability below it, supports this trend and increases the selling operations. On the upside, the success of the recent bounce will depend on the pair's ability to rush towards the resistance levels of 1.1120, 1.1200 and 1.1275, respectively. This may happen quickly if the Phase 1 trade agreement between the United States and China is announced.

As for the economic calendar data today: All focus will be on the US session data, with the announcement of US inflation figures, according to the consumer price index and then US oil stocks. Also, decisions of the monetary policy of the US central bank, then the statements of its governor Jerome Powell.