We did not witness any strong movement for the EUR/USD in the beginning of this week’s trading, as the pair moved in a narrow range from yesterday between 1.1053 and 1.1077, before settling around 1.1065 at the time of writing, and before the announcement of the important German ZEW index. The price returned to move under downward pressure again with its failure to overcome the important 1.1120 resistance, and the positive US job numbers that came stronger than expected. Yesterday, German export grow unexpectedly despite trade disputes and the global economic slowdown, while imports remained constant in October, and figures from German statistics agency Destatis showed that exports witnessed a growth of 1.2 percent on a monthly basis in October, which It overwhelms expectations of a 0.3 percent decrease. However, monthly growth fell from 1.5 percent in September.

Meanwhile, imports remained unchanged from September, when they increased by 1.2 percent. Economists had expected a 0.1 percent decrease. As a result, the trade surplus increased to 20.6 billion Euros, which is adjustable from 19.2 billion Euros in September.

In the same context, data from a survey of behavioral research institute Syntex showed that investor confidence in the Eurozone improved for the second month in a row to its highest level since May, and business expectations were the strongest in nearly two years, indicating that recession fears have subsided. Accordingly, the Sentix Business Confidence Index increased by 5.2 points to 0.7 in December. Economists had expected the reading to get worse to -5.3 from -5.5. The last reading was the highest since May 2019.

The results compensated somewhat for the announcement of a decline in German industrial production at the fastest pace in six months in October, driven by a sharp decline in capital goods production in October, and in general, the German economy remains the main driver of the Eurozone economy, suffering from the length of the trade dispute between the United States of America and China, and with time, expectations are increasing for the continuation of this conflict, as we are closer to December 15, which will impose a new batch of US tariffs on the remaining Chinese imports.

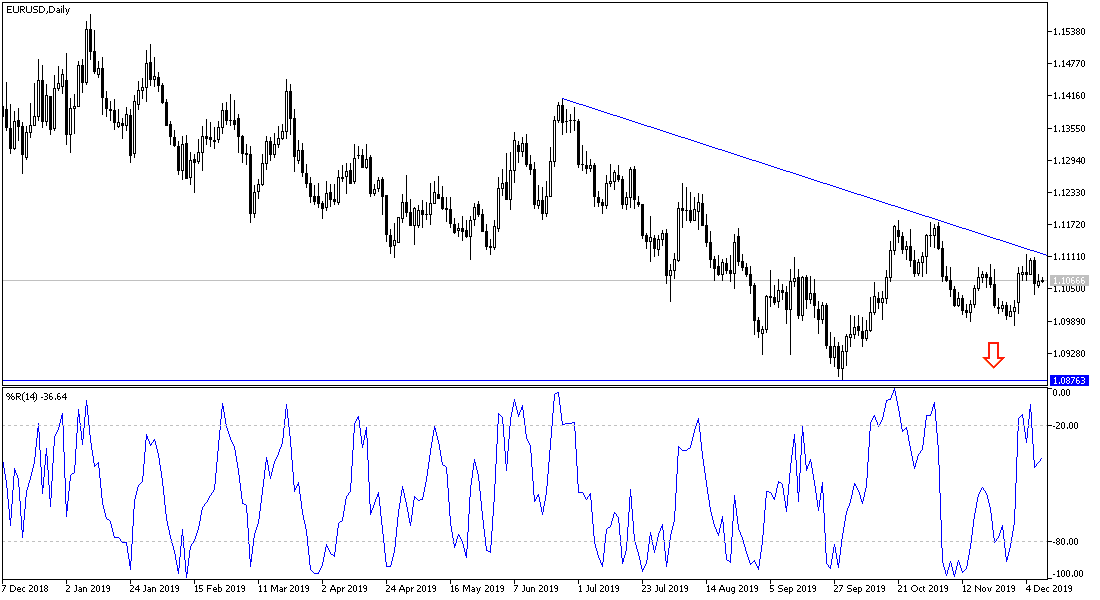

According to the technical analysis of the pair: There is no change in my technical point of view. With the EUR/USD pair going testing the 1.1000 psychological support, it will end the hopes of completing the recent bullish correction, which failed to overcome the 1.1120 resistance, which still represents the necessary momentum for the success of the correction. 1.1000 Support will increase the selling on the pair again, and the support levels at 1.0985 and 1.0880 will be the following targets. The divergence of monetary policy between the Federal Reserve Bank and the European Central Bank, and economic performance between the United States and the Eurozone, are still strong pressure factors on the pair’s attempts to make gains.

As for the economic calendar data today: From the Eurozone, French industrial production and the ZEW index of German economic sentiment will be announced. From the United States non-agricultural productivity and unit labor costs will be announced.