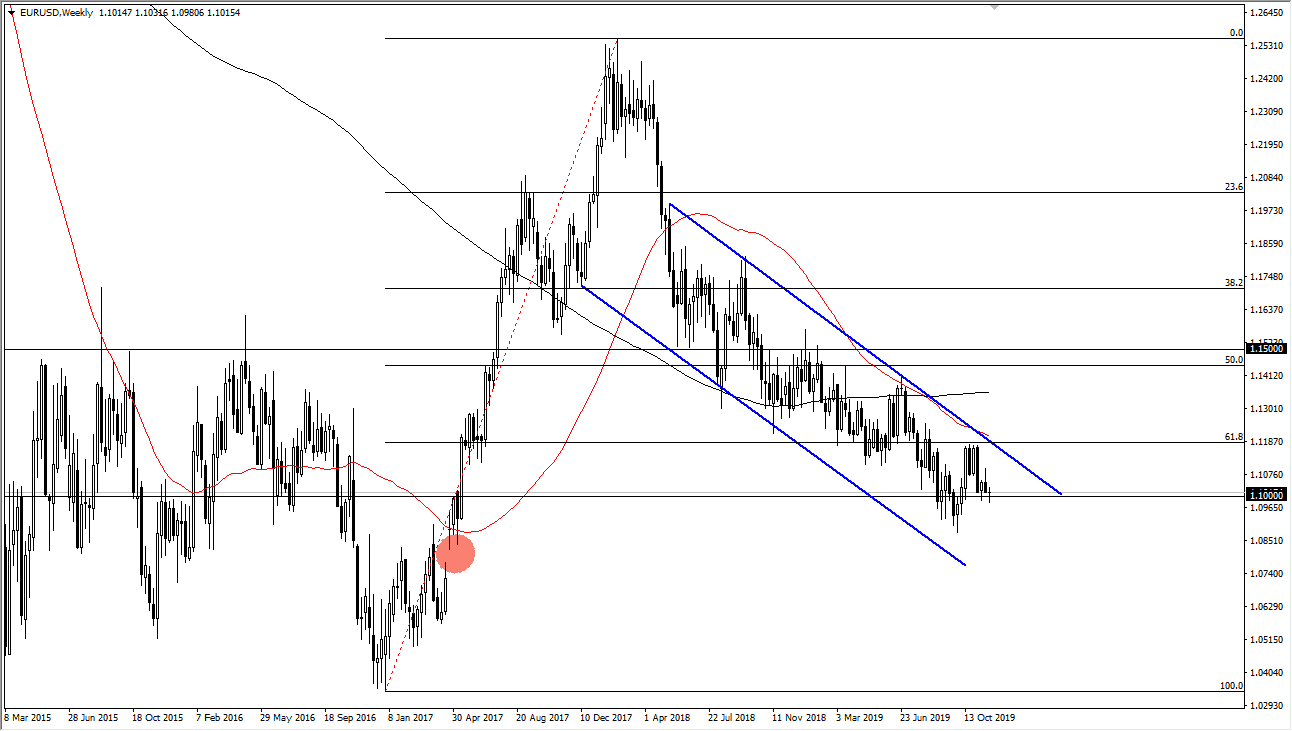

Looking at the Euro, you can see it has been more choppy behavior over the last month or so. However, when the 1.12 level was tested last month, the market hit that level for time before breaking down rather significantly. At this point, it’s likely that technical patterns should be paid quite a bit attention to, as it is a “four high, low close” pattern. We have since seen the 1.10 level offered quite a bit of support, and at this point it’s likely that it will continue to be a difficult piece of real estate on the map.

That being said, I do think that the market will eventually break down a bit, reaching towards the 1.09 level, and then eventually the 1.0850 level. Another thing to pay attention to is the fact that there is a gap closer to the 1.0750 level, so therefore we will probably have to drop in order to fill that level. Unfortunately, this pair moves to slow to make that happen this month, but it is something that I am looking at longer term. It should also be noted that the 50 week EMA is tracing right along the line of the top of the channel. All things being equal I believe that the Euro will continue to drift lower, but “drift” would be the key word. After all, this pair does not tend to move very fluidly, and most certainly hasn’t the last couple of years.

By the end of the month, I would anticipate that we will be lower, but probably not that much lower. I anticipate somewhere around 1.09 would be targeted, and unless you are a short-term trader, it’s going to be very difficult to trade this market for any type of profit. That being said, short-term traders that see signs of exhaustion after a rally will probably continue to flock towards this market. Christine Lagarde is taking over the ECB, and she is known as being very loose with monetary policy. This of course will continue to put downward pressure on the Euro as well. Beyond that, the economic figures coming out of the European Union have been very lumpy, meaning that some numbers in certain countries have been better than others, but on the whole, they haven’t been great anyway. With that being the case, the market is likely to continue to favor the US dollar, because the European Union is simply too unstable right now.