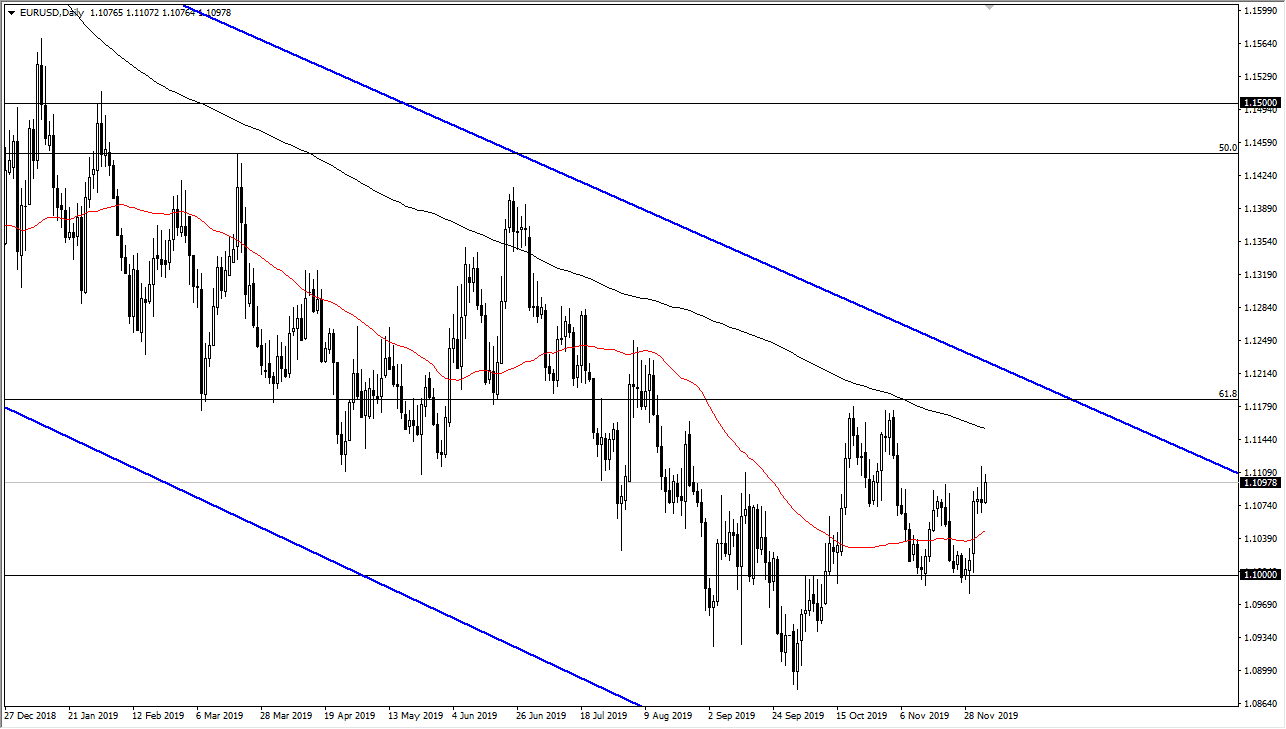

The Euro rallied a bit during the trading session on Thursday, but it still did not break above the top of the shooting star from Wednesday. If we did, that would be rather bullish sign as it would trap a lot of short sellers, but at this point there are plenty of reasons to think that the area above will still hold as resistance anyway. Remember, the Euro is a very choppy in short range type of currency pair, so looking for some type of major breakout at this point is probably asking quite a bit.

In order to have that longer-term break out to the upside, the market would need to see the 200 day EMA broken above, and then perhaps even the 1.12 handle. We have been in a downtrend for so long it simply easier to fade short-term rallies that show signs of exhaustion. At this point, I’m looking for signs of exhaustion that I can take advantage of, as the longer-term downtrend is still very much intact. With that in mind I think that the 1.11 level continues to be a major thorn in the side of the buyers, and I suspect that if we get too far above there, we will see sellers chop back in. Keep in mind that during the Friday session it is possible that we see some volatility due to the jobs figure.

Non-Farm Payroll comes out at 8:30 AM in New York and will throw a lot of volatility and that the currency markets. That being said though, the Euro rallying against that figure is probably going to be a nice selling opportunity as it goes against the longer-term trend. In the intermediate trend, it looks as if we are of bouncing around between 1.10 on the bottom at 1.12 on the top. I think we simply are kind of close to “fair value” for short-term trading so it makes quite a bit of sense that we are hanging out here. That being said, if we do make a move towards the 200 day EMA I expect that the sellers would jump in and take advantage of “cheap dollars”, as it would give in a short-term opportunity. On the other hand, we were to break down below the 1.10 level then it’s a selling opportunity as well, as we would more than likely go looking towards 1.09 level after that.