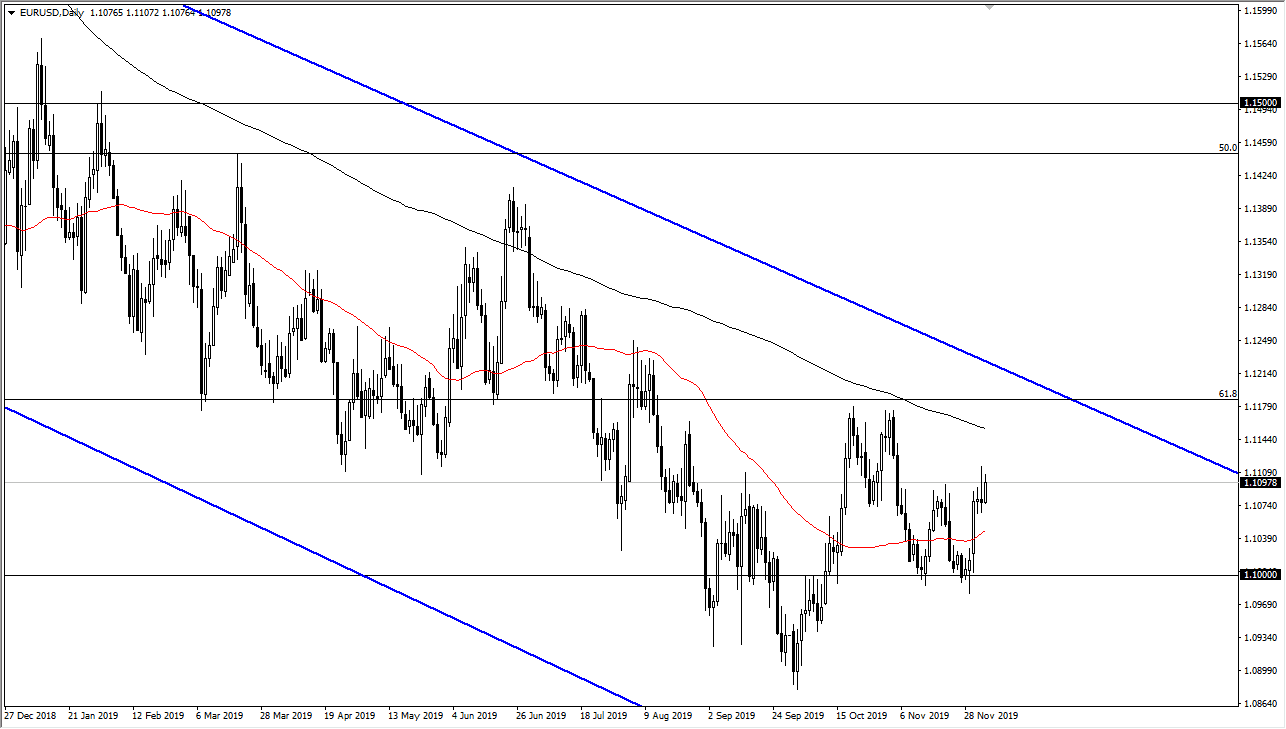

The Euro fell during the trading session on Friday, as we continue to see a lot of downward pressure on the common currency. We obviously had a stronger than anticipated jobs number coming out the United States and that of course puts a lot of people long of the US dollar. At this point, the market is likely to continue to reach down towards the 1.10 level underneath. If we were to break down below the 1.10 level, then it’s likely that the market will probably go looking towards the 1.09 level. That has been a massive support level underneath, and as a result it will be very difficult to break down through.

If we were to break down below the 1.09 level, it’s likely that the market would then go looking towards the 1.0750 level where there is a gap that has yet to be filled. Longer-term traders will continue to push towards that area and quite frankly with the European Central Bank looking to loosen monetary policy, it’s likely that the Euro continues to drop from here. Ultimately, rallies should continue to be sold, and I think that as long as we stay below the 1.12 level it’s very likely that we will continue to offer massive resistance on rallies.

This is a market that is likely to be very choppy and negative overall, so I am waiting to see whether or not the market gives me an opportunity to pick up the US dollar “on the cheap.” If that’s the case, then it’s likely that we continue to go much lower, based upon the longer-term trend and gives more room to run. I have no interest in buying until we break above the 1.12 and on at least a daily close, if not a weekly close. Yes, this is a pair the does chop around quite a bit but given enough time it’s likely that the overall malaise with the European Union continues, especially with the United States putting out strong employment figures. Ultimately, I believe that the trend is set and probably will continue to be very negative for the foreseeable future. It may take some time to get down to the 1.0750 level, perhaps even months but I do think that is our destination eventually. Having said that, if we were to break above that 1.12 level, we could go looking towards the 1.15 level.