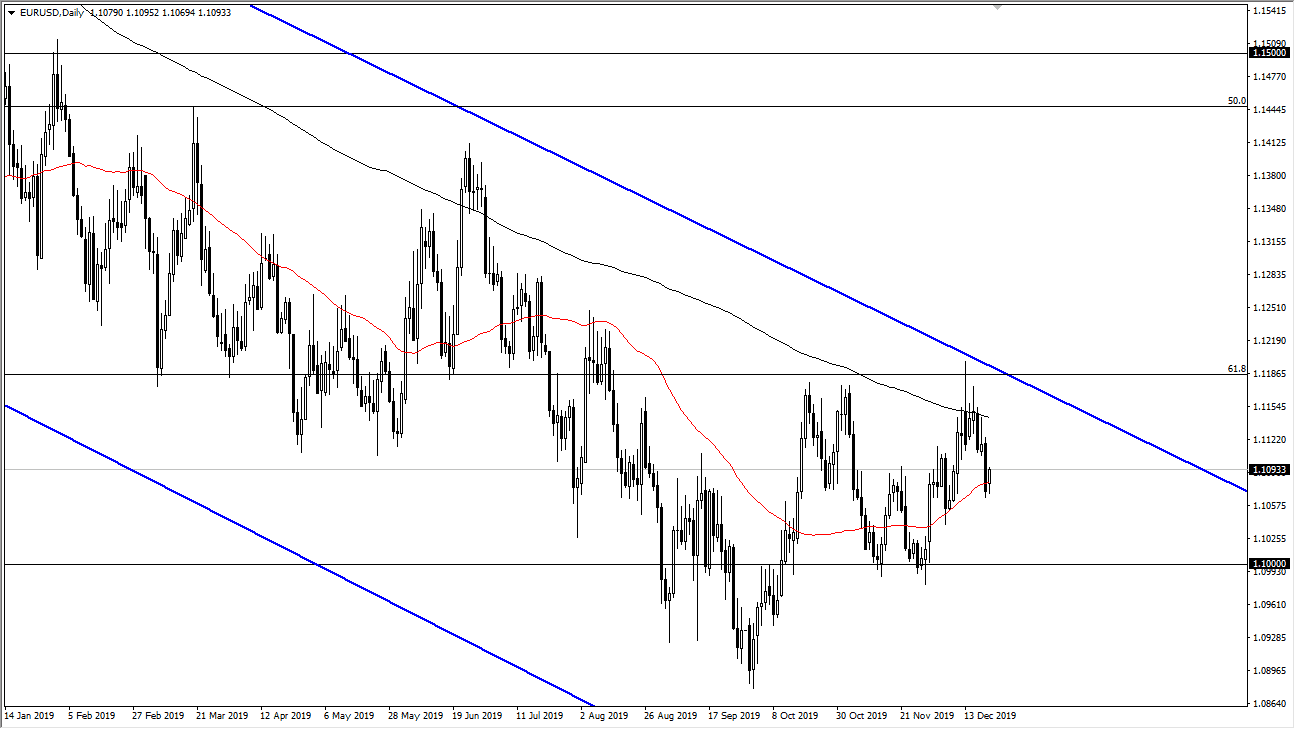

The Euro has rallied nicely during the trading session and low-volume at the 50 day EMA to kick off the week for Monday. Ultimately though, the 50 day EMA has been slumping higher so it should not be a huge surprise that the Euro rallied a bit. Furthermore though, the 200 day EMA is reaching lower levels so it’s more than likely going to be an area that traders will have to make some type of decision at. One of the things that may predicate the idea of a decision being put on hold though would be the holiday season and of course the low-volume. Christmas Eve isn’t exactly one a lot of traders like to put a ton of money to work, so it would not be surprising at all to see this market do very little.

We are in a longer term downtrend and that is something that you should keep in mind regardless. I believe that the 1.12 level continues offer massive resistance just as the 200 day EMA does. The downtrend line in the channel of course will influence this market and therefore I think at this point there are far too many resistance barriers above the suddenly get bullish. I believe that the European Central Bank will continue to be very loose with its monetary policy, and as a result we will continue to struggle when it comes to pricing the Euro.

Ultimately, if we were to break above the 1.12 handle, then it’s likely that the market will break out significantly and go looking towards the 1.14 handle, and then of course the 1.15 handle after that. The Euro might get a bit of a boost if the economic numbers continue to cause a bit of uncertainty when it comes to the US economy, because it could have people looking to the Federal Reserve for monetary policy, which of course would drive down the value of the US dollar if they suddenly got even looser with monetary policy. All things being equal though I think that the short-term rally will probably be a nice shorting opportunity near the 200 day EMA as we have seen the Euro rally a bit several times, only to rollover yet again. There is still a gap underneath at the 1.0750 level that has yet to be filled for what that’s worth. I believe rallies continue to be sold into.