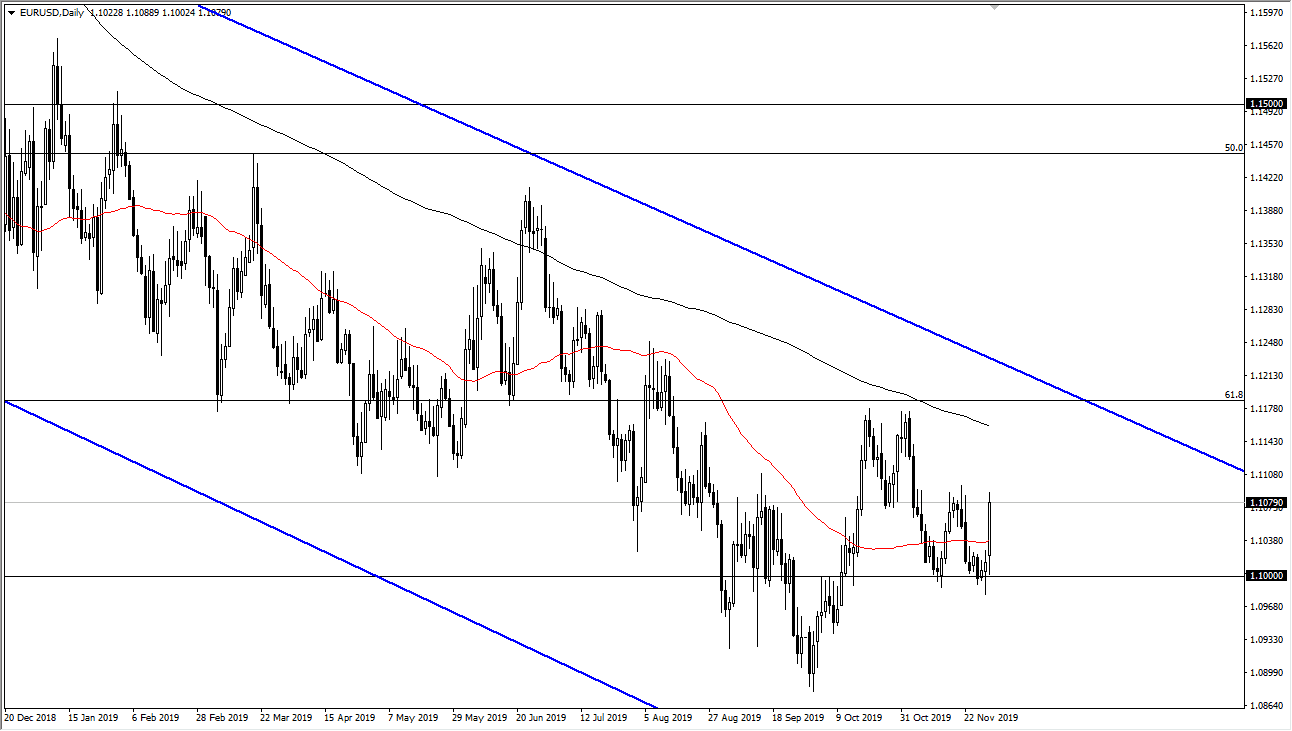

The Euro rallied rather significantly during the trading session on Monday, reaching towards the 1.11 USD level. However, the market has pulled back slightly late in the day, which makes sense considering it was previous resistance, and of course previous support. Is essentially the middle of a range that I think we will be trading in over the next couple of weeks, but we are still very much in a downtrend. With that in mind I like the idea of fading the Euro, not buying it.

On signs of exhaustion I am a seller, and I do believe that the 1.12 level above will be massive resistance as well. With that, I think it’s only a matter of time before the sellers come back in and push this market lower. I think that the 200 day EMA above is something you should be paying quite a bit of attention to, as it is a large indicator for trend overall. Alternately, if we were to turn around a break down below the 1.10 level, it’s likely that the market goes down to the 1.09 handle. Below there, the market then goes looking towards the 1.0750 level as it is the scene of a major. Ultimately, this is a technically negative market, and even though we have had such an explosive Monday, this was probably more or less a reaction to the ISM Manufacturing PMI figures in the United States more than anything else. Don’t forget that the European numbers were also negative, but quite frankly I don’t think that was a huge surprise.

It’s not until we break above the 1.12 level on a daily close, or perhaps even a weekly close that I would consider buying this pair. I have no interest in trying to fight the trend, so a simple matter of patience probably comes into play when it comes to shorting this market. The bullish candlestick the form for the trading session on Monday of course is rather impulsive, so if you do try to short this market may find yourself on the wrong side of the trade rather quickly. I essentially look at the 1.11 level is a place to put your stop loss is just above, and then the same thing at the 1.12 level if you do short. A breakdown below the bottom of the candlestick for the previous session allows me to get a little bit more aggressive to the downside.