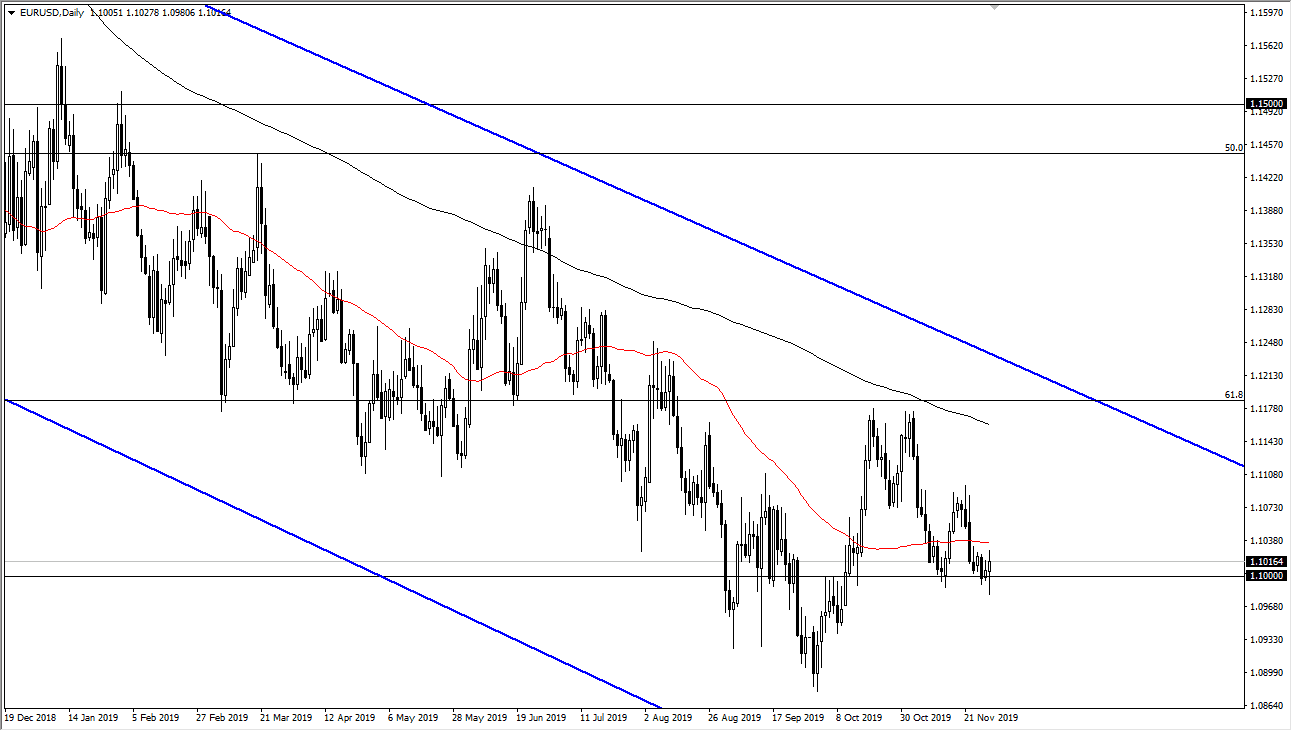

The Euro has gone back and forth during the trading session on Friday, in a sign that the 1.10 level continues to be crucial. This is an area that will attract a lot of attention in general so it’s not a huge surprise that we have seen the candlestick form the way it has. Beyond that, there has been a lack of volume due to the fact that it is the day after Thanksgiving, so that of course will come into play as well. With that being the case I like the idea of trying to trade back and forth. If we can break down below the bottom of the candlestick for the trading session on Friday, that is a market that goes down to the 1.09 handle. At this point, the 50 day EMA above continues offer resistance, and therefore break above there would be a positive sign, but there are still plenty of reasons to think that there is significant selling pressure after that.

The 1.11 level should cause a significant amount of resistance, and then after that the 1.12 level will as well. I think it’s only a matter of time before the market participants sell this market, as signs of exhaustion will continue to be a major possibility. The 1.09 level underneath would be massive support, but if we break down below there it’s very likely that the Euro will continue to see the market looking to push towards the gap at the 1.0750 level. That is an area that should continue to be crucial as support, and of course be a bit of a magnet for price. Over the longer term we continue to grind lower, but rallies do occur occasionally, only to be sold again. It is a very messy marketplace, and I don’t see that changing anytime soon. That being said, you should keep in mind that the European Central Bank should continue to be very loose with its monetary policy, it’s very likely that we will continue to see the Euro drift lower. Until something drastically changes in the European Union, this is a market that continues to be one that is a selling opportunity more than anything else. If you keep your position size small enough, you can simply sell and walk away, as most traders have probably done over the last three years. To the upside, it’s not until we break above the 200 day EMA that I would consider buying.