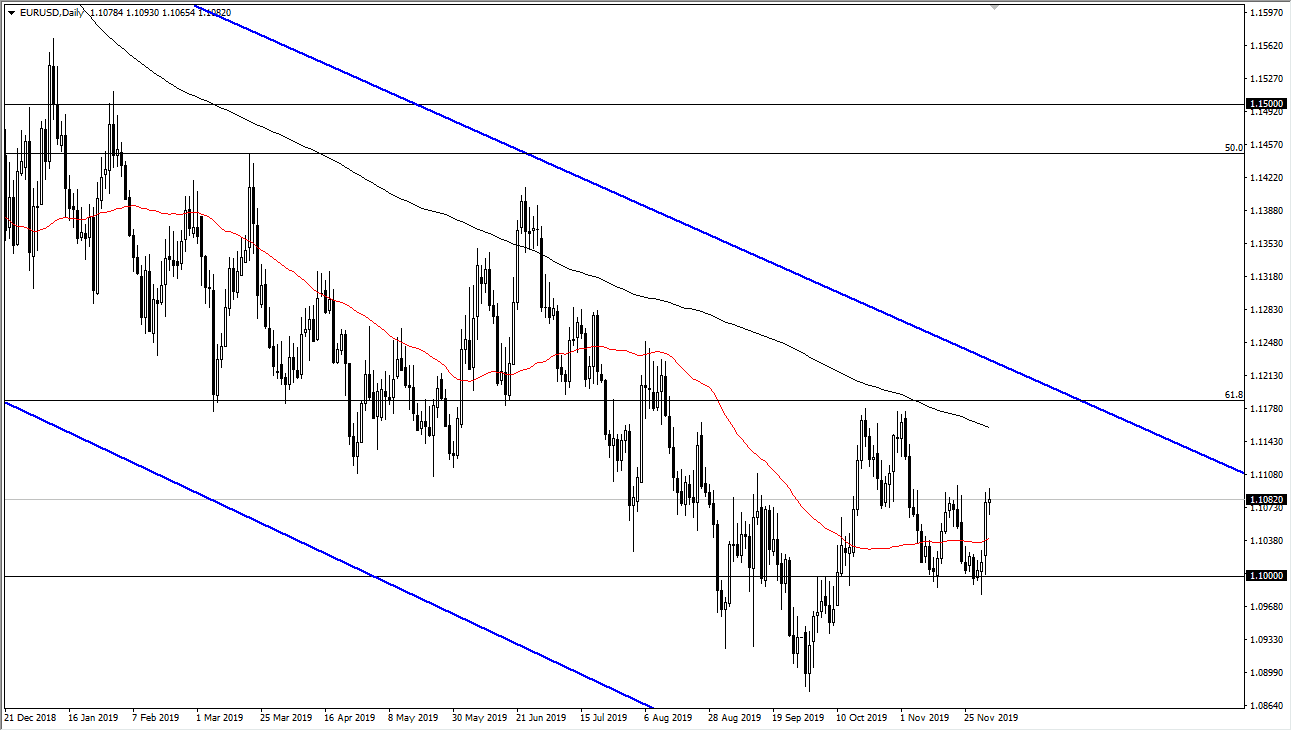

The Euro went back and forth during the trading session on Tuesday, as the 1.11 level is massive resistance, and it looks very likely to be an area that we will struggle with. At this point, the market looks as if it’s essentially stock in this area, between the 1.10 level on the bottom and the 1.11 level on the top. Above there, then the 1.12 level is massive resistance just as the 200 day EMA is. At this point, this is a market that will continue to chop around and do nothing, so it’s really not worth trading under most circumstances.

However, if you wish to run with the high-frequency traders, then breaking down below the bottom of the candlestick for the trading session on Tuesday does open up the move for about 40 pips to the downside. On the upside, if we were to break above the highs then we could go about 40 or 50 pips higher, but I don’t see this pair breaking out in one direction or the other. We have had manufacturing PMI figures come out of both economies that are weak. This is going to continue to be a major problem for this pair, and I think it just will continue more of the slow death that it has enjoyed for the last three years. Every time it rallies, it’s time to start selling again and if you are patient enough you will eventually end up in profit.

A breakdown below the 1.10 level opens up the door to the 1.09 level, and then possibly the 1.0750 level where there is a massive gap. I think at this point it’s very unlikely to break down below there, even if we get down there. Even if we were to get down there, at the speed this pair moves that might be a story for 2021. In all franc honesty, this is not a pair that I trade very often because quite frankly there is an enough fluid movement. If you are a short-term scalper, it’s the place for you but most trades are going to be of the 10 pips variety in this market. With that, the European Central Bank continues to ease monetary policy and while the Federal Reserve is on the side lines, it is very likely to do some type of quantitative easing or something along those lines down the road.