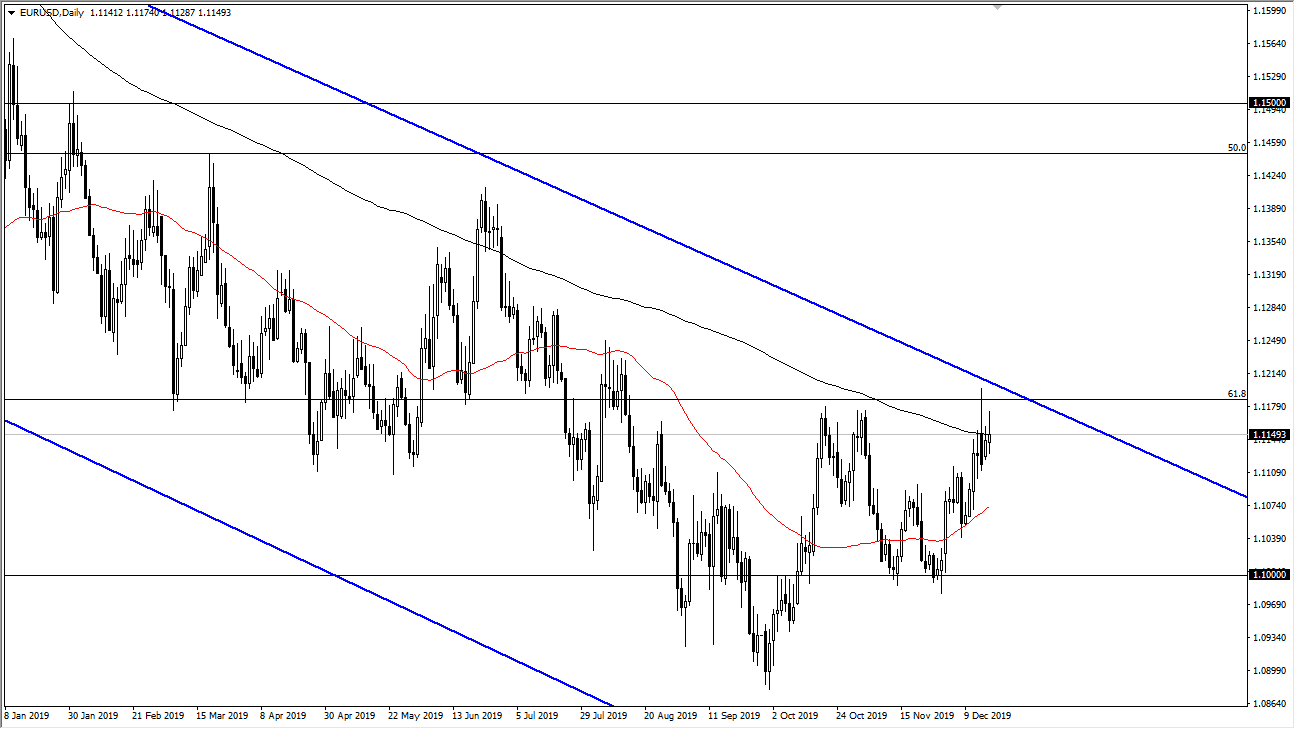

The Euro initially tried to rally during the trading session again on Tuesday but as we have seen multiple times, the market cannot hang out above the 200 day EMA for very long. With that being the case, I do believe that the Euro will rollover from here, and that it’s only a matter of time. Once we get that move it’s very likely we will go looking towards the 50 day EMA underneath which is currently at roughly 1.1060 below. Overall though, it makes sense that we rollover from here simply because the market is getting a bit exhausted and of course there are a lot of moving pieces out there that will continue to weigh upon the Euro itself. The ECB being loose with its monetary policy of course doesn’t bode well for the future of the Euro, but it should be noted that we are at least trying to make a move higher.

The 200 day EMA isn’t the only issue facing the Euro above though, we also have the 1.12 level which has a certain amount of psychological importance built in, and the downtrend line from the overall down trending channel. If we can break down below the bottom of the last couple of candles on the daily chart, the market is almost certainly ready to roll over and start breaking down. Ultimately, this is a market that I think will stay within the range between 1.10 and 1.12 between now and the end of the year. That being said, if we were to break above the 1.12 handle, at least on a daily close, then it’s very likely that we will then start going higher, reaching towards 1.14 level. In fact, there will be a lot of people out there discussing the idea of a potential trend change. I think it’s a bit unlikely though, so more often than not I think traders will come in to short this market on rallies. Ultimately, we are in the wrong time of year to expect a lot of monetary flow, and as we get closer to the New Year’s Day holiday, this market will slowly start to lose momentum. With that, I’m looking to fade any rally but I’m not looking for major movement between now and the beginning of next year. Ultimately, this is a market that continues to underwhelm and simply grind back and forth.