Tensions between NATO members France and Turkey have intensified with leaders from both countries lashing out in public. At the same time, the Eurozone manufacturing sector remains in a recession except for France. While France is home to the only Eurozone manufacturing sector in expansion, Turkey’s third-quarter GDP clocked in at 0.9% annualized and placed the country back on its growth track. The EUR/TRY ascended despite the positive news surrounding the Turkish economy and has now moved into its short-term resistance zone.

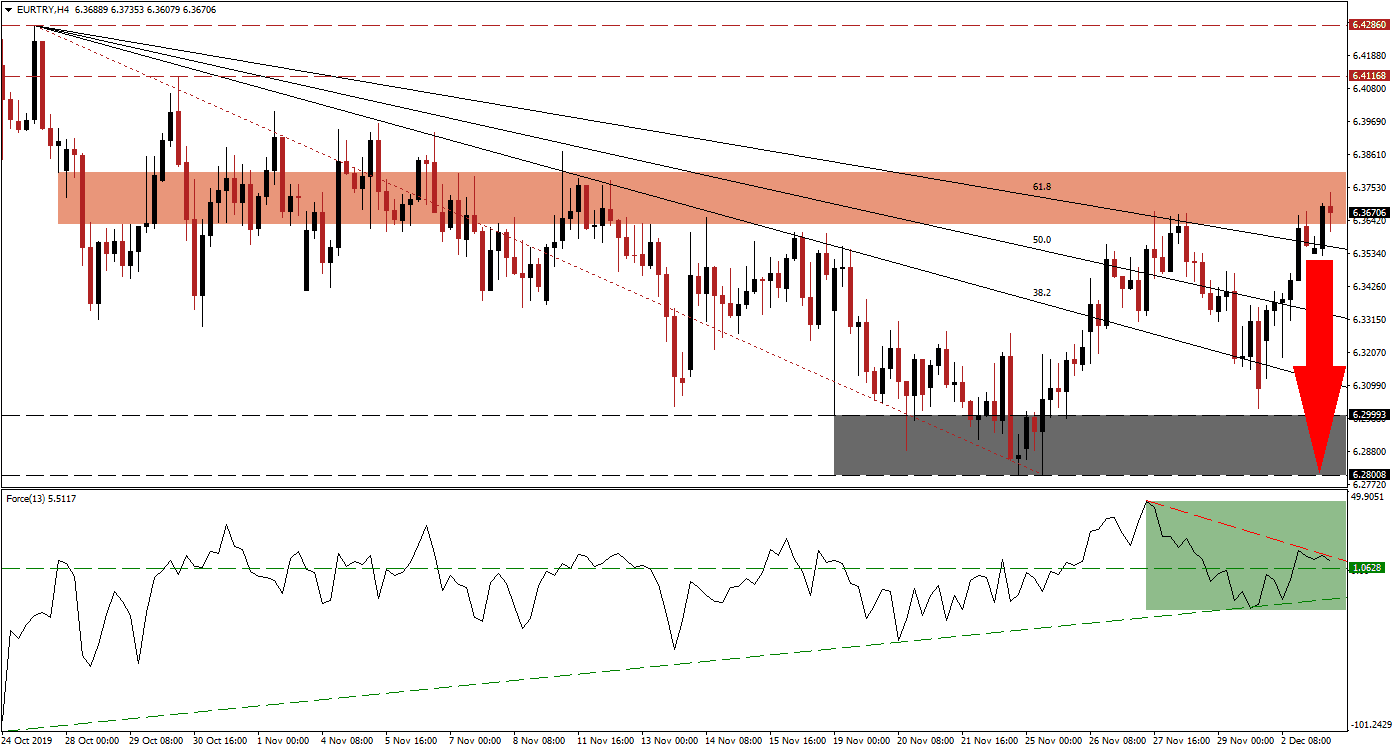

The Force Index, a next-generation technical indicator, started to contract before price action reached its resistance zone and a negative divergence formed as a result. This bearish trading signal suggests a breakdown is pending as bearish momentum is on the rise. The descending resistance level is pushing the Force Index to the downside, as marked by the green rectangle, and a breakdown below its horizontal support level is favored. This technical indicator is then on track to move into negative territory and place bears in charge of the EUR/TRY with a push below its ascending support level anticipated to follow. You can learn more about the Force Index here.

Forex traders are advised to monitor the Force Index as a breakdown below its horizontal support level is additionally expected to lead to a profit-taking sell-off in the EUR/TRY following a breakdown below its short-term resistance zone. This zone is located between 6.36310 and 6.38006 as marked by the red rectangle and a breakdown will push this currency pair below its descending 61.8 Fibonacci Retracement Fan Resistance Level. The Fibonacci Retracement Fan is then expected to guide price action to the downside.

Following a breakdown in this currency pair, the downside potential can extend into its next support zone which is located between 6.28008 and 6.29993 as marked by the grey rectangle. A breakdown in the Force Index below its ascending support level may result in a breakdown attempt below support, but a fundamental catalyst would be required. The next support zone awaits the EUR/TRY between 6.14473 and 6.17904. You can learn more about a breakdown here.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.36750

Take Profit @ 6.28250

Stop Loss @ 6.39000

Downside Potential: 850 pips

Upside Risk: 225 pips

Risk/Reward Ratio: 3.78

A breakout in the Force Index above its descending resistance level may inspire a breakout attempt in the EUR/TRY. Given the long-term fundamental outlook, the upside potential remains limited to its next long-term resistance zone located between 6.41168 and 6.42860 which marks an excellent short selling opportunity in this currency pair. The technical picture favors a contraction and this remains the dominant trading scenario.

EUR/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.40000

Take Profit @ 6.42500

Stop Loss @ 6.38750

Upside Potential: 250 pips

Downside Risk: 125 pips

Risk/Reward Ratio: 2.00