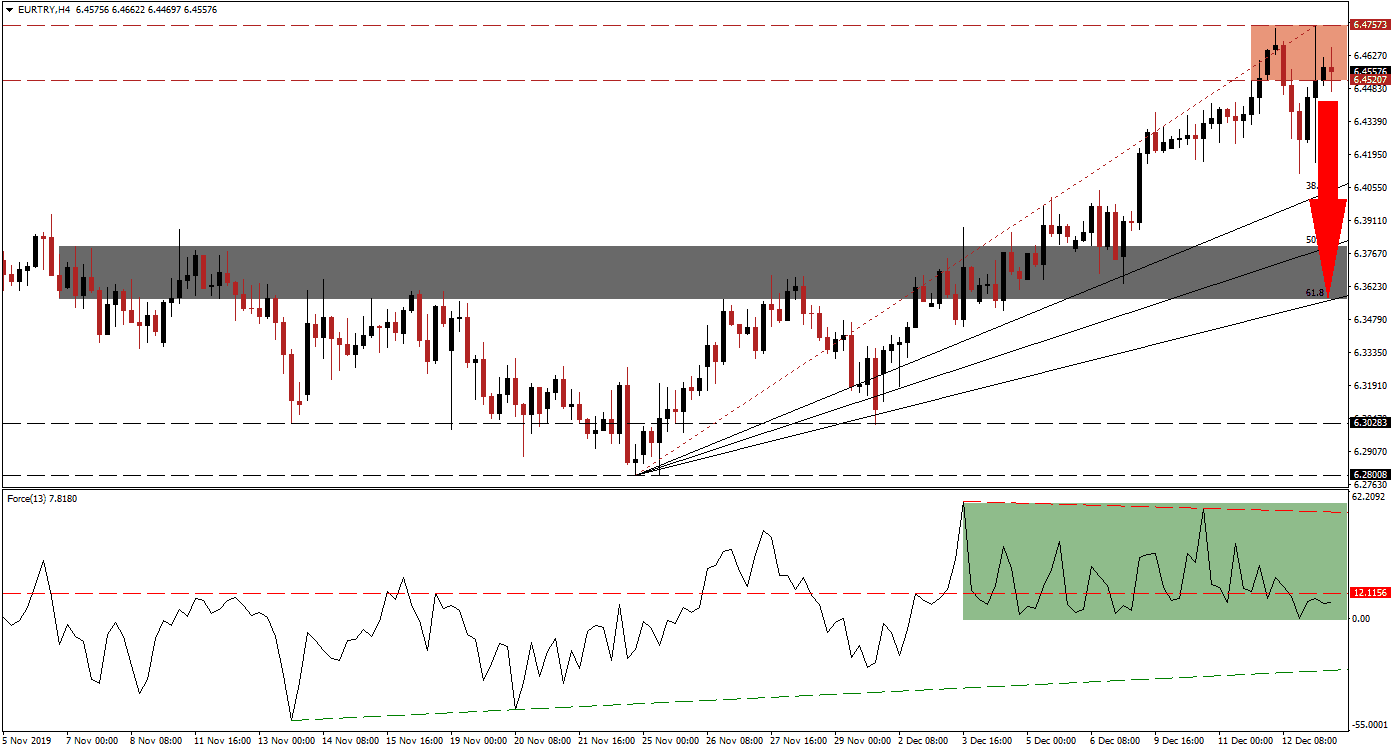

Central banks in developed economies are either in a holding pattern or cut interest rates from record-low levels. The situation in Turkey is much different, and the central bank slashed interest rates yesterday by 200 basis points to 12.00%. Adjusted for inflation, the real interest rate is lower than in many emerging markets; Turkey saw a contraction in its inflation from above 25% to single digits, but November edged up to 10.4%. The EUR/TRY advanced into its resistance zone, but a price action reversal is anticipated as bearish momentum is expanding.

The Force Index, a next-generation technical indicator, reversed as price action pushed to the upside and a negative divergence formed. This bearish development was magnified by a breakdown in the Force Index below its horizontal support level, turning it into resistance, as marked by the green rectangle. This technical indicator is now favored to descend into negative conditions and place bears in charge of the EUR/TRY; the ascending support level may act as a magnet for price action. You can learn more about the Force Index here.

Another bearish development materialized after this currency pair moved below its Fibonacci Retracement Fan trendline. A breakdown in the EUR/TRY below its resistance zone located between 6.45207 and 6.47573, as marked by the red rectangle, is anticipated. Following a sustained move to the downside, a profit-taking sell-off is additionally expected to force price action into a reversal. Forex traders are advised to monitor the intra-day high of 6.43790, a peak before a minor pause that pushed this currency pair into its resistance zone; a descend below this mark is likely to result in new net short positions.

A corrective phase should take the EUR/TRY back down to its short-term support zone located between 6.35644 and 6.37983, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level has entered this zone, and a breakdown extension cannot be ruled out. Expectations for the Turkish economy remain favorable and are improving, resulting in a long-term bearish outlook for this currency pair. Price action will face its next long-term support zone between 6.28008 and 6.30283.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 6.45550

- Take Profit @ 6.35650

- Stop Loss @ 6.47750

- Downside Potential: 990 pips

- Upside Risk: 220 pips

- Risk/Reward Ratio: 4.50

Should the Force Index push through its horizontal resistance level and advance towards its shallow descending resistance level, the EUR/TRY could attempt to follow. The upside potential remains limited to its next resistance zone, located between 6.54712 and 6.60022; this should be considered an excellent short-selling opportunity as the fundamental outlook, supported by technical developments, remains distinctively bearish.

EUR/TRY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 6.49000

- Take Profit @ 6.55000

- Stop Loss @ 6.46500

- Upside Potential: 600 pips

- Downside Risk: 250 pips

- Risk/Reward Ratio: 2.40