Despite the release of a disappointing New Zealand terms of trade index for the third quarter, with a contraction in trade volume grabbing the attention of traders, the EUR/NZD slid to the bottom range of its support zone. A Chinese manufacturing gauge surprised to the upside, countering the bearish sentiment out of New Zealand and boosting the New Zealand Dollar. The latest reports paint a mixed global trade picture, but bullish pressures in this currency pair started to increase and the steep sell-off has made price action vulnerable to a short-covering rally.

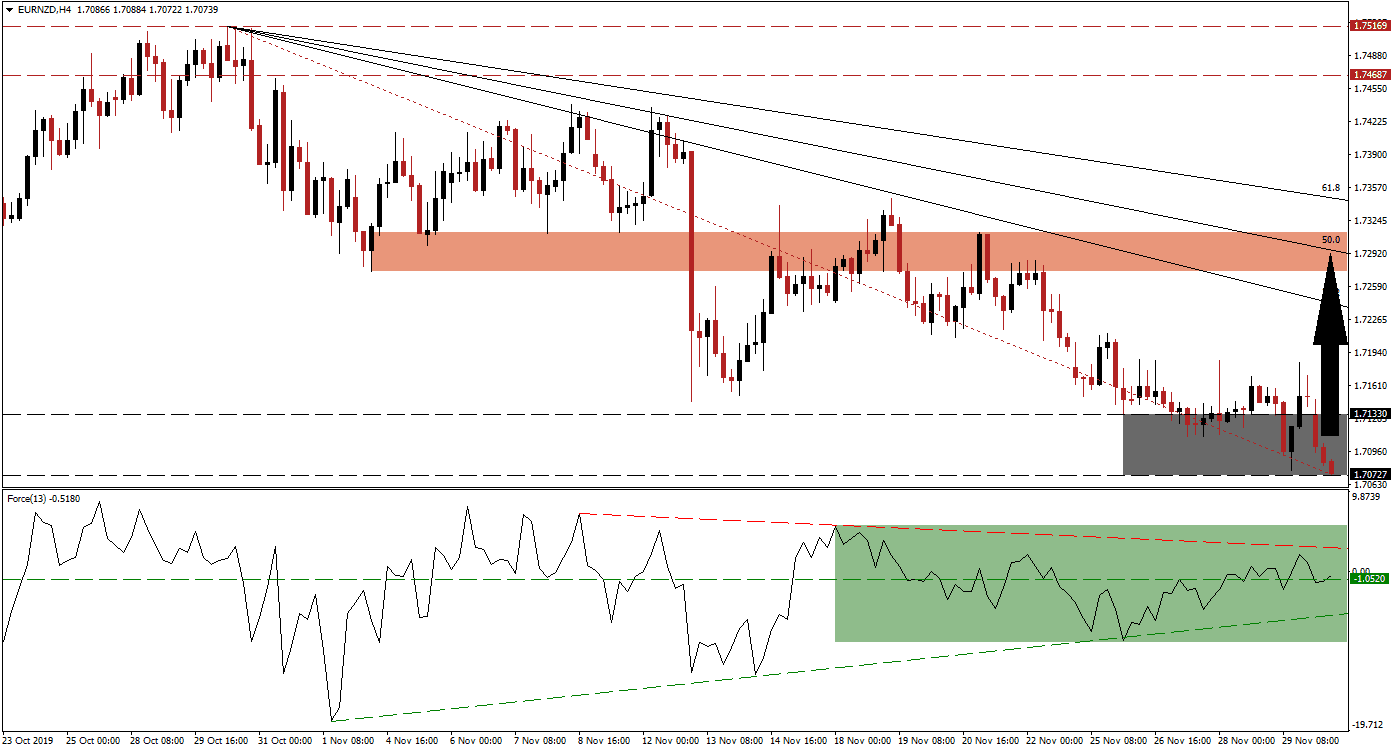

The Force Index, a next-generation technical indicator, indicates the presence of a positive divergence as marked by the green rectangle. An increase in the bullish moment has additionally elevated the Force Index above its horizontal resistance level and turned it into support. This technical indicator now possesses the directional momentum to push into positive conditions, place bulls in charge of the EUR/NZD, and lead to a counter-trend advance. A breakout in this currency pair above its descending resistance level will further accelerate a move to the upside. You can learn more about the Force Index here.

Manufacturing PMI’s out of Spain, Italy, France, Germany, and the Eurozone will be released throughout the European morning trading session and may provide the spark for the pending short-covering rally in this currency pair. Another bullish development occurred after the EUR/NZD moved above its Fibonacci Retracement Fan trendline. A breakout in price action above its support zone, located between 1.70727 and 1.71330 as marked by the grey rectangle, is expected to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level.

One key level to monitor is the intra-day high of 1.71847 which marks the peak of a failed breakout attempt in the EUR/NZD; a maintained push above this level is likely to result in the addition of new net-buy orders and further boost the expected short-covering rally. Price action will face its first test at its next short-term resistance zone located between 1.72745 and 1.73127 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is currently passing through this zone and may end the advance.

EUR/NZD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.70750

⦁ Take Profit @ 1.72900

⦁ Stop Loss @ 1.70300

⦁ Upside Potential: 215 pips

⦁ Downside Risk: 45 pips

⦁ Risk/Reward Ratio: 4.78

Should the Force Index reverse below its horizontal support level and complete a breakdown below its ascending support level, the EUR/NZD could attempt a breakdown. The short-term technical outlook remains bullish, but the long-term picture is clouded due to the US-China trade war on the bearish side of the equation with the RCEP trade pact on the bullish side. Price action will face its next support zone between 1.69287 and 1.68544.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.69800

⦁ Take Profit @ 1.68600

⦁ Stop Loss @ 1.70300

⦁ Downside Potential: 120 pips

⦁ Upside Risk: 50 pips

⦁ Risk/Reward Ratio: 2.40