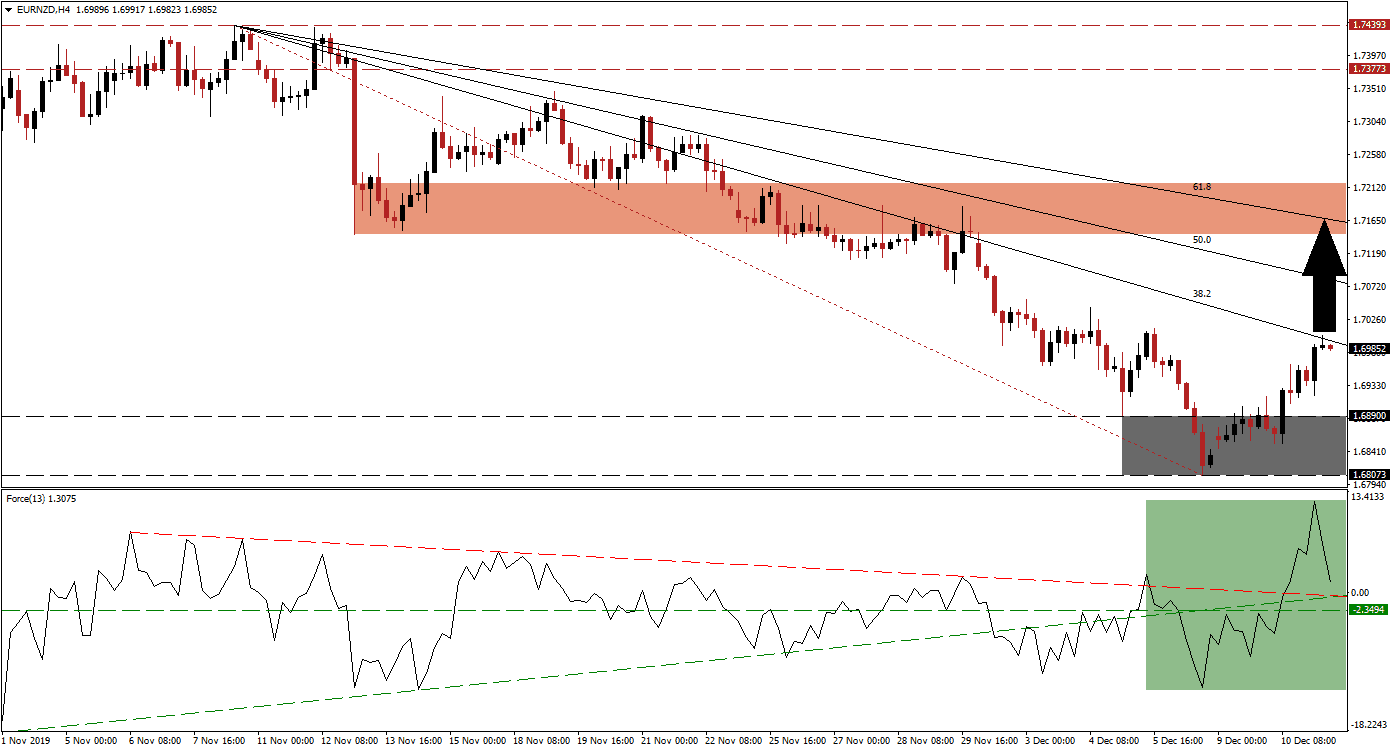

Following the release of the New Zealand half-year fiscal and economic update, the New Zealand Dollar came under selling pressure. While this report is backward-looking, it showed the economy performed worse than expected. Adding to selling pressure was retail card spending data for November, posting an unexpected contraction. The EUR/NZD was able to extend its breakout above its support zone and is now faced with its descending 38.2 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, spiked to a fresh high as price action accelerated to the upside; bullish momentum started to reverse from its peak but remains well above its horizontal support level. The Force Index has additionally eclipsed its ascending support level and its descending resistance level, as marked by the green rectangle. Bulls are in charge of the EUR/NZD as this technical indicator maintains its position in positive conditions, and more upside in this currency pair is anticipated. You can learn more about the Force Index here.

Initiating the breakout in price action above its support zone located between 1.68073 and 1.68900, as marked by the grey rectangle, was a strong ZEW report released yesterday. The Euro advanced after a positive surprise out of Germany as well as the Eurozone, hinting at a potential economic recovery. Due to the absence of new fundamental releases during today’s session, the breakout is anticipated to extend and push the EUR/NZD above its 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a breakout here.

Forex traders are advised to monitor the intra-day high of 1.70543, the peak of a minor pause in the corrective phase before this currency pair accelerated to the downside; a breakout above this level is likely to attract fresh net buy orders. The advance in price action above its Fibonacci Retracement Fan trendline resulted in another bullish development, and the EUR/NZD may advance into its next short-term resistance zone. This zone is located between 1.71461 and 1.72171, as marked by the red rectangle, but the 61.8 Fibonacci Retracement Fan Resistance Level could end the move to the upside.

EUR/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.69850

Take Profit @ 1.71500

Stop Loss @ 1.69350

Upside Potential: 165 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 3.30

A breakdown in the Force Index below its descending resistance level, which currently acts as temporary support, is expected to reverse the EUR/NZD to the downside. The long-term fundamental outlook remains uncertain, but the short-term technical picture favors an extension of the breakout. A fundamental catalyst may invalidate this and the next support zone awaits price action between 1.66559 and 1.67038.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.68500

Take Profit @ 1.67000

Stop Loss @ 1.69100

Downside Potential: 150 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.50