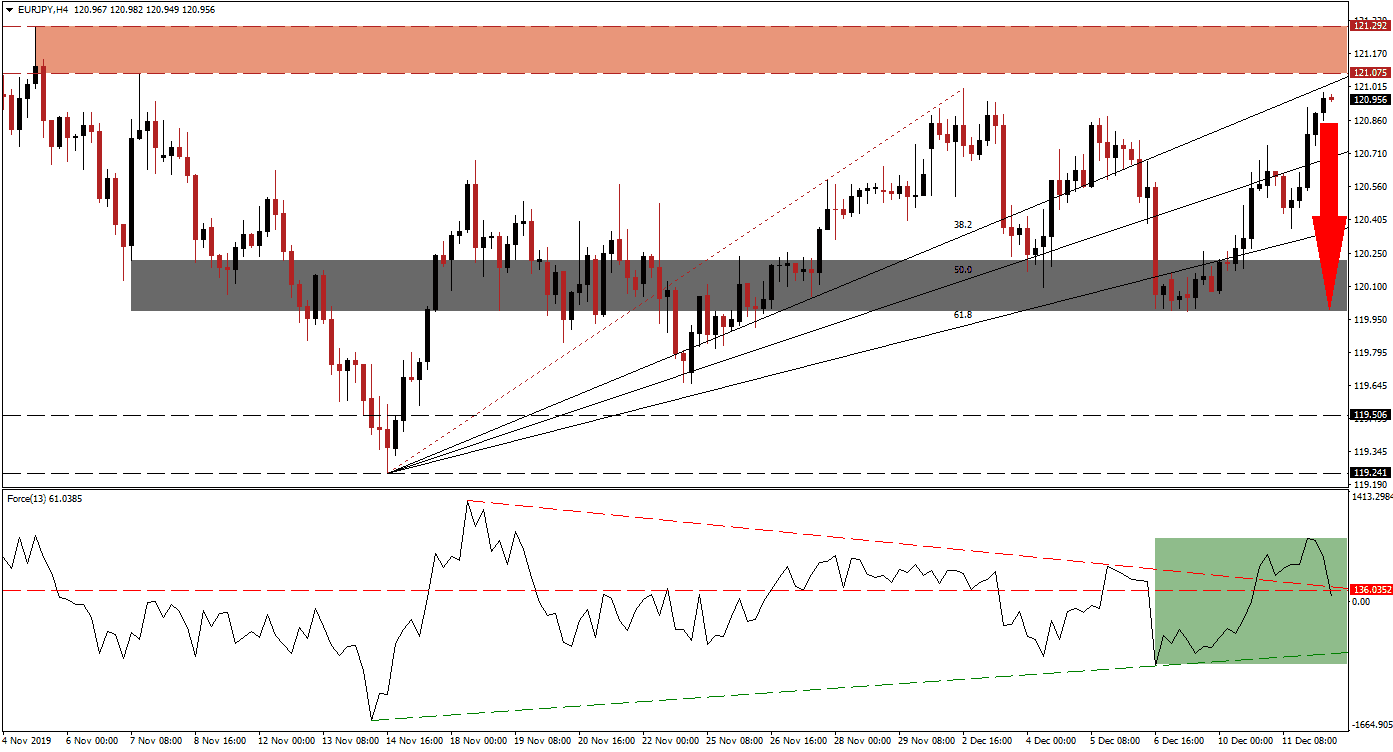

Economic data out of Japan, in the form of machine orders that plunged in October, disappointed. The Japanese Yen came under selling pressure, and the EUR/JPY extended its advance; the Fibonacci Retracement Fan sequence provided upward guidance. Price action has approached the bottom range of its resistance zone, and bullish momentum is retreating; this currency pair is now vulnerable to a profit-taking sell-off. New ECB President Lagarde will face the first market test during today’s press conference, following the ECB interest rate announcement.

The Force Index, a next-generation technical indicator, points towards the collapse in bullish momentum as the EUR/JPY closed in on its resistance zone. The Force Index reversed below its horizontal support level, turning it back into resistance; it additionally moved below its descending resistance level, as marked by the green rectangle. This technical indicator is anticipated to extend its slide into its ascending support level, which will place it in negative condition with bears in control of price action. You can learn more about the Force Index here.

Upside momentum remains exhausted. The ascending 38.2 Fibonacci Retracement Fan Resistance Level is on the cusp of entering its resistance zone located between 121.075 and 121.292, as marked by the red rectangle. Forex traders are advised to monitor the intra-day high of 121.008, the peak of the previous advance and end-point of the Fibonacci Retracement Fan sequence. While a push into its resistance zone cannot be ruled out, the EUR/JPY is anticipated to enter a corrective phase.

A breakdown sequence in price action through its Fibonacci Retracement Fan sequence is expected to take this currency pair into its short-term support zone located between 119.985 and 120.218, as marked by the grey rectangle. Another critical level for the EUR/JPY is the intra-day high of 120.748; the high of a push above its 50.0 Fibonacci Retracement Fan Resistance Level, that was reversed before this currency pair accelerated to the upside. More net sell orders are likely following a breakdown below this level. You can learn more about a support zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 120.950

Take Profit @ 120.000

Stop Loss @ 121.250

Downside Potential: 95 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.17

In the event of a breakout in the Force Index above its descending resistance level, the EUR/JPY could launch a breakout attempt of its own. Due to the number of uncertainties, and growing global economic weakness, the upside potential is expected to be confined to its next resistance zone. This zone awaits price action between 122.030 and 122.312; a good short selling possibility.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 121.550

Take Profit @ 122.250

Stop Loss @ 121.950

Upside Potential: 70 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.33