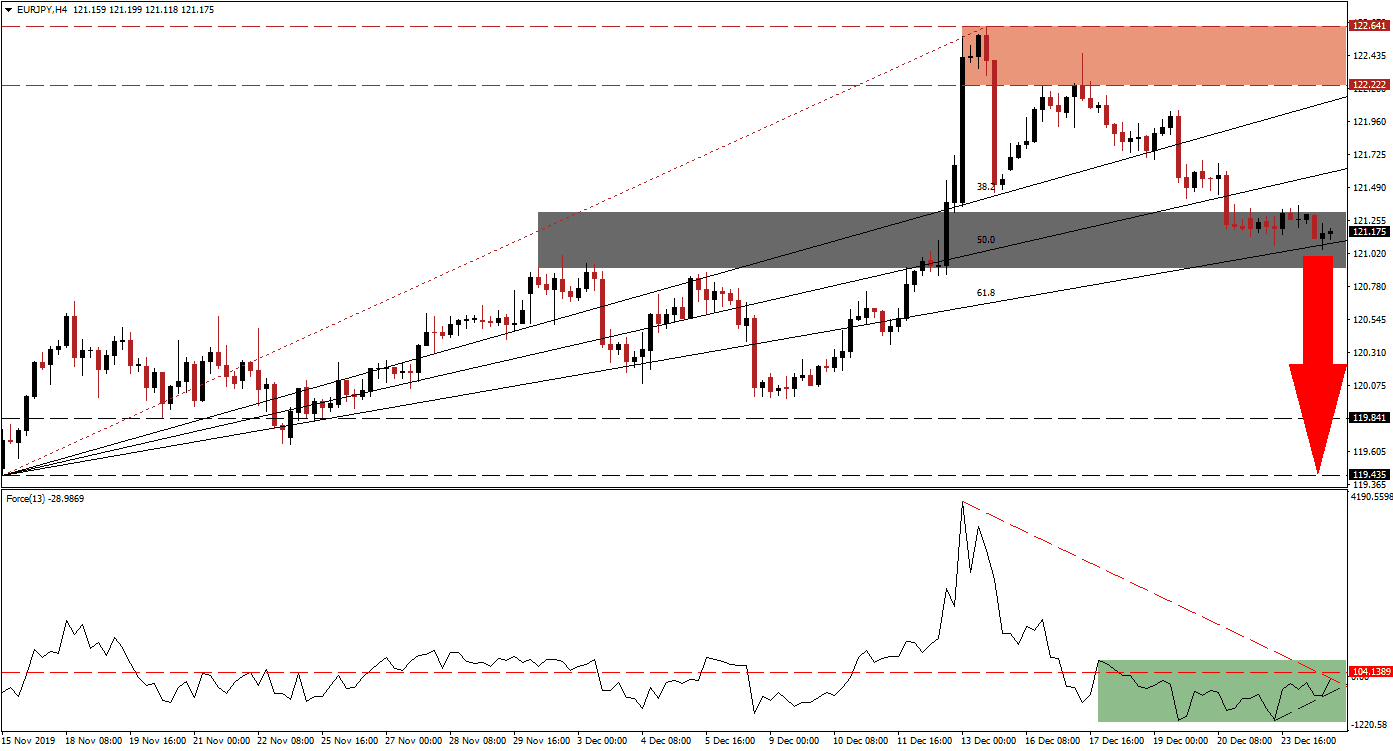

After price action descended into its short-term support zone, the corrective phase in the EUR/JPY temporarily paused. The ascending 61.8 Fibonacci Retracement Fan Support Level is enforcing the support zone, but as more global economic data points towards a slowing economy, the risk-off sentiment is anticipated to return. This morning’s Singapore industrial production data showed an unexpected slump, likely to be echoed throughout the region. A double breakdown in this currency pair is expected to lead to an extension of the sell-off.

The Force Index, a next-generation technical indicator, was able to recover from its lows after the EUR/JPY reached its short-term support zone. A minor ascending support level formed, but the Force Index remains below its horizontal resistance level and is now faced with its descending resistance level. This technical indicator additionally remains in negative conditions with bears in control of price action, as marked by the green rectangle. You can learn more about the Force Index here.

Following the breakdown in this currency pair below its resistance zone, a series of lower highs and lower lows emerged. This zone is located between 122.222 and 122.641, as marked by the red rectangle, and the bearish chart pattern is favored to pressure the EUR/JPY farther to the downside. The Eurozone economy is expected to extend its current slowdown in 2020, led by weakness out of Germany and the global economy as a whole. While price action may spike into its 50.0 Fibonacci Retracement Fan Resistance Level, a double breakdown is favored to force more long-term downside.

Forex traders are advised to monitor the Force Index, which is anticipated to lead this currency pair into a breakdown. A conversion of its short-term resistance zone, located between 120.914 and 121.301 as marked by the grey rectangle, is expected to initiate a fresh wave of net sell orders. The next long-term support zone awaits the EUR/JPY between 119.435 and 119.841. More downside is possible, but a new fundamental catalyst will be required. You can learn more about a support zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 121.200

Take Profit @ 119.450

Stop Loss @ 121.700

Downside Potential: 175 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.50

A breakout in the Force Index above its descending resistance level is anticipated to guide the EUR/JPY back into its long-term resistance zone. The 38.2 Fibonacci Retracement Fan Resistance Level is approaching the bottom range of this zone. Due to the long-term bearish fundamental outlook, a breakout above this zone remains unlikely. Forex traders should view any such advance as a good short-selling opportunity in this currency pair.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 122.100

Take Profit @ 122.600

Stop Loss @ 121.850

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00