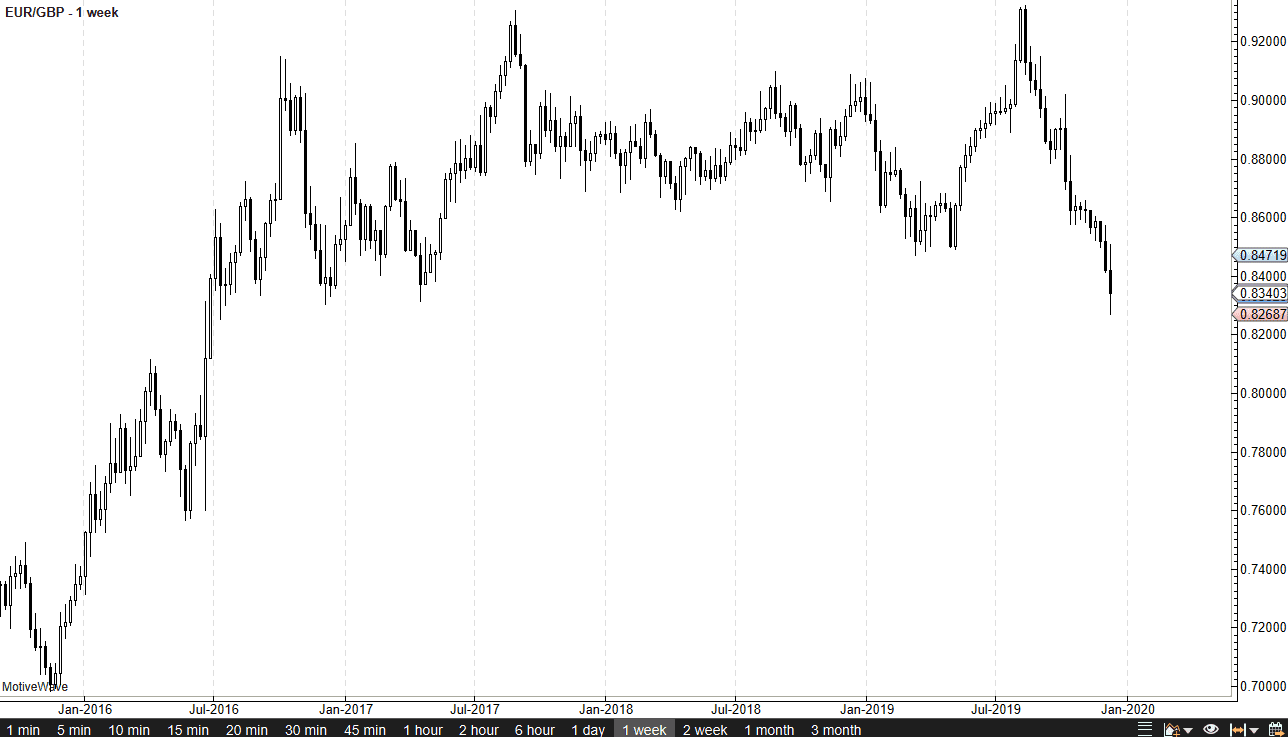

The Euro has been absolutely pummeled against the British pound during most of the back half of 2019. This was due to the election and all things Brexit of course, and now that the election results have come back pro-conservative, and therefore it’s likely that we will get the Brexit at the beginning of the year. That being said, now we have the conversation when it comes to trade agreements. The fact that there is a bit of certainty with the British pound now dollars of course help the British pound, as Sterling has been struggling for most of the last three years. Because of this, I think this pair might be one of the more interesting ones to follow and 2020 as well, because it is “Ground Zero” for the negotiations.

It’s very likely that the British will end up with massive trade gains when it comes to countries like the United States, Canada, Australia, New Zealand, and of course anything involving the old Commonwealth. On the other hand, you have the Europeans which will now seem very disjointed as the attitude of the entire Brexit has shifted. The British government is now reasonably united, and now the cracks in attitude will start to show itself from the European Union. This doesn’t mean that the pair go straight down though, and quite frankly I would not be surprised at all to see a short-term bounce.

I anticipate that we will probably see a bit of a bounce towards the 0.86, where the sellers should reemerge. Ultimately, if we were to break down below the 0.82 level, then it’s very likely we go looking towards the 0.80 level. Remember, this pair does not tend to move quickly, so it can take several weeks for a couple of handles to be gained or lost. That being said though, keep in mind that the PIP value is of course higher. Because of this, you don’t need massive moves to make sizable profits. I anticipate that short-term we may get a bit of a relief rally but by the time it’s all said and done the downward pressure in this pair will continue. Ultimately, it would not be surprising at all to see this pair reach towards the 0.76 handle, but that might be more of a Q3 story at this point. I remain bearish, but I recognize that we have covered quite a bit of ground over the last couple of months.