Following the landslide electoral victory by British Prime Minister Johnson, giving him an 80-seat majority in Parliament, the EUR/GBP spiked amid profit-taking in the British Pound. A short-covering rally added to the bullish move in this currency pair but was quickly exhausted as price action moved into its short-term resistance zone. PM Johnson is now on track to deliver Brexit, but more uncertainty regarding the transition period has emerged; Parliament is expected to amend the bill and make an extension past December 2020 illegal. You can learn more about a short-covering rally here.

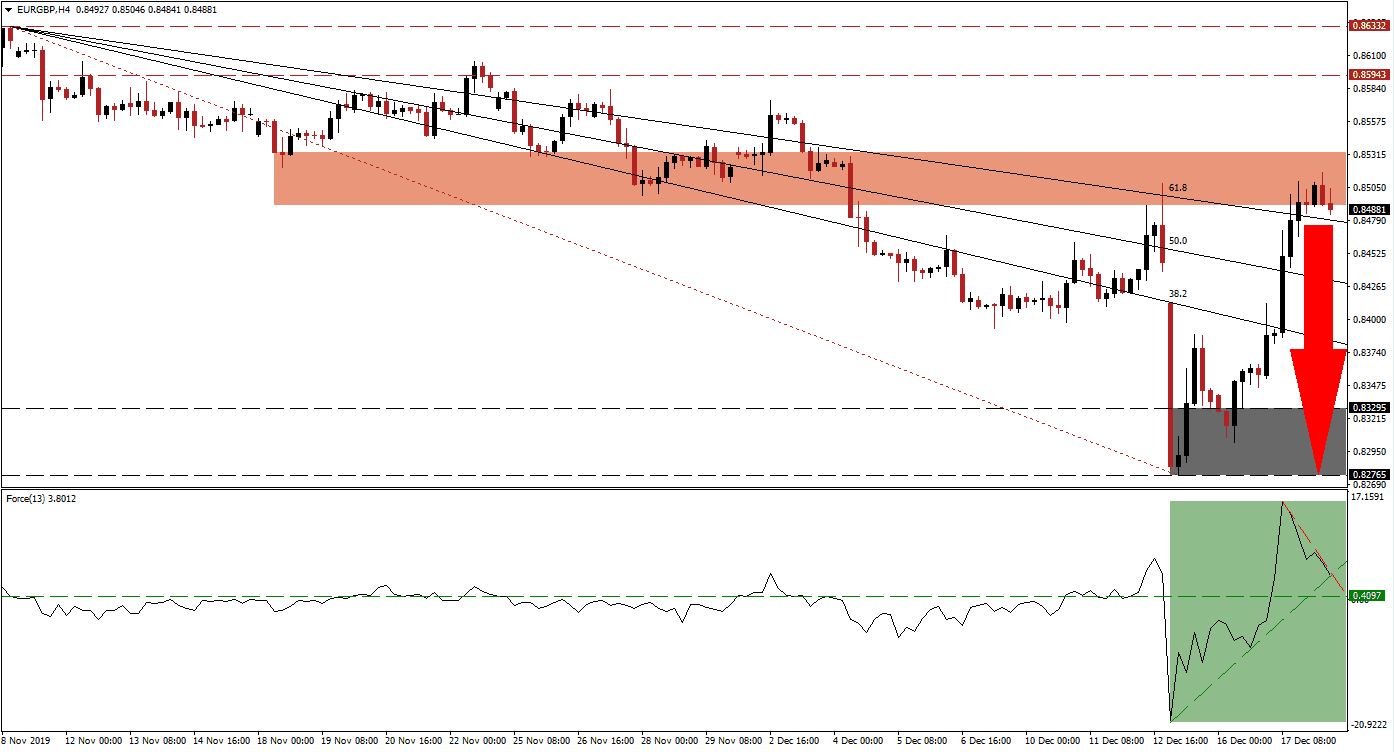

The Force Index, a next-generation technical indicator, points towards the contraction in bullish momentum after the EUR/GBP advanced into its short-term resistance zone. A steep descending resistance level formed, as marked by the green rectangle, and is pressuring the Force Index farther to the downside; a breakdown below its ascending support level is favored to follow. The magnitude of the momentum reversal is anticipated to take this technical indicator below its horizontal support level, converting it into resistance, and into negative territory, leading price action into a breakdown.

This currency eclipsed the Fibonacci Retracement Fan sequence as it moved into its short-term resistance zone located between 0.84906 and 0.85331, as marked by the red rectangle. A sustained breakdown will take the EUR/GBP below its descending 61.8 Fibonacci Retracement Fan Support Level, and convert it back into resistance. The Fibonacci Retracement Fan sequence is then anticipated to guide this currency pair to the downside; the long-term fundamental outlook for the British Pound, behind a strengthened Tory parliament, remains extremely bullish.

Economic data out of Germany may provide a short-term fundamental catalyst, but a renewed push to the downside is anticipated. This currency pair is likely to test the strength of its support zone located between 0.82765 and 0.83295, as marked by the grey rectangle; more downside is possible to follow. The Eurozone economy remains fragile, the ECB divided, and the economic prospects dim. A breakdown in the EUR/GBP below its 61.8 Fibonacci Retracement Fan Support Level is additionally expected to result in a profit-taking sell-off. You can learn more about a breakdown here.

EUR/GBP Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.84900

Take Profit @ 0.82750

Stop Loss @ 0.85450

Downside Potential: 215 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 3.91

A breakout in the Force Index above its descending resistance level may pressure the EUR/GBP into a breakout attempt of its own. Due to the long-term fundamental outlook, supported by technical developments, the upside potential remains limited to its next long-term resistance zone. Price action will face this zone between 0.85943 and 0.86332, which represents a great short-selling opportunity.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.85800

Take Profit @ 0.86300

Stop Loss @ 0.85550

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00