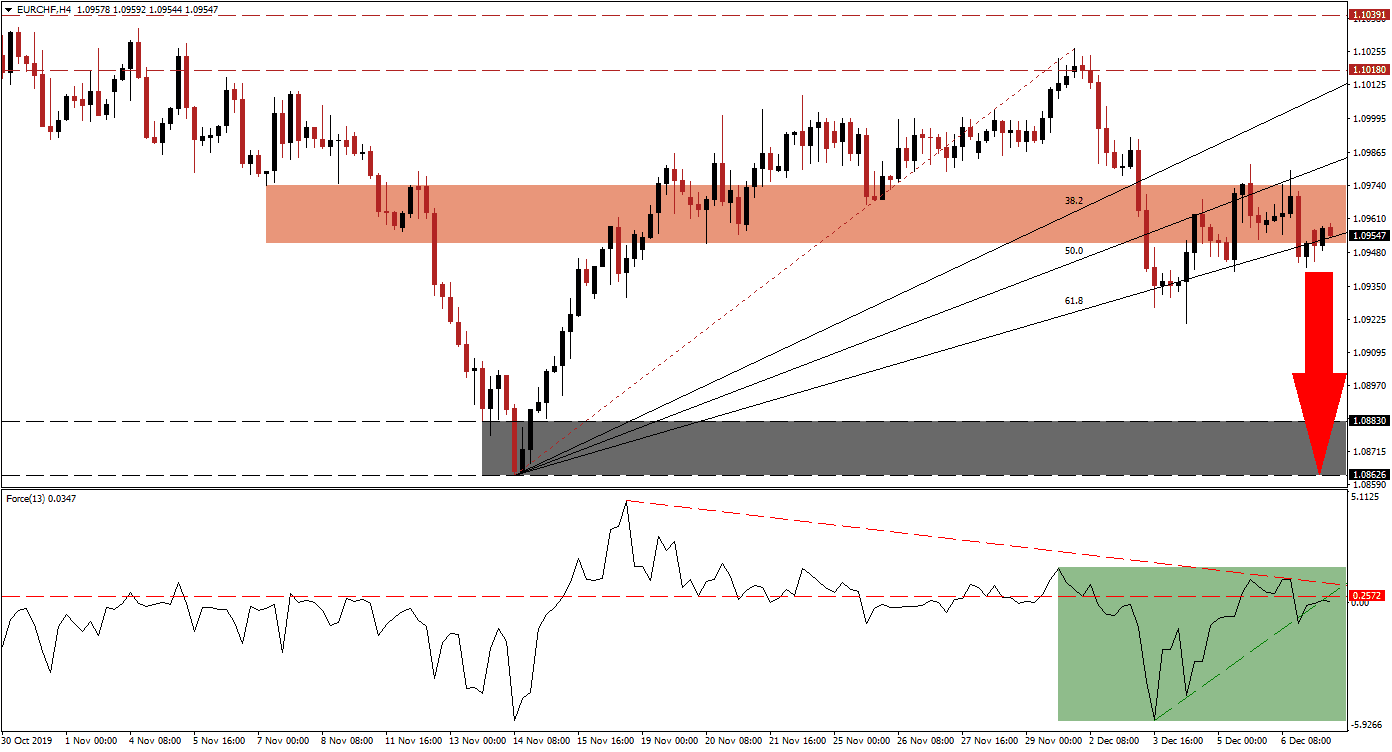

Following the release of Chinese trade data, German trade data showed a surprise increase in exports despite the disappointing industrial production data released. The EUR/CHF remains in a holding pattern inside of its short-term resistance zone, as the ascending 61.8 Fibonacci Retracement Fan Support Level has entered this zone. As a safe-haven currency, the Swiss Franc is likely to attract bids as the general fundamental scenario supports a further slowdown in the global economy, and allow for a breakdown in price action to materialize.

The Force Index, a next-generation technical indicator, plunged with the sell-off in the EUR/CHF that converted its short-term support zone into resistance. The following recovery resulted in a lower high in the Force Index, and a descending resistance level emerged. This technical indicator reversed below its horizontal support level, turning it into resistance, and moved below its ascending support level as marked by the green rectangle. The Force Index is now expected to move into negative conditions, and place bears in charge of price action. You can learn more about the Force Index here.

More downside in this currency pair is anticipated after the 61.8 Fibonacci Retracement Fan Support Level has entered the short-term resistance zone, located between 1.09514 and 1.09738 as marked by the red rectangle. A breakdown will clear the path for the EUR/CHF to accelerate to the downside and into its support zone. Forex traders are advised to monitor the intra-day low of 1.09424, the low from the most recent descend below the 61.8 Fibonacci Retracement Fan Support Level; a move lower is expected to attract fresh net sell orders.

Uncertainty about the global economy is expected to carry into 2020, and the Swiss Franc is anticipated to benefit from this. Additionally, Eurozone economic data has come in weaker than expected, and the ECB restarted quantitative easing on November 1st to the tune of €20 billion in bond purchases. As more disappointing Eurozone is expected, the EUR/CHF is likely to descend into its support zone, which is located between 1.08626 and 1.08830 as marked by the grey rectangle. You can learn more about a support zone here.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.09550

Take Profit @ 1.08650

Stop Loss @ 1.09850

Downside Potential: 90 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.00

A triple breakout in the Force, elevating this technical indicator above its descending resistance level, could pressure the EUR/CHF through its short-term resistance zone. Given the long-term fundamental picture, the upside potential remains limited to its intra-day high of 1.10265; the current end-point of its Fibonacci Retracement Fan sequence. This level is additionally located inside the next long-term resistance zone between 1.10180 and 1.10391 and represents an excellent short-selling opportunity.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.09950

Take Profit @ 1.10250

Stop Loss @ 1.09800

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00