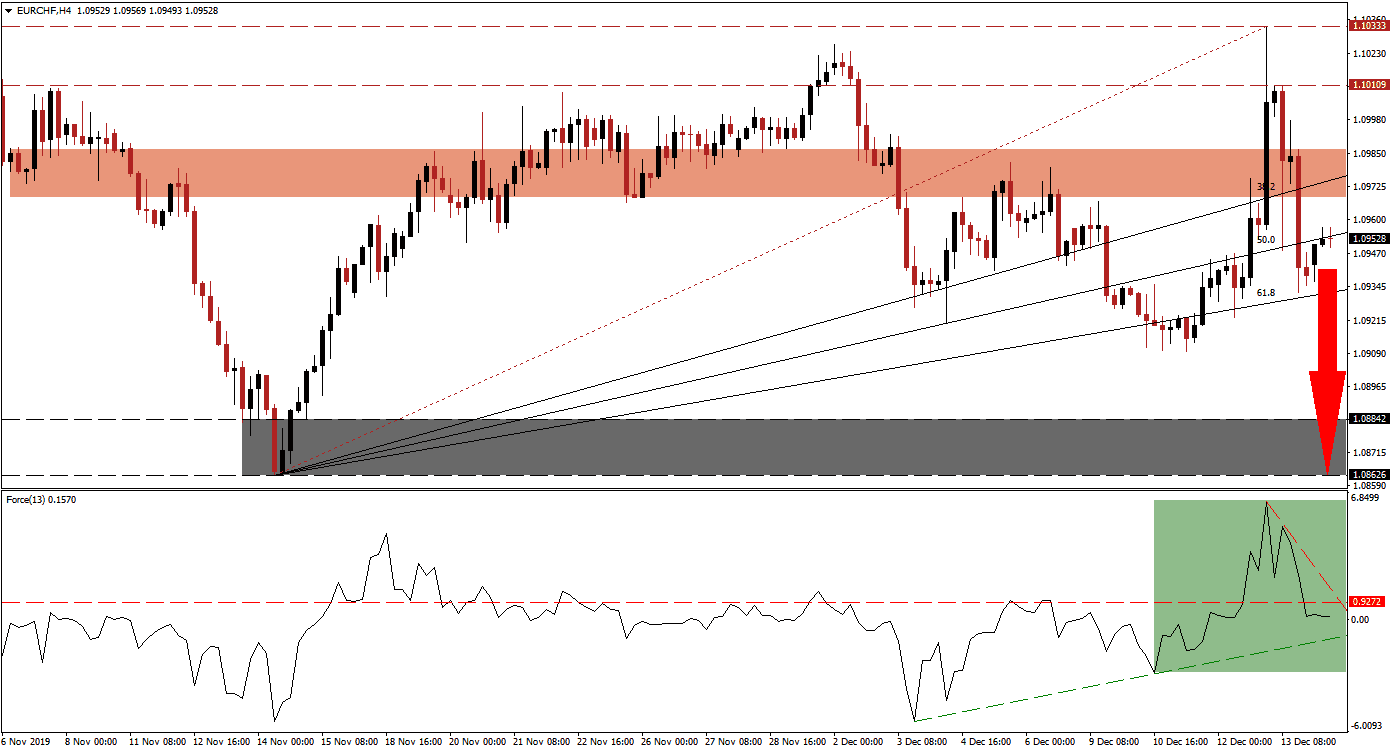

Preliminary PMI data out of France, Germany, and the Eurozone as a whole will provide the next fundamental catalyst for the EUR/CHF. The highly anticipated phase-one trade deal between the US and China disappointed, and key data remains unclear. This currency pair initiated its corrective phase following the breakdown below its long-term resistance zone. Bearish momentum sufficed to pressure price action below its short-term support zone, converting it into resistance. You can learn more about the support and resistance zones here.

The Force Index, a next-generation technical indicator, collapsed from its peak and turned its horizontal support level back into resistance. With the rise in bearish momentum, more downside is favored. The Force Index is additionally pressured by its descending resistance level, as marked by the green rectangle. A breakdown in this technical indicator below its ascending support level is favored to follow, which will place the Force Index into negative conditions and bears in control over the EUR/CHF.

Following the breakdown in this currency pair below its short-term resistance zone located between 1.09683 and 1.09867, as marked by the red rectangle, more downside is anticipated. The Swiss Franc, a safe-haven currency, is likely to attract more buyers as 2019 comes to an end. The EUR/CHF paused its breakdown sequence after approaching its ascending 61.8 Fibonacci Retracement Fan Support Level, but as the Fibonacci Retracement Fan sequence starts to cross its short-term resistance zone, breakdown pressures are expanding.

With a slowing Eurozone economy and divided ECB, the long-term outlook for the EUR/CHF remains bearish. An extension of the breakdown sequence in this currency pair is expected to take price action into its next support zone located between 1.08626 and 1.08842, as marked by the grey rectangle. A breakdown in the Force Index into negative territory is favored to invite the next wave of sell orders, and forex traders are additionally advised to monitor the intra-day low of 1.09325; this marks the low of the current breakdown, and a move below this mark is expected to increase downside pressure.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.09550

Take Profit @ 1.08650

Stop Loss @ 1.09850

Downside Potential: 90 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index above its horizontal as well as descending resistance level could pressure the EUR/CHF to the upside. Given the long-term fundamental outlook for this currency pair, the upside remains limited to its long-term resistance zone located between 1.10109 and 1.10333. Any advance into this zone should be considered an excellent short-selling opportunity.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.10000

Take Profit @ 1.10300

Stop Loss @ 1.09850

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00