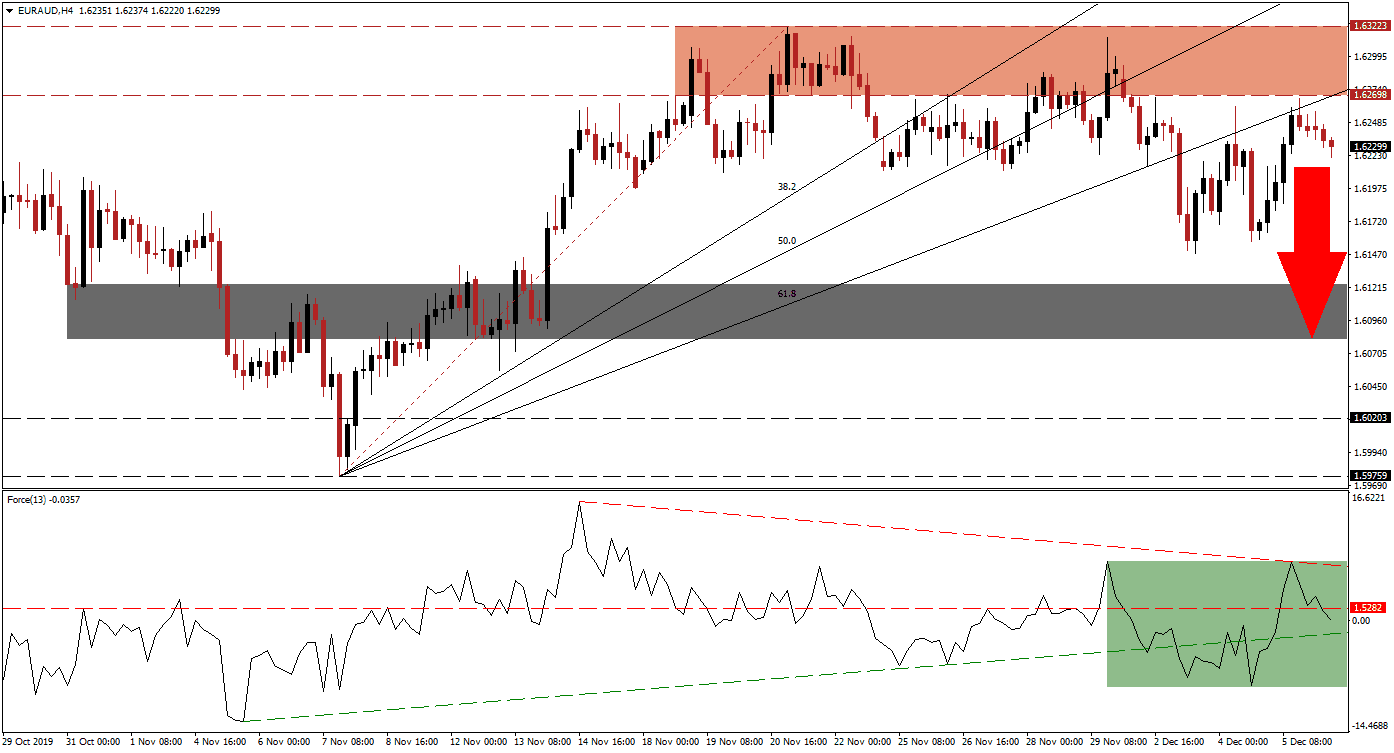

Following the rejection in the EUR/AUD by its resistance zone as well as its ascending 61.8 Fibonacci Retracement Fan Retracement Level, more downside is likely to follow. China has been quiet on the progress of trade negotiations with the US, but rifts appear on multiple fronts. Expectations are now for a meaningless, trimmed down version of a phase-one deal for political capital on both sides. While the Australian Dollar will be impacted, weakness out of the Eurozone economy is worse-than-expected and driving bearish momentum; this currency pair has more downside potential after an advance was rejected.

The Force Index, a next-generation technical indicator, shows the gradual contraction in bullish momentum as this currency pair was rejected on six occasions. A descending resistance level emerged and the Force Index has now completed a breakdown below its horizontal support level, converting it into resistance as marked by the green rectangle. This technical indicator additionally moved into negative territory and placed bears in charge of the EUR/AUD. A breakdown in the Force Index below its ascending support level is favored to provide more downside pressure.

After this currency pair failed to push through its resistance zone, located between 1.62698 and 1.63223 as marked by the red rectangle, a breakdown sequence materialized. The move below its 61.8 Fibonacci Retracement Fan Resistance Level was quickly reversed and offered forex traders a second short-entry opportunity. The EUR/AUD has started its descend and a breakdown below the intra-day low of 1.61976, the last instance price action recovered from its Fibonacci Retracement Fan trendline, is favored to initiate a profit-taking sell-off.

Price action has a clear path into its next short-term support zone, located between 1.60812 and 1.61238 as marked by the grey rectangle. More downside is possible, but a new fundamental catalyst would be required to extend a corrective phase in the EUR/AUD. The next long-term support zone awaits price action between 1.59759 and 1.60203. Volatility is likely to remain elevated, but the long-term outlook for this currency pair remains bearish. You can learn more about a breakdown here.

EUR/AUD Technical Trading Set-Up - Price Action Reversal Extension Scenario

Short Entry @ 1.62300

Take Profit @ 1.60800

Stop Loss @ 1.62700

Downside Potential: 150 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.75

A recovery in the Force Index above its horizontal resistance level, assisted by its ascending support level, may inspire a reversal in the EUR/AUD. Given the long-term fundamental outlook, upside potential remains limited and forex traders are advised to take advantage of any potential advance with short positions at a more profitable level. The next resistance zone is located between 1.63945 and 1.64324.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.63300

Take Profit @ 1.64300

Stop Loss @ 1.62900

Upside Potential: 100 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.50