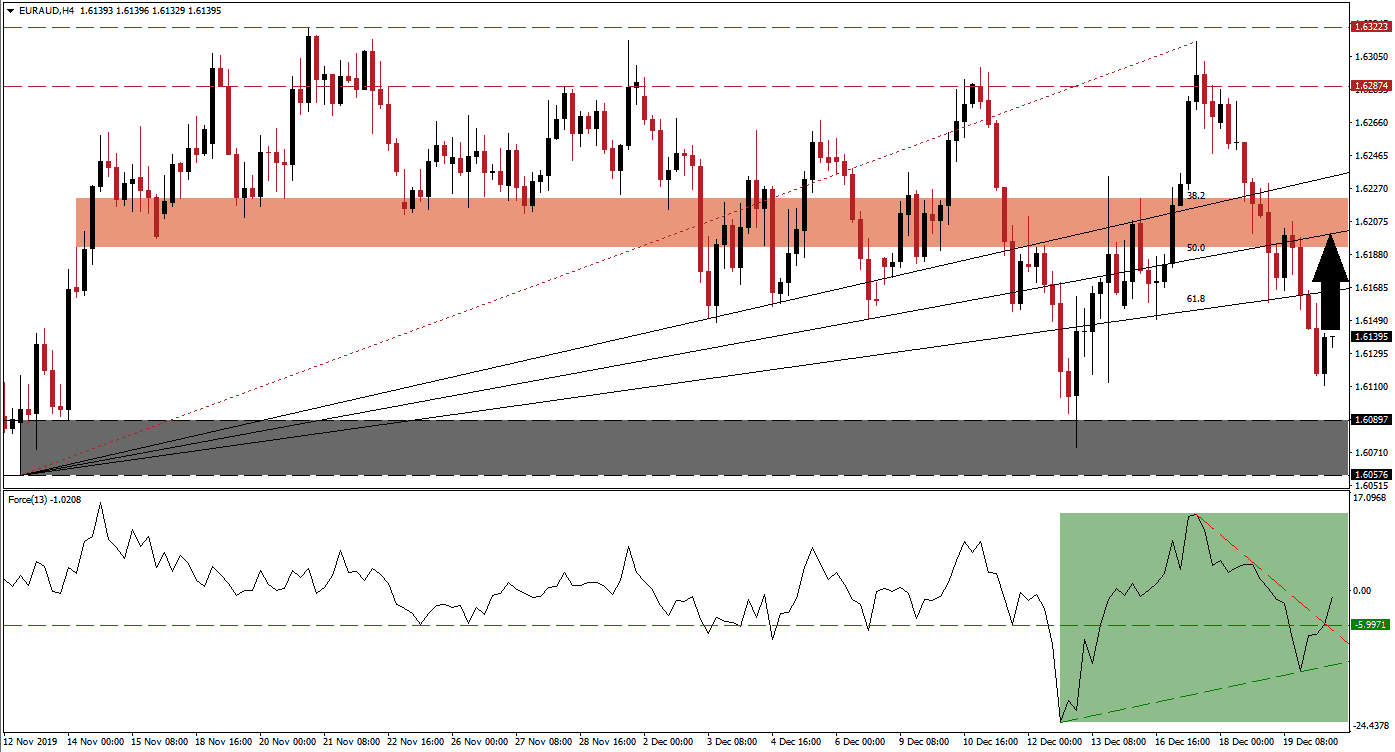

Downside pressure on the EUR/AUD is temporarily easing. This paused the breakdown sequence, which took it from its long-term resistance zone below its entire Fibonacci Retracement Fan sequence. The sell-off additionally converted its short-term support zone into resistance. Bullish momentum started to recover after this currency pair descended below its ascending 61.8 Fibonacci Retracement Fan Support Level, turning it into resistance. The People’s Bank of China maintained its prime lending rate at existing levels, halting the corrective phase.

The Force Index, a next-generation technical indicator, initially dropped below its horizontal support level before recording a higher low and reversing direction. The ascending support level aided the advance, which also took it above its descending resistance level. The Force Index now possesses the directional momentum to move into positive conditions, as marked by the green rectangle. A move above the 0 centerline will place bulls in charge of the EUR/AUD and result in an extension of the short-term recovery. You can learn more about the Force Index here.

As a result of the pause in the sell-off, a higher low formed above its support zone, which represents a bullish development. The support zone is located between 1.60576 and 1.60897, as marked by the grey rectangle. A recovery into its 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to follow. Forex traders are advised to monitor the Force Index together with the intra-day low of 1.61478, the low of the first breakdown in price action below its short-term support zone, which converted it into resistance. A push above this level is likely to elevate the EUR/AUD farther.

This currency pair may advance until it can challenge its short-term resistance zone located between 1.61922 and 1.62212, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is crossing through this zone and could mark the end of the anticipated minor push to the upside. The long-term outlook for the EUR/AUD remains bearish, and an advance into its short-term resistance zone will keep the downtrend intact. A fresh breakdown sequence is expected to follow and result in fresh lows.

EUR/AUD Technical Trading Set-Up - Minor Recovery Scenario

Long Entry @ 1.61350

Take Profit @ 1.62000

Stop Loss @ 1.61150

Upside Potential: 65 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.25

A breakdown in the Force Index below its ascending support level will invalidate the minor recovery scenario in the EUR/AUD. This is expected to take price action into its support zone from where a breakdown is favored to follow. The next support zone awaits this currency pair between 1.59054 and 1.59759. More downside is possible, but a new fundamental catalyst would be required.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.60350

Take Profit @ 1.59750

Stop Loss @ 1.60600

Downside Potential: 60 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.40