Ethereum has to deal with more than growing competition from more promising projects like TRON, Tezos, and Binance. Developers have headed for the exit, and miners may be soon to follow. As Ethereum is planning to transition from the proof-of-work (PoW) concept to proof-of-stake (PoS), the profitability of mining Ethereum with a graphics card has plunged to $0. The ETH/USD is in the process of breaking into its support zone from where more downside is likely. Ethereum may face an existential crisis and the risk of a network crash increases. Since the Constantinople hardfork, the issuance of new Ethereum almost plunged by 50% and is contracting further.

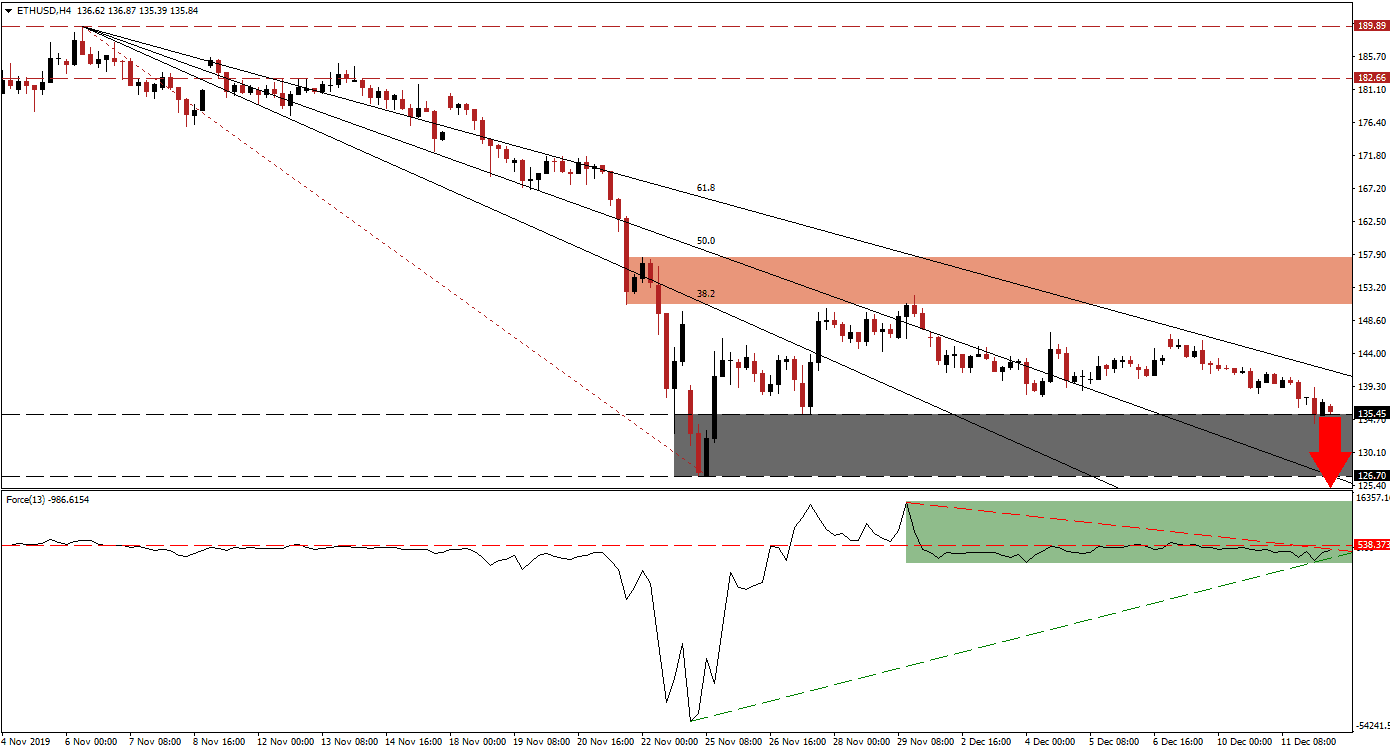

The Force Index, a next-generation technical indicator, remained confined to a narrow range with a bearish bias after peaking following the latest failed breakout attempt in this cryptocurrency pair. The Force Index descended below its horizontal support level and converted it into resistance. This technical indicator is now trapped between its ascending support level and its descending resistance level, as marked by the green rectangle. It additionally remains in negative territory and bears are in control of the ETH/USD. A breakdown in the Force Index below its ascending support level is favored to lead price action farther to the downside.

At the end of November, the ETH/USD was rejected by its short-term resistance zone located between 150.92 and 157.50, as marked by the red rectangle. This cryptocurrency pair descended and launched a second attempt after moving below its descending 50.0 Fibonacci Retracement Fan Support Level. This resulted in a lower high, as the 61.8 Fibonacci Retracement Fan Resistance Level reversed the advance; price action extended its slide, and recorded a lower low after a move into its support zone, confirming a bearish chart pattern. You can learn more about the Fibonacci Retracement Fan here.

Breakdown pressures have spiked and the 61.8 Fibonacci Retracement Fan Resistance Level is on the verge of crossing through its support zone; this zone is located between 126.70 and 135.45, as marked by the red rectangle. A breakdown in the ETH/USD is anticipated to accompany the exodus of developers and miners, with a mining difficulty time bomb threatening a potential collapse of the network. The next support zone awaits this cryptocurrency pair between 95.99 and 100.92, a breakdown below the $100 level will deliver a significant blow to psychology and further threaten the existence of Ethereum.

ETH/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 135.50

Take Profit @ 96.00

Stop Loss @ 145.00

Downside Potential: 3,950 pips

Upside Risk: 950 pips

Risk/Reward Ratio: 4.16

In case of a breakout in the Force Index above its descending resistance level, which will additionally convert its horizontal resistance level into support, the ETH/USD may attempt a recovery. Given the dismal fundamental outlook, supported by technical conditions, the upside potential remains limited to its short-term resistance zone. Any advance should be viewed as an outstanding short-selling opportunity in this cryptocurrency pair.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 147.00

Take Profit @ 157.00

Stop Loss @ 142.00

Upside Potential: 1,000 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 2.00