Ethereum reversed its advance and the bearish environment remains dominant; cryptocurrency traders should expect more downside to follow. On December 8th 2019, the Istanbul hard fork will update the blockchain; but over 59% of clients have failed to update their version to one compatible with the pending hard fork. Big clients like MyEtherWallet, ZhuZhu, and MiningPoolHub are among those not ready for Istanbul. The delay displays issues and discontent with the world’s second-largest cryptocurrency; the hard fork lacks backward compatibility, and clients who fail to upgrade are no longer able to interact with the blockchain. Unless there will be a rush to upgrade before the deadline, the ETH/USD may be pressured below its support zone.

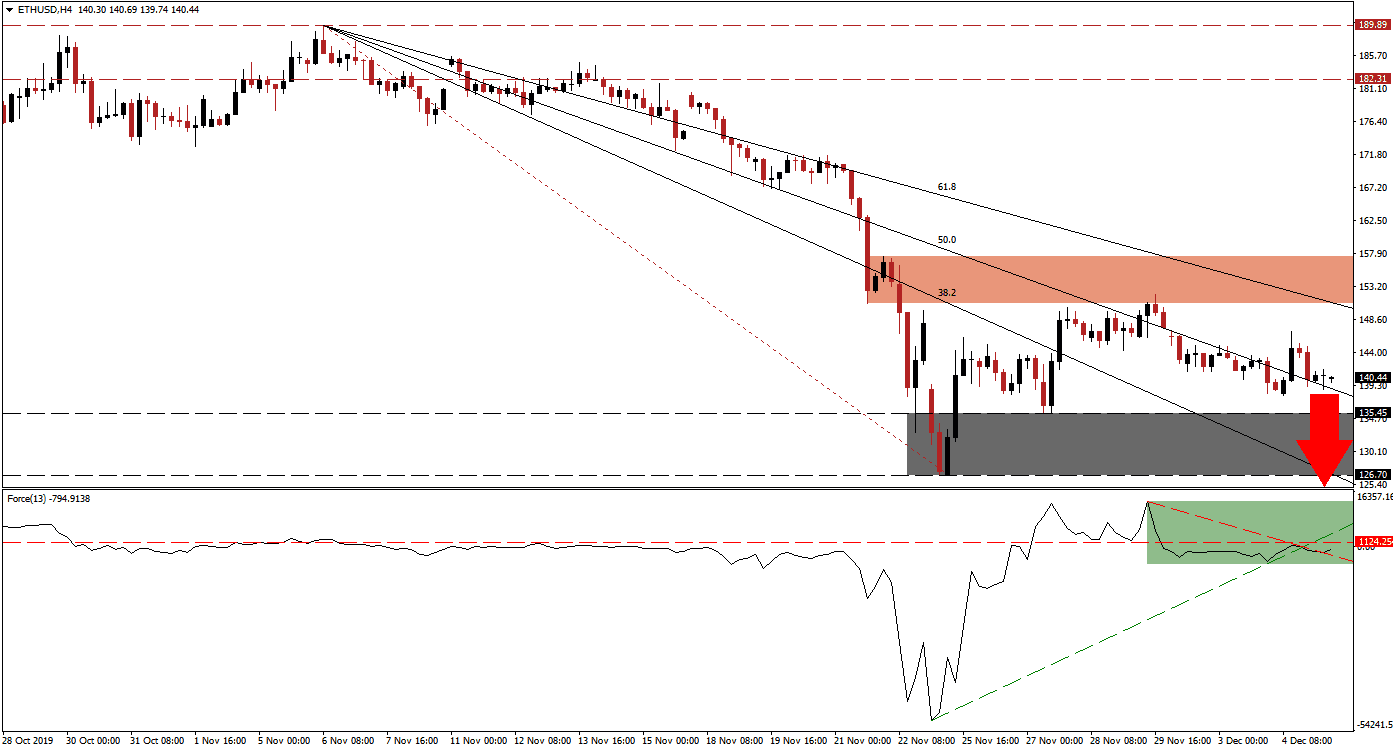

The Force Index, a next-generation technical indicator, reversed together with this cryptocurrency pair and moved below its horizontal support level; this turned it back into resistance. Bearish momentum additionally took the Force Index below its ascending support level, as marked by the green rectangle, and turned it into temporary resistance. Selling pressure on the ETH/USD eased as it is closing in on its support zone which allowed this technical indicator to move above its descending resistance level. The Force Index remains well-anchored in negative territory and bears remain in charge of price action. You can learn more about the Force Index here.

After price action was rejected by its short-term resistance zone, located between 150.92 and 157.50 as marked by the red rectangle, the ETH/USD is being directed to the downside by its Fibonacci Retracement Fan sequence. The descending 50.0 Fibonacci Retracement Fan Support Level acts as the primary guide to the downside. Fundamental bearish developments like the failure to prepare for the upgrade by the majority of users displays structural issues, and are expected to result in more downside. The Istanbul hard fork is expected to mark the last one for the Ethereum 1.0 blockchain before 2.0 will be introduced.

As the 50.0 Fibonacci Retracement Fan Support Level is on the verge of crossing its support zone, located between 126.70 and 135.45 as marked by the grey rectangle, a fresh spike in selling pressure is anticipated. The 38.2 Fibonacci Retracement Fan Support Level has already crossed below the support zone and the ETH/USD is likely to follow its path. A short-term advance cannot be ruled out as price action approaches the top range of its support zone; the 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to limit any bounce off of support from where a breakdown is expected to materialize. The next support zone is located between 106.73 and 112.19. You can learn more about a breakdown here.

ETH/USD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 140.00

- Take Profit @ 106.75

- Stop Loss @ 151.00

- Downside Potential: 3,325 pips

- Upside Risk: 1,100 pips

- Risk/Reward Ratio: 3.02

In the event of a breakout in the Force Index above its ascending support level, the ETH/USD could launch a breakout attempt above its short-term resistance zone. Given the fundamental developments in this cryptocurrency pair, any breakout attempt should be taken advantage of with short orders as the outlook remains bearish. Upside potential remains limited to its intra-day high of 169.59, the peak before price action accelerated to the downside and into its support zone.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 159.00

- Take Profit @ 169.00

- Stop Loss @ 155.00

- Upside Potential: 1,000 pips

- Downside Risk: 400 pips

- Risk/Reward Ratio: 2.50