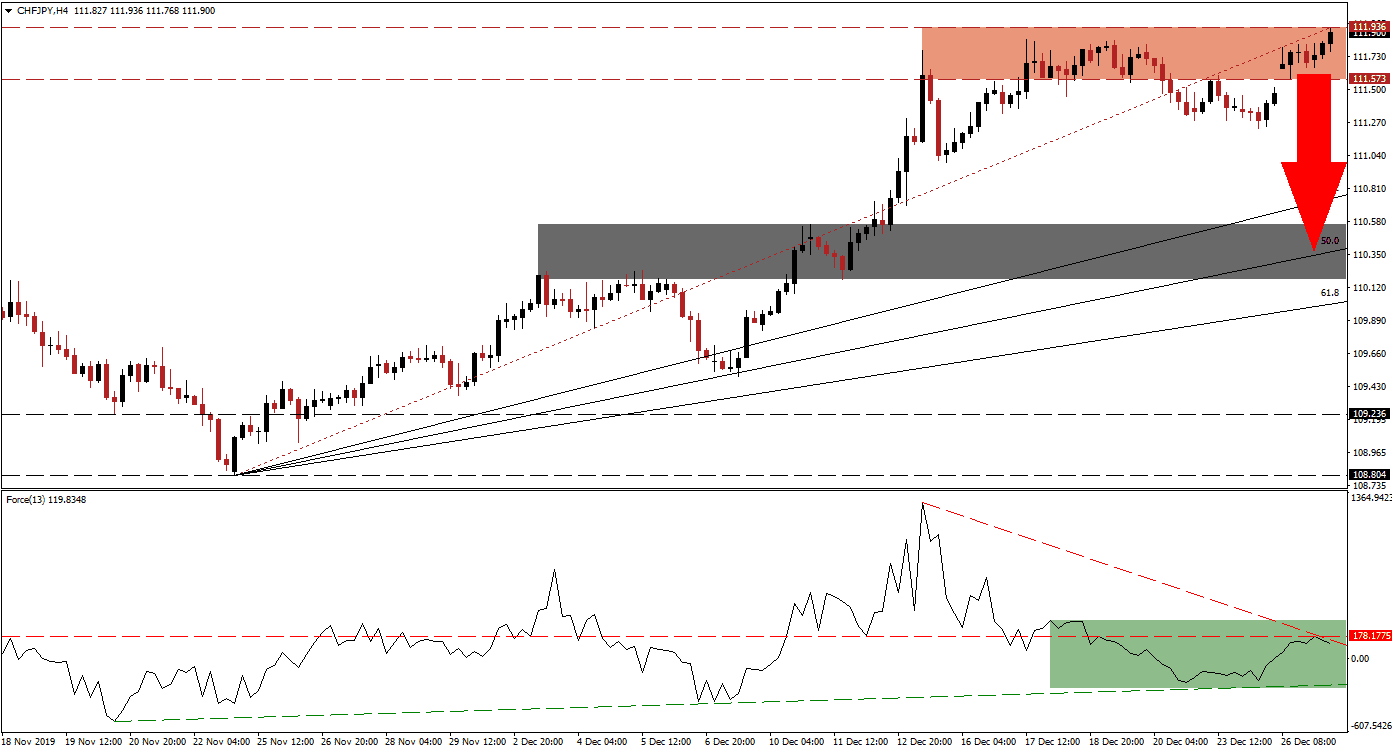

With the expected return of volatility and a risk-off period, safe-haven assets will be in demand. The Japanese Yen and the Swiss Franc are the top two currency pairs in this category. Forex traders often ignore economic developments in favor of parking their capital in assets presumed safe and with growth potential. Japanese economic data has been weaker than expected, allowing the CHF/JPY to extend its advance. Bearish momentum has increased since this currency pair advanced into its resistance zone, and breakdown pressures are expanding.

The Force Index, a next-generation technical indicator, peaked after the CHF/JPY initially reached its resistance zone. It descended since then as price action drifted higher, and a negative divergence materialized. The Force Index corrected below its horizontal support level, turning it back into resistance. This technical indicator was able to recovery off of its ascending support level but failed to eclipse its horizontal resistance level, as marked by the green rectangle. Its descending resistance level is adding to bearish pressures and a push into negative conditions is anticipated to follow, placing bears in control of price action. You can learn more about the Force Index here.

This currency pair additionally moved below its Fibonacci Retracement Fan trendline, adding to bearish developments. A breakdown below its resistance zone located between 111.573 and 111.936, as marked by the red rectangle, is expected to emerge. A profit-taking sell-off is anticipated to drive the CHF/JPY farther to the downside and close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Forex traders are recommended to monitor the intra-day low of 111.231, the low of a failed breakdown attempt. New net short positions are expected once price action descends past this level.

A corrective phase into its next short-term support zone, located between 110.177 and 110.557 as marked by the grey rectangle, will keep the long-term uptrend in this currency pair intact. The 50.0 Fibonacci Retracement Fan Support Level is enforcing this resistance zone temporarily. While a further breakdown in the CHF/JPY below its enforced short-term support zone cannot be ruled out, a fresh fundamental catalyst would be required. You can learn more about a support zone .

CHF/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 111.900

Take Profit @ 110.400

Stop Loss @ 112.200

Downside Potential: 150 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 5.00

In the event of a sustained breakout in the Force Index above its descending resistance level, the CHF/JPY could attempt to add to its current advance. The upside remains extremely limited above the 112.000 level, and the technical picture favors a breakdown in price action. The next resistance zone awaits this currency pair between 112.861 and 113.317, which marks a great short-entry possibility.

CHF/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 112.400

Take Profit @ 113.150

Stop Loss @ 112.100

Upside Potential: 75 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.50