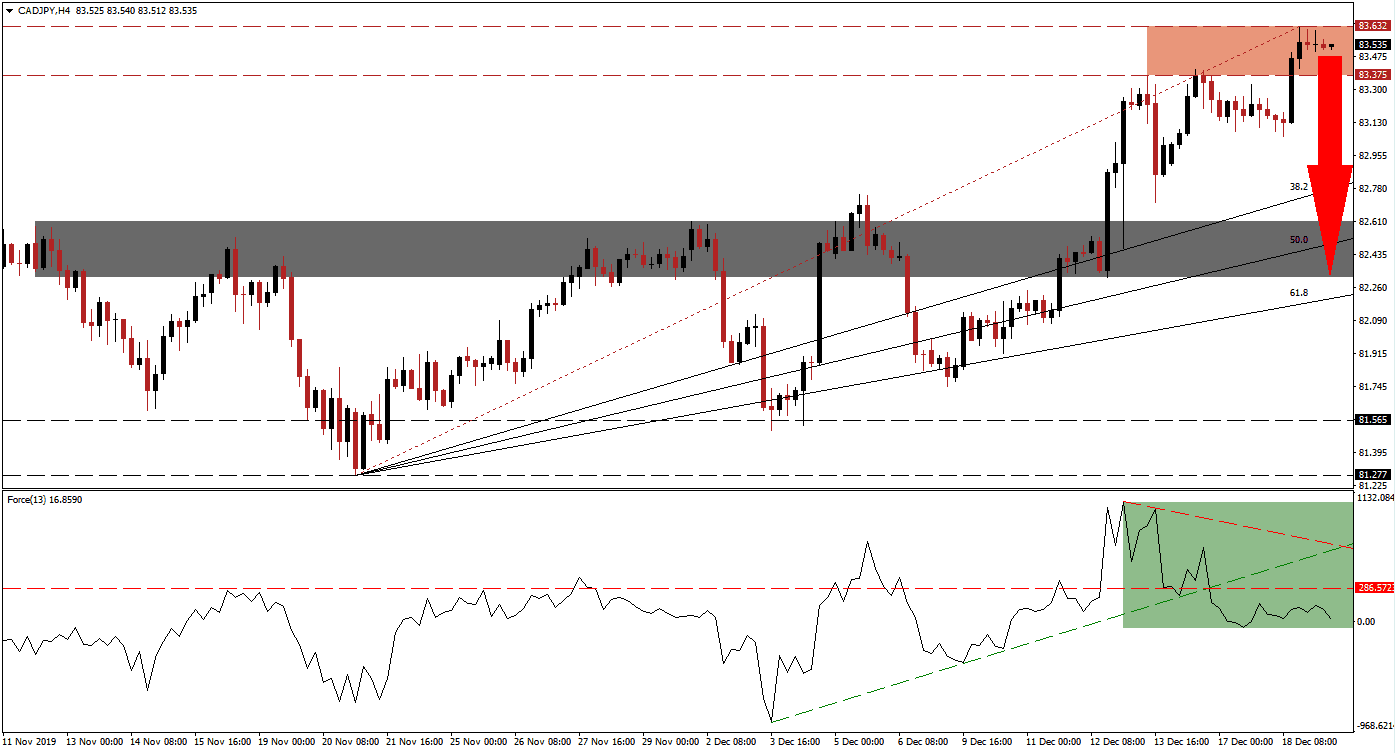

As widely expected, the Bank of Japan left its monetary policy unchanged. The Japanese central bank has cautioned markets that further easing remains an option, but decided to delay adjustments after the announcement of the phase-one trade truce between the US and China. The CAD/JPY paused its advance inside its resistance zone, while forex traders await more data. The Japanese Yen remains the primary safe-haven currency, and therefore heavily impacted by geopolitical and global economic data. You can learn more about a resistance zone here.

The Force Index, a next-generation technical indicator, shows the loss in bullish momentum after this currency pair advanced into its resistance zone and a negative divergence formed. Bearish pressures are mounting after the Force Index converted its horizontal support level into resistance. This additionally resulted in a breakdown below its ascending support level, as marked by the green rectangle. The ascending support level has now intersected the descending resistance level, and more downside is anticipated to pressure this technical indicator into negative conditions. Bears will then be in control of the CAD/JPY, and a corrective phase is favored to follow.

Another bearish development materialized after this currency pair moved below its Fibonacci Retracement Fan trendline inside its resistance zone. The resistance zone is located between 83.375 and 83.632, as marked by the red rectangle. A breakdown below it is anticipated to result in a profit-taking sell-off, which will add downside pressure on the expected corrective phase. It will additionally close the gap between the CAD/JPY and its ascending 38.2 Fibonacci Retracement Fan Support Level. You can learn more about a profit-taking sell-off here.

Forex traders are advised to monitor the intra-day low of 83.054, the low of the previous rejection in the advance of the CAD/JPY by its resistance zone that led to a higher high. A breakdown below this level is expected to result in the addition of new net short positions in this currency pair. The corrective phase is likely to pause at its next short-term support zone located between 82.314 and 82.610, as marked by the grey rectangle. Enforcing this zone is the 50.0 Fibonacci Retracement Fan Support Level which is passing through it. More downside remains an option, and the long-term support zone awaits price action between 81.277 and 81.565.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 83.555

Take Profit @ 82.350

Stop Loss @ 83.950

Downside Potential: 120 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index above its ascending support level could pressure the CAD/JPY into more upside. With the global economic outlook uncertain and a bearish bias gaining dominance, the upside potential remains limited to the next resistance zone located between 84.785 and 85.229. Any advance into this zone should be considered a good short-selling opportunity.

CAD/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 84.200

Take Profit @ 84.900

Stop Loss @ 83.850

Upside Potential: 70 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.00