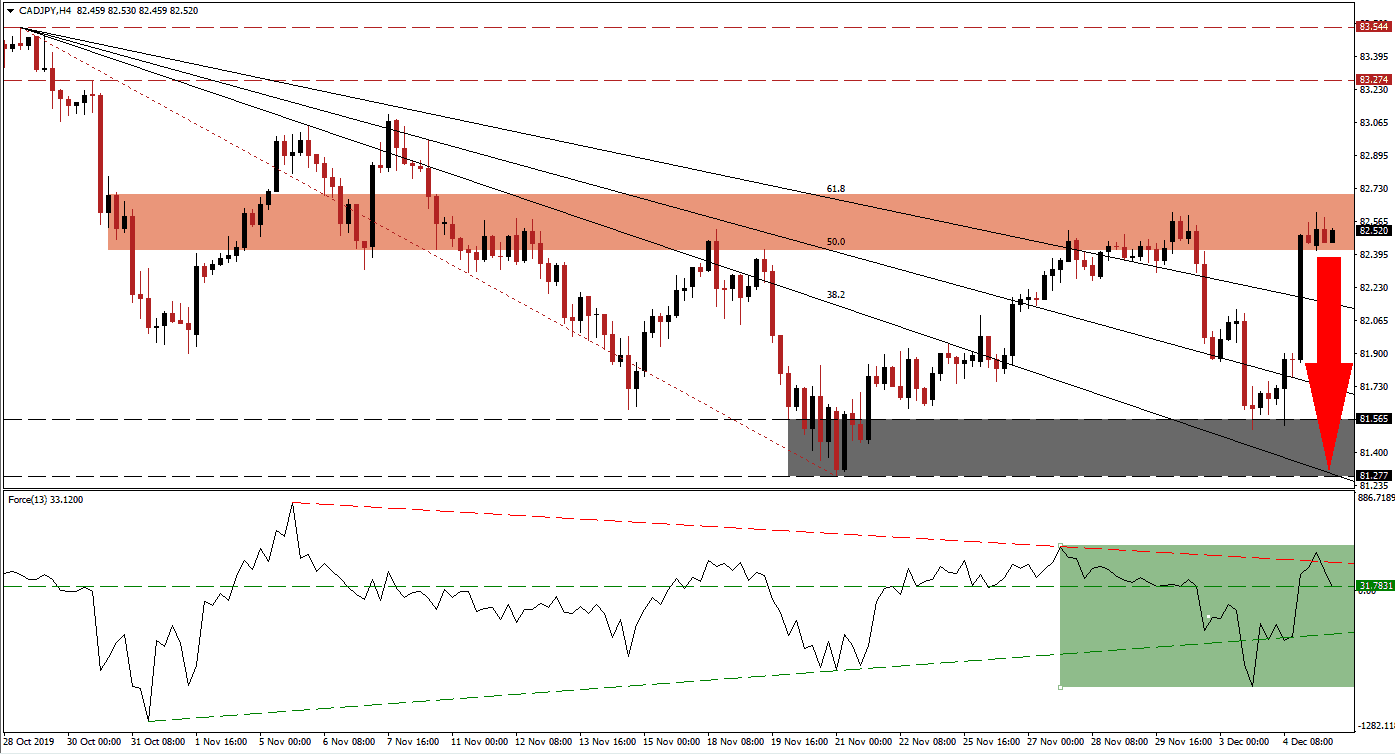

As the Bank of Canada kept interest rates unchanged at 1.75%, in a move widely expected by markets, the Canadian Dollar rallied; according to the central bank, the global economic expansion remains intact. The safe-haven Japanese Yen came under pressure despite the ongoing uncertainty about trade negotiations between the US and China; this allowed the CAD/JPY to accelerate higher after grazing its support zone, but the upside is limited after price action reached its short-term resistance zone and bearish momentum is rising.

The Force Index, a next-generation technical indicator, briefly pierced its descending resistance level to the upside as this currency pair advanced but quickly reversed. As price action remains inside its short-term resistance zone, the Force Index is in the process of breaking down below its horizontal support level and turning it into resistance as marked by the green rectangle. This technical indicator is favored to descend into its ascending support level which would place it in negative conditions and bears in charge of the CAD/JPY. You can learn more about the Force Index here.

A confirmed breakdown in this currency pair below its short-term resistance zone, located between 82.416 and 82.702 as marked by the red rectangle, is expected to result in a profit-taking sell-off. Forex traders are advised to monitor the intra-day low of 82.268 which marks the low of a previously reversed failed breakdown attempt; a move below this level is likely to result in the addition of new net sell orders. This should provide the necessary momentum to force the CAD/JPY below its descending 61.8 Fibonacci Retracement Fan Support Level.

Safe-haven assets like the Japanese Yen will see an increase in demand if the December 15th tariffs are enforced while the commodity-dependent Canadian Dollar is feeling the impact of the global economic slowdown and its effect on commodity prices. The long-term fundamental outlook remains bearish and after a move in the CAD/JPY below its 61.8 Fibonacci Retracement Fan Support Level, the Fibonacci Retracement Fan sequence may guide this currency pair into its support zone; this zone awaits price action between 81.277 and 81.565 as marked by the grey rectangle. A further breakdown is possible and the 38.2 Fibonacci Retracement Fan Support Level has already moved below the support zone.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 82.500

- Take Profit @ 81.300

- Stop Loss @ 82.750

- Downside Potential: 120 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 4.80

Should the Force Index reverse off of its horizontal support level and push through its descending resistance level, the CAD/JPY may follow with a breakout attempt of its own. The next long-term resistance level is located between 83.274 and 83.544 which represents a good short-selling opportunity. Afresh fundamental catalyst would be required to maintain a breakout attempt from current levels as the outlook remains bearish.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 82.950

- Take Profit @ 83.500

- Stop Loss @ 82.750

- Upside Potential: 55 pips

- Downside Risk: 25 pips

- Risk/Reward Ratio: 2.20