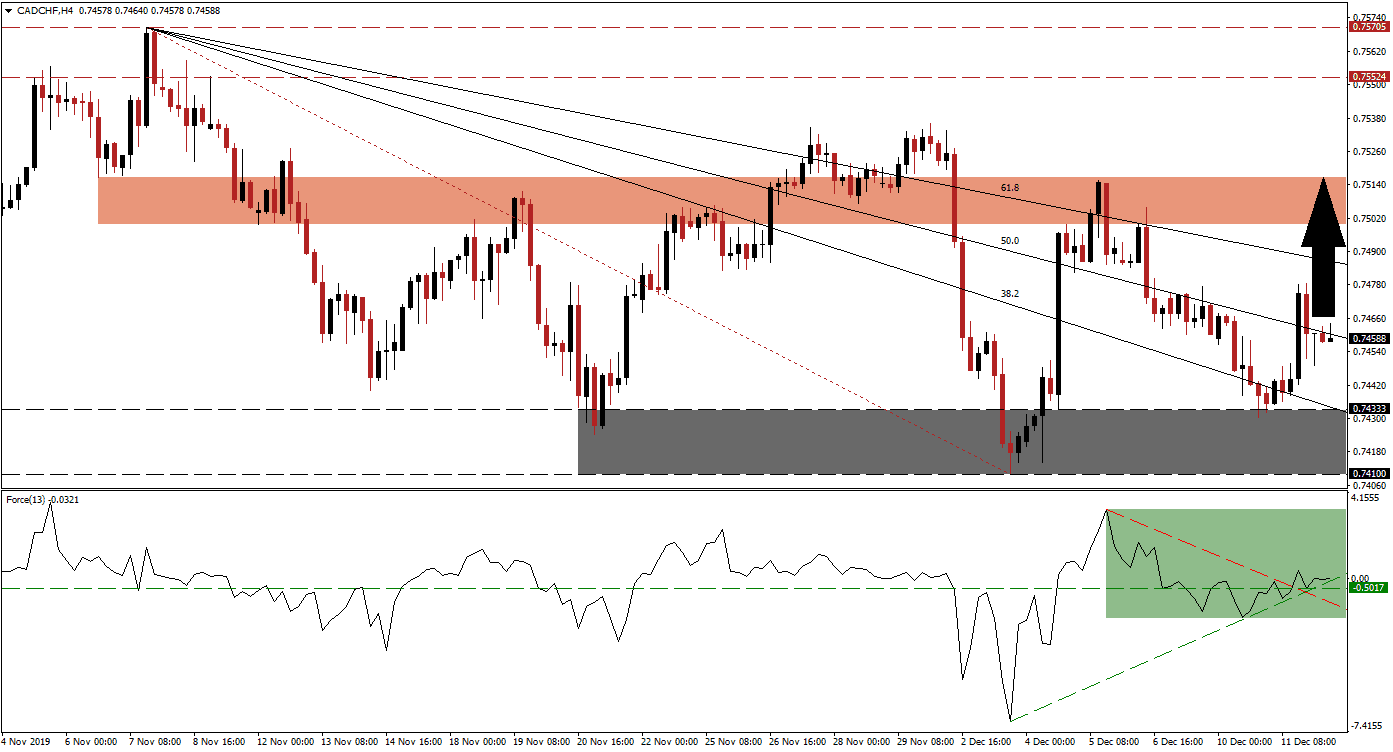

Today’s Swiss National Bank interest rate announcement is expected to show no change; Switzerland, together with Denmark, is home to the lowest global interest rate at -0.75%. The press conference thirty minutes after the announcement will carry more weight, especially after the SNB communicated to markets that an interest rate cut remains on the table. The CAD/CHF recovered from its corrective phase, after briefly dipping into its support zone. A renewed push to the upside is anticipated, as bullish momentum is expanding. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, corrected in unison with price action, After moving below its horizontal support level, the Force Index recorded a high low and an ascending support level formed. It guided this technical indicator to the upside and elevated it above its descending resistance level, as marked by the green rectangle. The Force Index is now expected to ascend into positive conditions and place bulls in charge of the CAD/CHF, leading to an extension of the recovery.

Following the initial advance in this currency pair off of its support zone, located between 0.74100 and 0.74333, as marked by the grey rectangle, price action stalled. A spike above its descending 50.0 Fibonacci Retracement Fan Resistance Level was reversed, but bullish momentum remained dominant. The 38.2 Fibonacci Retracement Fan Support Level has entered the support zone, and pressures for either a breakout or breakdown have increased. The SNB press conference may provide the next fundamental catalysts, and a breakout in the CAD/CHF is anticipated.

Forex traders are recommended to monitor the intra-day high 0.74785, the peak of the failed breakout attempt, as a push above this level is anticipated o result in the addition of fresh net buy orders. The CAD/CHF will face its next short-term resistance zone between 0.74997 and 0.75166, as marked by the red rectangle. An additional breakout is possible, especially after the Bank of Canada removed the risk of an interest rate cut for now. The next long-term resistance zone is located between 0.75524 and 0.75705; you can learn more about a breakout here.

CAD/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.74550

Take Profit @ 0.75150

Stop Loss @ 0.74350

Upside Potential: 60 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.00

Should the Force Index push below its descending resistance level, the CAD/CHF may attempt a breakdown below its support zone. While the technical picture favors a short-term breakout, the long-term fundamental outlook for this currency pair remains bearish. Global economic uncertainty is anticipated to boost the safe-haven appeal of the Swiss Franc, and price action will face its next support zone between 0.73362 and 0.73594.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.73950

Take Profit @ 0.73400

Stop Loss @ 0.74200

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20