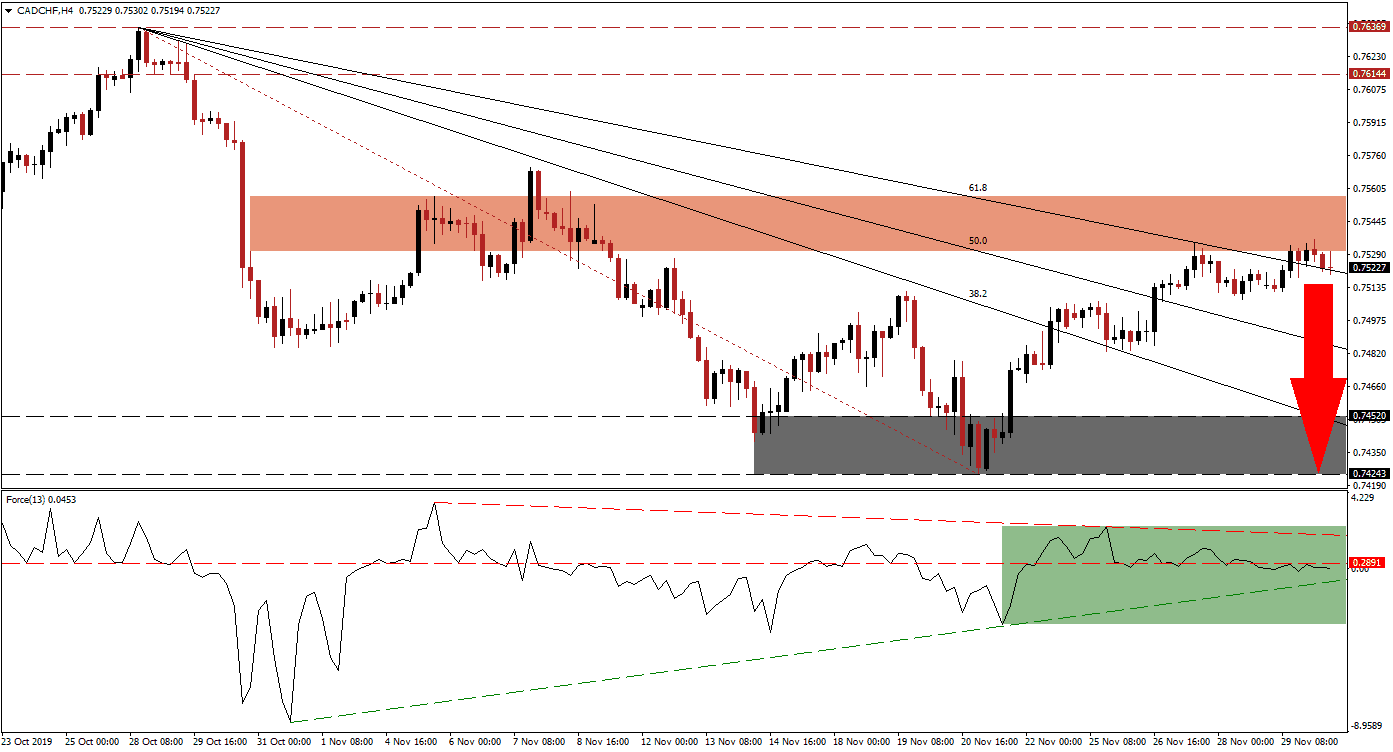

Bullish momentum in the CAD/CHF is fading as this currency pair eclipsed its entire Fibonacci Retracement Fan, but ran into a strong resistance zone. The Canadian Dollar enjoyed a strong rally against the Swiss Franc after the SNB put an interest rate cut on the table. Select economic data out of Switzerland came above expectations since then, led by GDP figures, and this is likely to keep the SNB on the sidelines. The loss in bullish momentum is favored to push price action into a profit-taking sell-off.

The Force Index, a next-generation technical indicator, confirms deflated bullish momentum after the CAD/CHF broke out above its descending 38.2 Fibonacci Retracement Fan Resistance Level. As price action extended its breakout sequence, the Force Index moved below its horizontal resistance level and turned it into support. This technical indicator is now approaching its ascending support level as marked by the green rectangle. A breakdown will take the Force Index into negative territory and place bears in charge of price action. You can learn more about the Force Index here.

Tensions between the US and China are on the rise following US President Trump’s signing of a bill into law that supports the Hong Kong protesters. This has clouded negotiations for a phase one trade truce and new tariffs are set to kick in on December 15th 2019. Safe-haven assets like the Swiss Franc are expected to outperform as uncertainty is on the rise. The short-term resistance zone, located between 0.75306 and 0.75565, as marked by the red rectangle, is providing sufficient bearish pressures for the CAD/CHF to complete a breakdown below its 61.8 Fibonacci Retracement Fan Resistance Level.

Forex traders are advised to monitor the intra-day low of 0.75074 which represents the bottom of a failed breakdown attempt. This currency pair recovered back into its resistance zone and is now developing its second breakdown. A sustained move below this mark is favored to initiate a profit-taking sell-off and a breakdown sequence in this currency pair. The Fibonacci Retracement Fan sequence can then guide the CAD/CHF down into its support zone located between 0.74243 and 0.74520 as marked by the grey rectangle. You can learn more about a support and resistance zone here.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.75250

⦁ Take Profit @ 0.74250

⦁ Stop Loss @ 0.75550

⦁ Downside Potential: 100 pips

⦁ Upside Risk: 30 pips

⦁ Risk/Reward Ratio: 3.33

A breakout in the Force Index above its horizontal resistance level as well as above its descending resistance level may allow the CAD/CHF to attempt a breakout. Given the long-term fundamental outlook regarding trade and the global economy as a whole, upside potential remains limited to the next long-term resistance zone; this awaits price action between 0.76144 and 0.76369. Forex traders should consider this an excellent short-selling opportunity.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 0.75750

⦁ Take Profit @ 0.76250

⦁ Stop Loss @ 0.75500

⦁ Upside Potential: 50 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.00