Volatility is anticipated to increase after traders return from their Christmas holiday break and start their 2020. This is expected to boost demand for safe-haven currencies like the Swiss Franc, which to a lesser degree is also a commodity currency. The Canadian Dollar, one of the top three commodity currencies, may come under more selling pressure as the global economic slowdown extends and diminished demand for oil. Canada is heavily dependent on the oil market, being a top seven producer globally. The breakdown in the CAD/CHF below its short-term resistance zone is favored to lead to more downside.

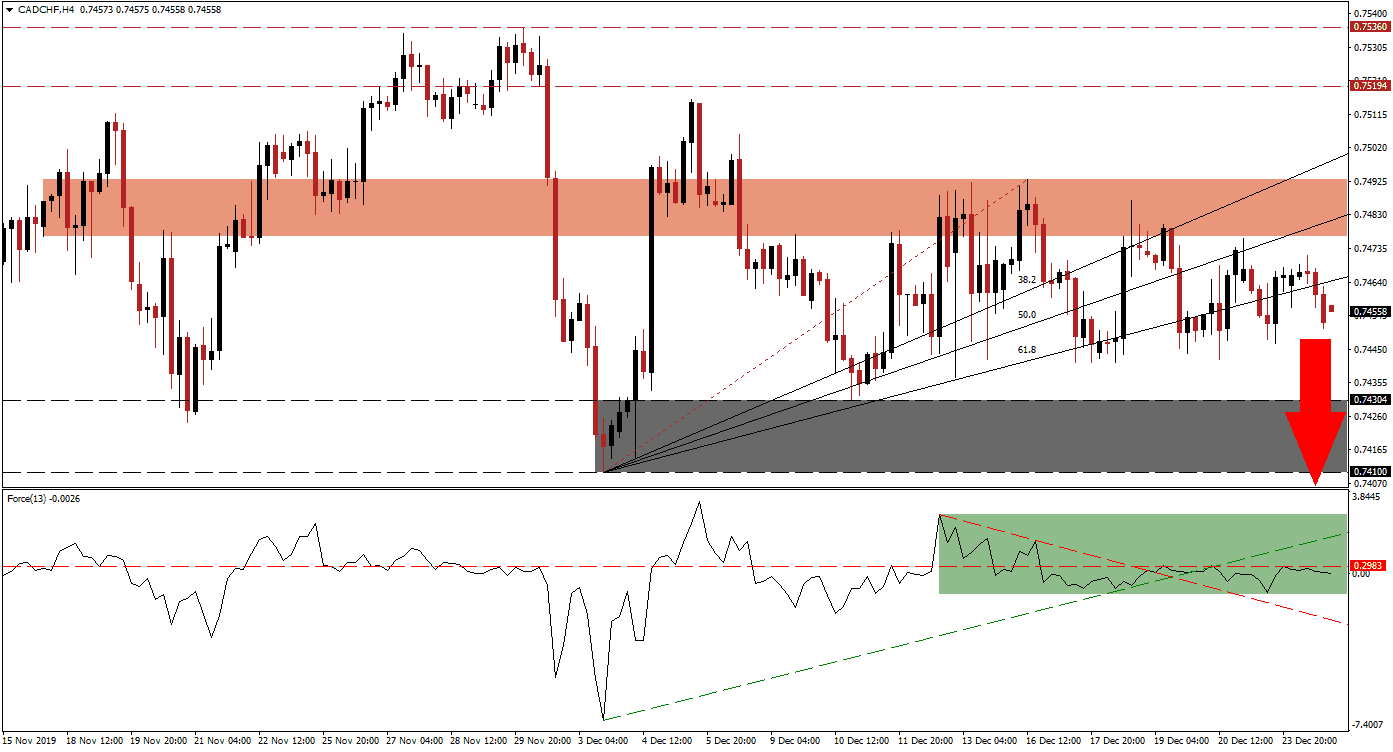

The Force Index, a next-generation technical indicator, suggests more selling pressure is ahead after the CAD/CHF completed a breakdown below its Fibonacci Retracement Fan sequence. The Force Index remains below its horizontal resistance level, as marked by the green rectangle. As a result of the sideways trend, this technical indicator moved above its descending resistance level and below its ascending support level. It additionally descended into negative territory, placing bears in charge of this currency pair. You can learn more about the Force Index here.

Adding to bearish developments in the CAD/CHF is the formation of lower highs. This caused the Fibonacci Retracement Fan sequence to be redrawn, but price action already moved below its ascending 61.8 Fibonacci Retracement Fan Support Level, turning it into resistance. The short-term resistance zone located between 0.74769 and 0.74929, as marked by the red rectangle, has rejected a breakout attempt on seven occasions, and allowed bearish pressures to expand. As the risk-off mood is anticipated to return in January, more downside is favored.

This currency pair now has a clear path into its support zone located between 0.74100 and 0.74304, as marked by the grey rectangle. Given the long-term bearish fundamental outlook for the CAD/CHF, a breakdown is expected to lead price action farther to the downside. The Bank of Canada and the Swiss National Bank have not ruled out interest rate cuts to combat the ongoing slowdown, but the risks for such a move are greater out of Canada. The next support zone is located between 0.72649 and 0.72960. You can learn more about a breakdown here.

CAD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.74550

Take Profit @ 0.72950

Stop Loss @ 0.74950

Downside Potential: 160 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 4.00

Should the Force Index push through its horizontal resistance level and sustain a breakout above its ascending support level, the CAD/CHF may attempt to follow with a breakout of its own. The upside potential remains limited to the long-term resistance zone located between 0.75194 and 0.75360. Forex traders are recommended to consider this an outstanding short-selling opportunity.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.75050

Take Profit @ 0.75350

Stop Loss @ 0.74900

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00