Bitcoin is amid an insignificant bounce, although a further breakdown is expected to follow. Interest in Bitcoin has descended to 2019 lows and is reminiscent of the Crypto Winter of 2018. Research indicates that 59% of the circulating supply has not transferred in nearly two years, suggesting that long-term investors are sustaining positions. New capital into the ecosystem has decreased, and the overall outlook for the BTC/USD remains bearish unless a fresh fundamental catalyst will emerge. You can learn more about a breakdown here.

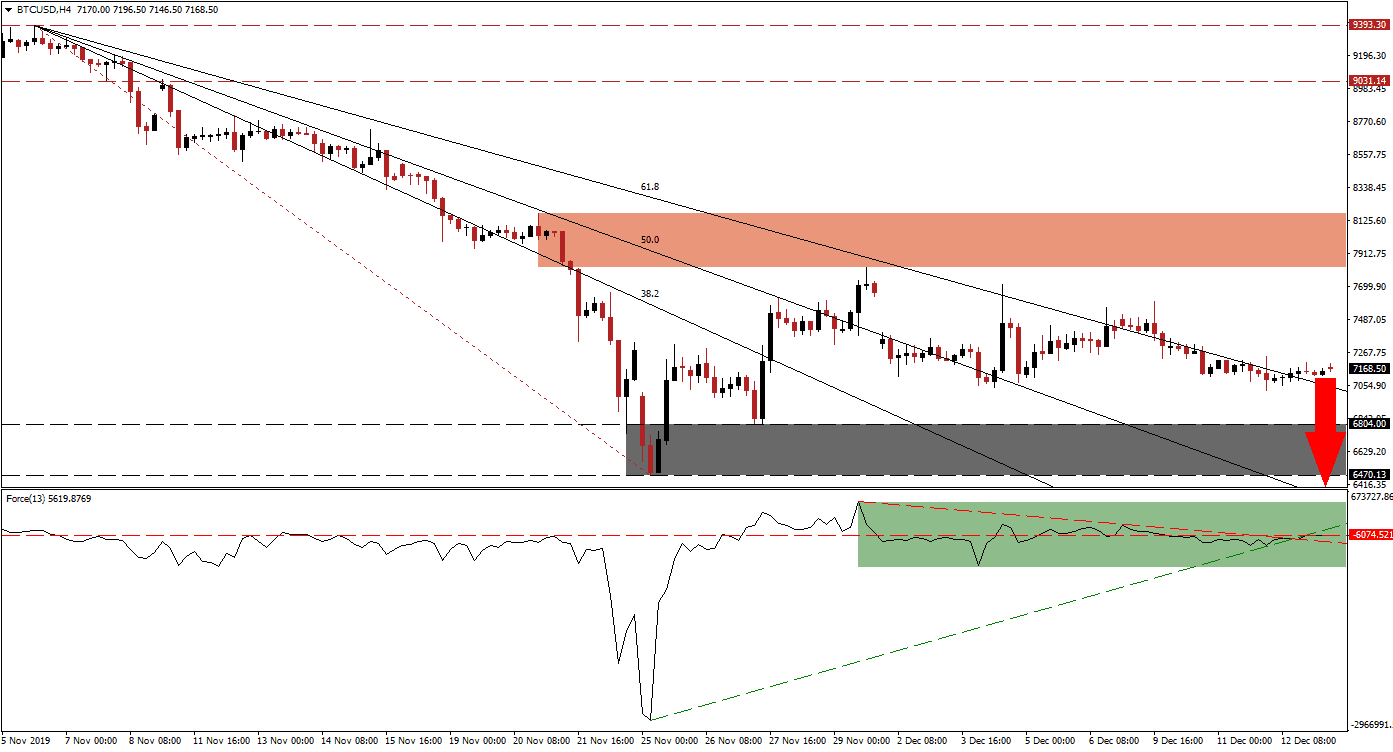

The Force Index, a next-generation technical indicator, points towards a narrow range, following the rejection of the BTC/USD by its short-term resistance zone, with a bearish bias. The horizontal resistance level remains dominant, despite the Force Index moving above its shallow descending resistance level. Furthermore, it maintains its position below its ascending support level, as marked by the green rectangle. This technical indicator remains in positive territory, but the rise in fundamental bearish developments is favored to force a drop into negative conditions.

Bearish momentum intensified after this cryptocurrency pair was rejected by its short-term resistance zone located between 7,819.00 and 8,170.50, as marked by the red rectangle. The Fibonacci Retracement Fan sequence has guided the BTC/USD to the downside, following the breakdown below its long-term resistance zone located between 9,031.14 and 9,393.30. Price action eclipsed its descending 61.8 Fibonacci Retracement Fan Resistance Level, temporarily converting it into support, but is unlikely to sustain current levels. You can learn more about the Fibonacci Retracement Fan here.

With the lack of fresh capital and the fading interest in Bitcoin, a breakdown below its next support zone is anticipated. This support zone is located between 6,470.13 and 6,804.00, as marked by the grey rectangle. The 38.2 and 50.0 Fibonacci Retracement Fan Resistance Levels have already moved below it, resulting in further bearish development. Breakdown pressures are on the rise, and the BTC/USD will face its next support zone between 5,592.01 and 5,920.29.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 7,150.00

- Take Profit @ 5,725.00

- Stop Loss @ 7,450.00

- Downside Potential: 142,500 pips

- Upside Risk: 30,000 pips

- Risk/Reward Ratio: 4.75

In case of a breakout in the Force Index above its ascending support level, the BTC/USD may extend its bounce. The upside potential remains limited to its short-term resistance zone, but a series of lower highs may cap the advance near the 7,500 level. Any push in price action into its short-term resistance zone should be viewed as a good short-selling opportunity in this cryptocurrency pair.

BTC/USD Technical Trading Set-Up - Price Action Recovery Extension Scenario

- Long Entry @ 7,600.00

- Take Profit @ 8,000.00

- Stop Loss @ 7,400.00

- Upside Potential: 40,000 pips

- Downside Risk: 20,000 pips

- Risk/Reward Ratio: 2.00