Bitcoin markets rallied a bit during the trading session on Friday and what would have been very light trading overall, as Americans are still focusing on the Thanksgiving holiday. Ultimately, this is a market that has recently pierced major support and has been in a downtrend for several months. All things being equal, this is a market that should continue to go much lower, but it looks as if we are forming a short-term base in this area.

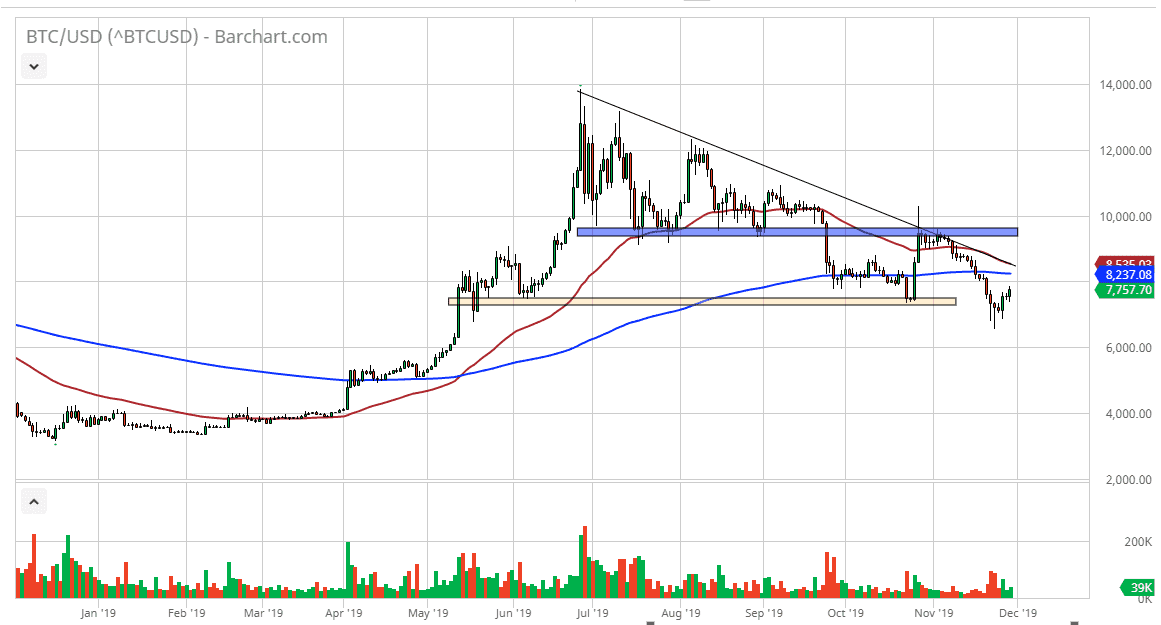

Recently, the Chinese had made comments about researching block chain, but they have also recently mentioned that block chain and Bitcoin are two different things. Because of this, a lot of the people who bought Bitcoin during that weekend have jumped back out of the market, and now we have even broken below that level. By doing that, the market is likely to continue to see a lot of sellers above, especially near the 200 day EMA. Beyond that, the 50 day EMA is tracing the downtrend line, and therefore I see far too many technical issues above to start buying.

Beyond that, the market had broken below a descending triangle, slammed right into it during that weekend of bullish pressure, and that has fallen from there. At this point in time, we have not fulfilled that potential move, which is down at the $4800 level. I still believe that’s going to happen, and as a result it’s likely that the market continues to find reasons to fall. Quite frankly, in an environment where central banks around the world are loosening monetary policy, it’s a bit difficult to imagine why Bitcoin would stay this low unless there is a significant lack of demand. That seems to be the case, and therefore Bitcoin continues to struggle.

A lot of the major bullish pressure to the upside in Bitcoin was due to Chinese trying to get money out of the country, so therefore the fact that the Chinese Communist Party has recently suggested it was going to crack down on Bitcoin also has a lot of people concerned about the crypto market. All things being equal, I am a seller and I think that we will see enough exhaustion near the 8250 level to start selling again. With this, the market is likely to continue lower, but the alternate scenario might be the simple break down below the most recent low. If that happens, that’s a selling opportunity as well.