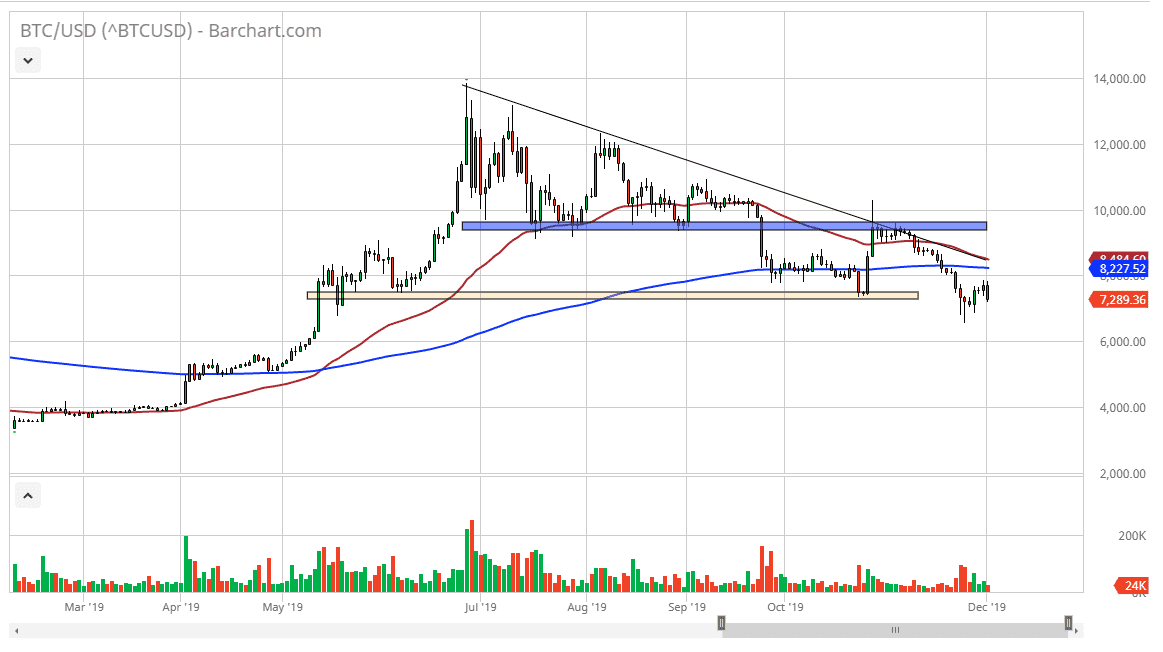

Bitcoin initially tried to rally during the trading session on Monday but as we have seen so many times, simply rolled over and started to sell off yet again. At this point, Bitcoin seems to be a bit of an unloved asset, and as a result I think we will probably try to go down towards the bottom of the hammer from last week. All things being equal, the 200 day EMA is just above and offering a major resistance barrier. The fact that the candlestick is sold off the way it did suggests to me that we will continue to see a lot of troubles.

Remember, the market had initially tried to break higher based upon headlines coming out of China and the idea of China doing massive amounts of research in block chain. However, the idea of China investigating the idea of researching block chain doesn’t equate to Bitcoin going higher. Beyond that, the People’s Bank of China reiterated that they were not backing the idea of investing in crypto currency. As soon as that was announced on Monday, Bitcoin started to drift lower.

At this point I suspect that any rally is to be sold, as the 50 day EMA is starting to reach towards the 200 day EMA, and the downtrend line that is so prominent in this market. At this point, we are getting ready to have the so-called “death cross”, so that’s another reason to think that Bitcoin is going to continue to falter. Based upon the descending triangle from previous trading, there was a target of roughly $4800, and it’s very unlikely to do anything other than fall from here. I don’t even see a scenario in which we would be buying Bitcoin, so therefore it’s a “short only” market. There will be detractors going on about central banks and what they are going to fiat currencies, but the reality is that the Bitcoin market has been extraordinarily soft even while most major central banks around the world continue to cut interest rates and loosen monetary policy. In other words, this is exactly when Bitcoin should be going much higher. With that in mind, it is a “sell the rallies” type of scenario that we find ourselves in yet again as crypto currency has yet to be adopted on a wide scale, and of course 10 years later we don’t really have much use of the block chain itself.