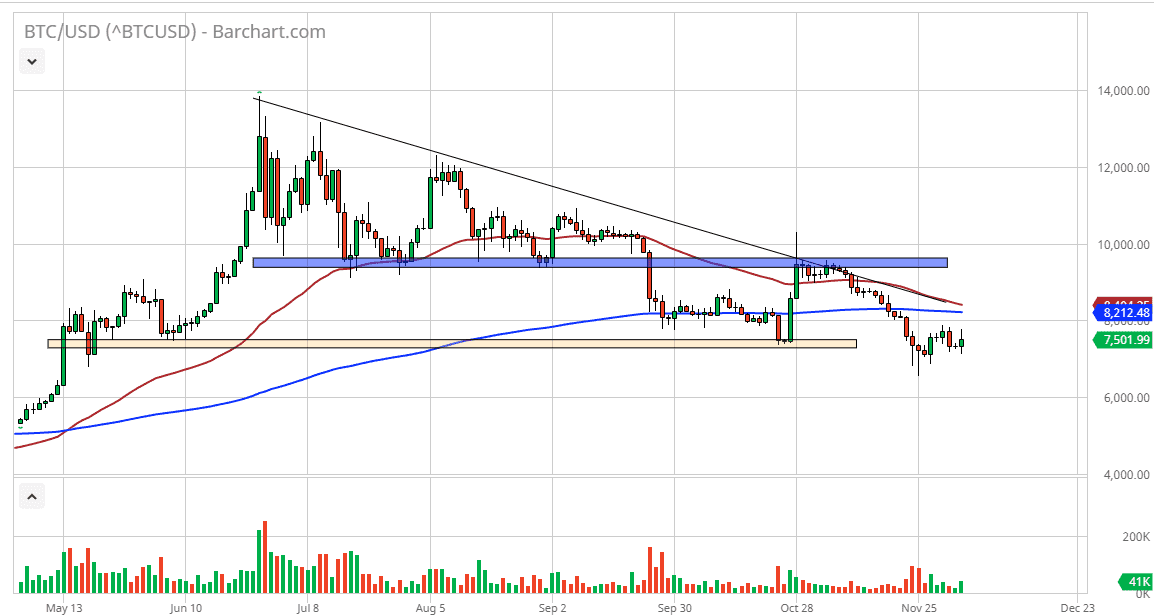

Bitcoin initially tried to rally during the trading session on Wednesday but gave up gains again closer to the $8000 level. At this point Bitcoin looks very susceptible to selling pressure, and it’s probably only a matter of time before the market drops from here. Ultimately, the 200 day EMA above is massive resistance, and it continues to influence Bitcoin quite a bit. The market looks as if it is ready to continue dropping from here, and it’s likely that we will finally fulfill that target of $4800 based upon the descending triangle that had been broken through back in late September. While it hasn’t necessarily been a massive meltdown, it has been a grind lower for some time.

The bounce that the market had seen over that weekend was due to the noise coming out of China suggesting that it was going to research block chain. Ultimately, the People’s Bank of China suggested that block chain did not mean Bitcoin, so therefore the bounce that we had seen for the crypto currency market is completely wiped out since then, and now that we are broken down from the downtrend line and that’s in general vicinity it suggests that we are going to continue to see a lot of trouble. I think at this point anytime that Bitcoin rallies you should be selling, because quite frankly nothing good has appeared on this chart for quite some time.

Beyond all that, Bitcoin is not been widely adopted, despite what some of the die hards will say. Ultimately, Bitcoin has been exposed as a speculators market more than anything else. That’s fine, but keep in mind that you are not trading “new money”, you are trading something that people are betting on back and forth. Again, that doesn’t really matter but at the end of the day the technical analysis certainly looks as if the jigs up in the short term. If we do rally from here, I would not be comfortable buying Bitcoin until we break well above the $9000 level and even then, I would be quite a bit cautious about doing so. If we break down below the $4800 level on a move lower, then it’s likely we go looking towards the $4000 level after that. At this point, this is a market that continues to be very negative, despite the fact that we tried to rally during the day.