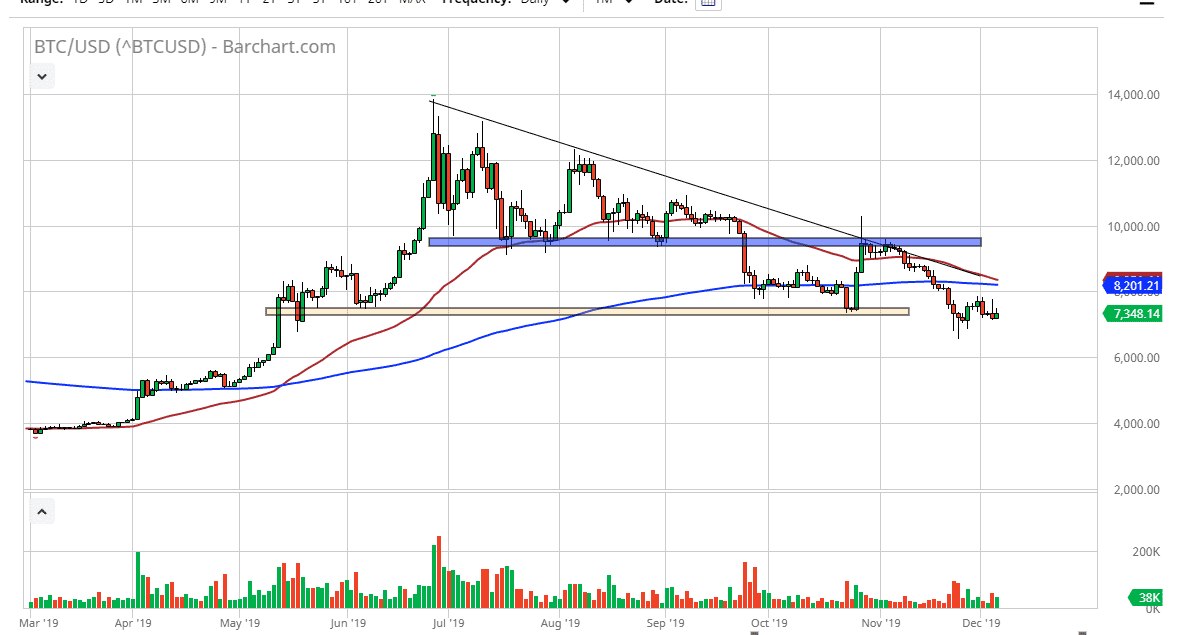

The Bitcoin market has gone back and forth during the trading session on Friday, as we continue to dance around the $7000 level. That of course is a large, round, psychologically significant number but I think at this point what we are seen as the market trying to decide whether or not it can break down a bit. All things being equal, we also have the 50 day EMA getting ready to cross below the 200 day EMA and that in and of itself will cause some issues as well. That is the so-called “death cross” that is very negative. It is worth paying attention that there is a downtrend line right there as well, so I think the resistance is far too strong to allow Bitcoin to move much higher from here.

If we break down and close below the $7000 level on a daily close, it’s likely that the market will then reach down towards the $4800 level, a longer-term target that I have established due to the descending triangle that we had broken down through at the $10,000 handle. We have bounced significantly previously due to the Chinese suggesting that they were going to research block chain, but have rolled over since then as the People’s Bank of China warned investors that buying Bitcoin wasn’t the same thing as crypto currency and black chain aren’t necessarily going to be connected in that scenario.

Another thing worth paying attention to is that the Chinese government seems to be hell-bent on cracking down on crypto currency flight from the country, and as China is one of the biggest users of Bitcoin that causes a lot of people to equate China with Bitcoin. At this point, the market is likely to see more downward pressure as the Chinese abandon Bitcoin, at least for the time being. I believe that we will eventually reach that $4800 level, but it may take a while to get there. In fact, it’s not until we break above the $9000 level that I would be pressed to consider buying this market. This is a horrible looking chart, and with the US dollar strengthening in general, that should continue to work against the value of Bitcoin. I have no scenario in which I want to buy this market at the moment, and then on top of that I believe that once we break down below the $7000 level, we will accelerate the downside again.