Bitcoin markets initially tried to rally during the trading session on Monday but gave back the gains to form a less than impressive candlestick. At this point it’s obvious that the market is going to continue to find sellers every time it rallies, and we can’t seem to pick up any momentum. There is no catalyst on the horizon anytime soon, although there is another change to the hash rate coming in 2020, doubling the effort needed to mine coins. That is the one thing right now that could offer a little bit of hope, but quite frankly it doesn’t look as if anybody cares.

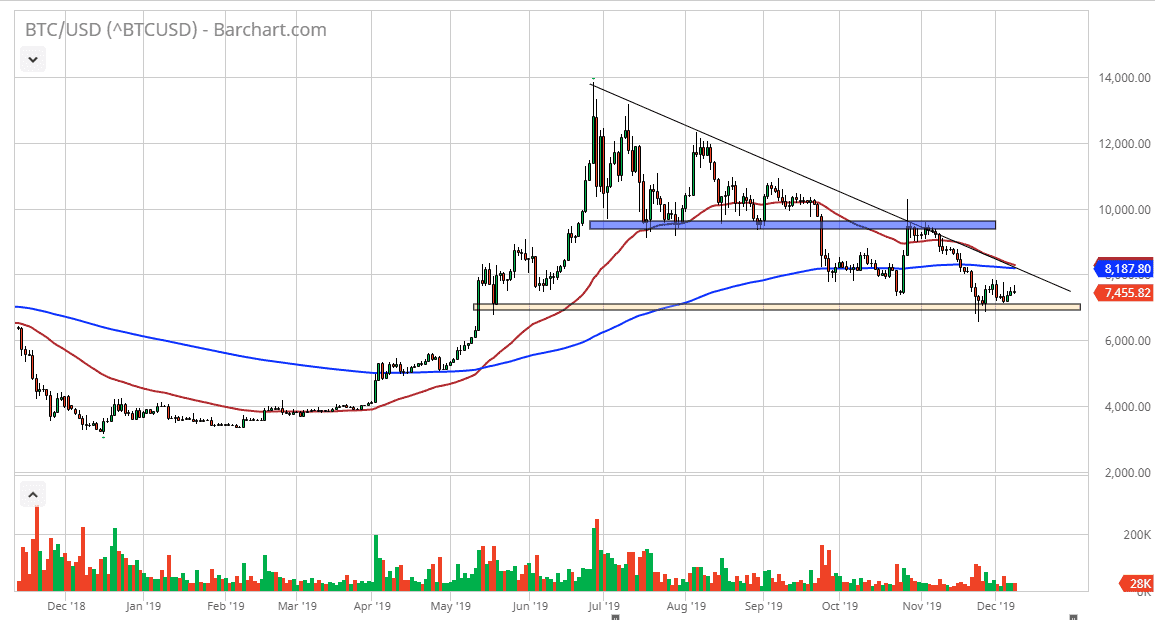

The $7000 level offers support from the standpoint of being a large, round, psychologically significant figure, so it doesn’t surprise me that we have bounced a bit from there. Ultimately though, I do think that we are building up enough pressure to finally break down and go much lower. The ascending triangle above broken through support at the $9000 level, and then turned around to break above there only to give back the gains and break down significantly. This was due to the Chinese announcing that they were looking to research block chain but has been squashed by the People’s Bank of China suggesting that block chain isn’t the same thing is Bitcoin.

Ultimately, this is a market that is likely to continue to be sold and based upon that ascending triangle that I mentioned that we could be moving down towards the $4800 level. That is my longer-term target, and I think it’s only a matter of time before we get down there. Having said that, there is the fact that the 50 day EMA is starting to break down below the 200 day EMA right at a downtrend line. These are a multitude of negative pressures, and it’s likely that we will continue to see those come into play as well. Otherwise, if we were to turn around a break above that level and perhaps test the $10,000 handle, then we can start to argue about the possibility of an uptrend but right now that looks to be far away in the future. Quite frankly, selling rallies has worked for months and I don’t see anything on this chart that tells me it’s going to be any different anytime soon. I remain bearish going forward, as the problems with Bitcoin continue to pile up.