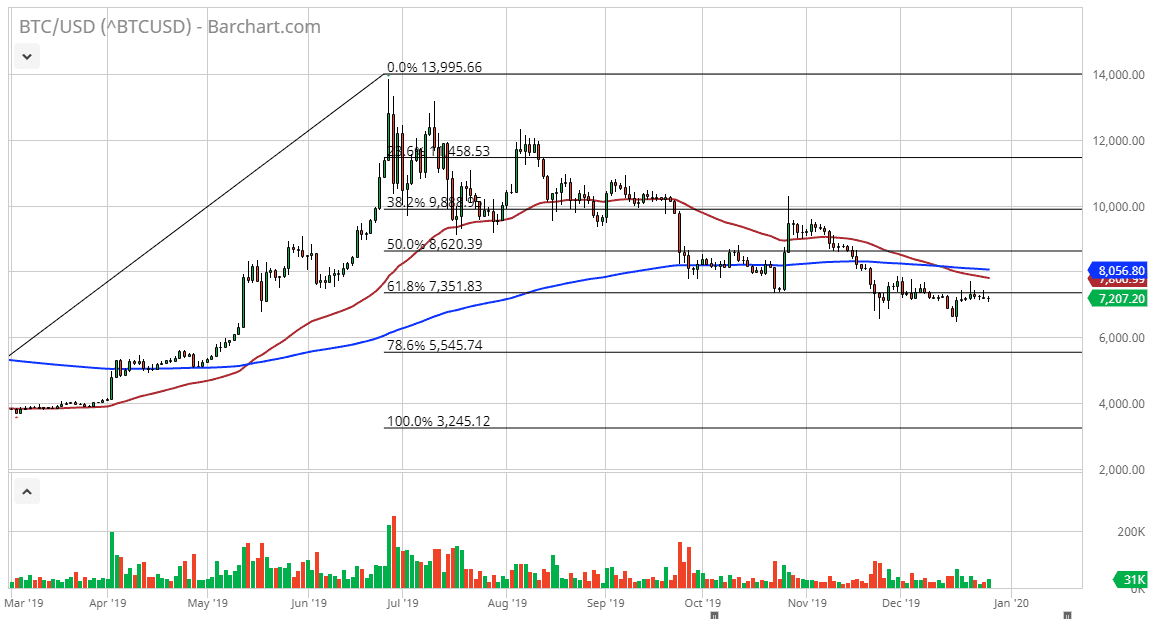

Bitcoin is very unlikely to do much during the remainder of the year, as we continue to hang around the $7200 level. That being said, looking at the longer-term picture it’s obvious that the bitcoin market simply do not have enough volume or interest in order to move the market. Quite frankly, volume has dropped off yet again and as we head towards the New Year’s Day celebrations, it’s difficult to imagine that Bitcoin is suddenly going to become a market that a lot of people will be interested in. With this being the case, one would have to assume that the longer-term trend should continue.

To the downside, I think that this market will probably break the lows given enough time, but this may be a story for January. Over the next couple of days, I would anticipate that the Bitcoin market could be subject to erratic moves, but it will be difficult to hang on to either gains or losses at this point because of lack of volume. Longer-term, I believe that Bitcoin is going to go much lower because nobody seems to care anymore.

That being said, there is a downtrend fully intact as the 50 day EMA has crossed below the 200 day EMA, and of course there was a previous descending triangle that measured for a move down to the $4800 level. That’s a longer-term target for me, but I do think that there’s nothing on this chart that suggests we can’t get there. With that in mind I think that rallies will continue to be sold as the 50 day EMA has been rather reliable, and now that we are well below the 200 day EMA, even longer-term traders will probably look at this as an opportunity to sell as well. Having said that, I do recognize that there are a couple of levels between here and there that should be paid attention to, not the least of which will be the $7000 level as it has a certain amount of psychological importance to it.

Below there, then we will have the $6000 level, and the $5000 level should be rather difficult. I anticipate that the $4800 level will probably be targeted based upon some type of short-term spike below the $5000 level, and at that point the downtrend may try to reverse. Having said that, there is nothing bullish about this chart so it’s not until we break above the $200 EMA at the very least that I would consider buying.