Australian consumer confidence rose slightly at the beginning of the month, and third-quarter house prices came in better than expected. Home equity creates the biggest wealth impact on consumers and generally leads to an increase in spending. The AUD/USD paused its advance but converted its short-term resistance zone into support. Consumer prices in China heated up as measured by the CPI, but pork prices carried the load in that report. Bullish momentum started to expand, and this currency pair is likely to attempt a breakout above its short-term support zone.

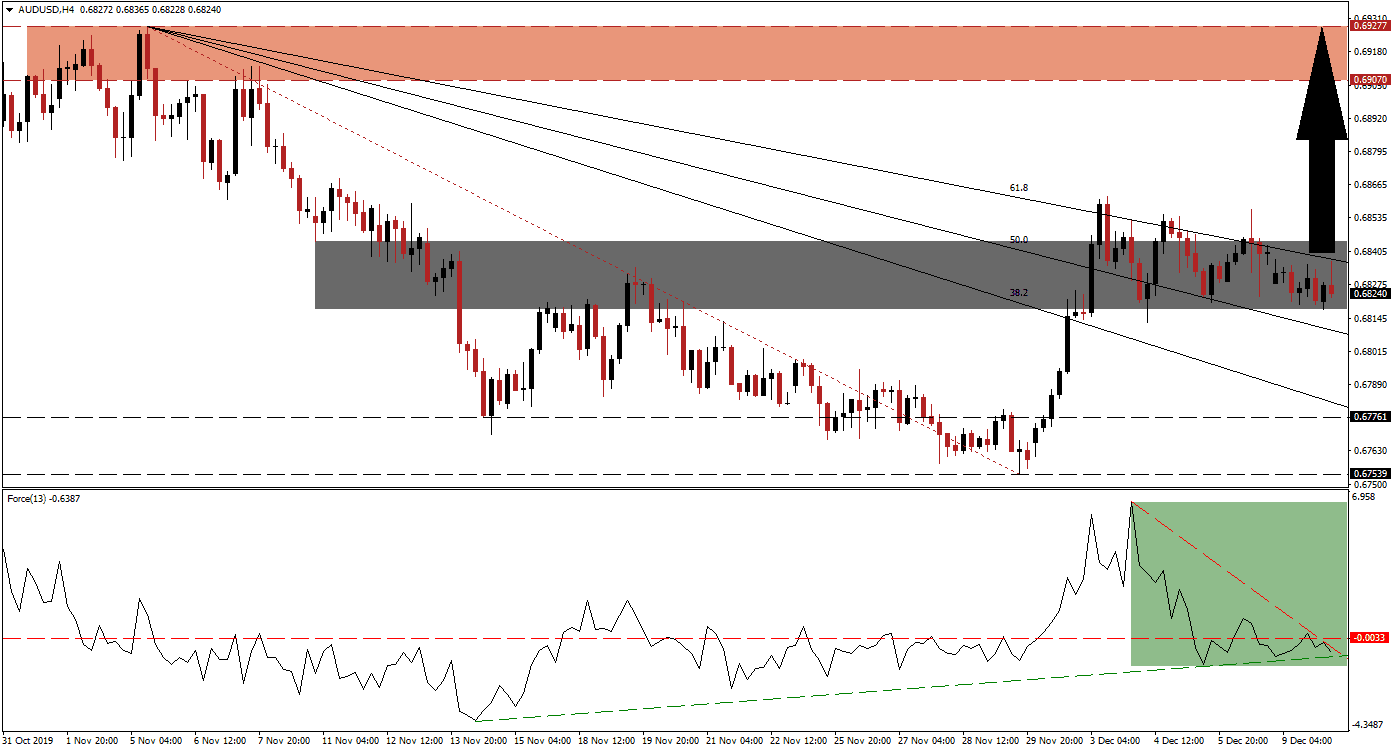

The Force Index, a next-generation technical indicator, contracted after price action pierced its descending 61.8 Fibonacci Retracement Fan Resistance Level to the upside. The descend was halted after the Force Index converted its horizontal support level into resistance, as marked by the green rectangle. An ascending support level was confirmed, a reversal to the upside followed but was reversed once again. This technical indicator is now expected to bounce off of its ascending support level, push through its steep descending resistance level, and back into positive conditions; this will place bulls in charge of the AUD/USD.

Price action was rejected three times by its 61.8 Fibonacci Retracement Fan Resistance Level. The short-term support zone located between 0.68179 and 0.68445, as marked by the grey rectangle, is expected to provide the AUD/USD with enough bullish momentum for a sustained advance. The 61.8 Fibonacci Retracement Fan Resistance Level has entered this zone, and pressures for either a breakout or breakdown have increased. Australian business conditions for November remained stable and countered the bearish impact of China’s CPI surge. You can learn more about the Fibonacci Retracement Fan here.

Forex traders are advised to monitor the Force Index, as a double breakout is anticipated to lead this currency pair into one its own. Another critical level to watch is the intra-day high of 0.68617, the peak of the previous breakout sequence; a move above this mark is likely to attract fresh net long positions in the AUD/USD. It will additionally clear the path for price action to advance into its resistance zone, located between 0.69070 and 0.69277, as marked by the red rectangle.

AUD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.68250

Take Profit @ 0.69250

Stop Loss @ 0.68000

Upside Potential: 100 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 4.00

Should the Force Index move below its ascending support level, the AUD/USD is expected to attempt a breakdown. Given the long-term bullish fundamental outlook in this currency pair, confirmed by short-term technical developments, the downside potential remains limited to its next long-term support zone; this zone is located between 0.67539 and 0.67761. Any potential descend into this zone should be considered a good buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.67850

Take Profit @ 0.67550

Stop Loss @ 0.68000

Downside Potential: 30 pips

Upside Risk: 15 pips

Risk/Reward Ratio: 2.00