The Australian dollar has been relatively quiet as of late, but when you think about it makes quite a bit of sense as the Australian economy is so heavily dependent on the Chinese mainland. As Australia is a major exporter of hard commodities to China, the US/China trade war continues to be a major thorn in the side of the Aussie economy. Beyond that, we also have a lot of concerns with the Australian housing market, and now it appears that the RBA is likely to be looser than tight going forward, so that will continue to weigh upon the currency.

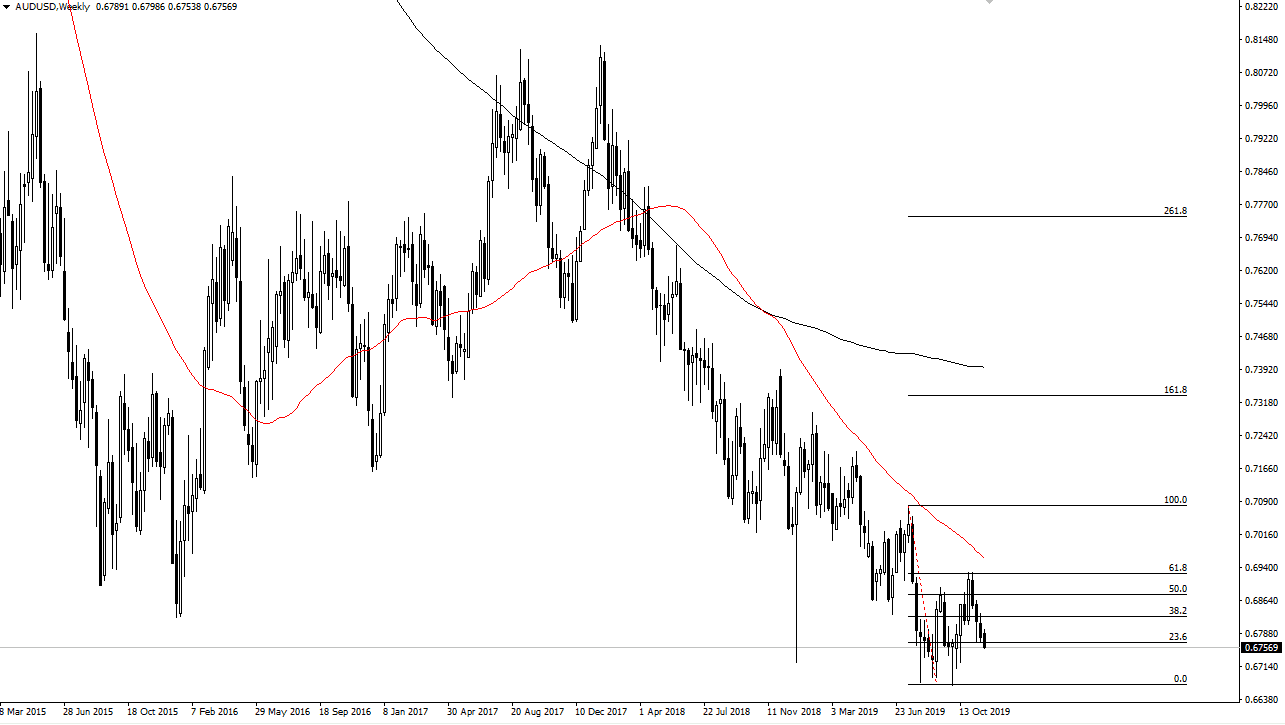

However, when looked at through historical prism, the Australian dollar trading near the 0.68 level is rather cheap. I also recognize that there is a lot of support at the 0.67 handle, and I think that level will be what tells the tale going forward. As long as the market can stay above the 0.67 handle, it’s likely that there are a certain amount of value hunters out there getting involved. If that’s going to be the case, we may be getting close to the bottom here for the Australian dollar. This will be especially true if the Americans and the Chinese come to some type of an agreement for a “Phase 1 deal.” That will probably send money into the Australian dollar hand over fist, as it will certainly have a major “knock on effect” on Oz.

With that being said, if we do break below the 0.67 handle the market will then go looking towards the 0.65 level because it is not only a historically supportive level, but it is also a large, round, psychologically significant figure. That would almost undoubtedly be due to some type of increase in tension between the Americans and the Chinese, but as of late we have seen a lot of movement towards positivity. It is because of this that I suspect the Australian dollar may be a bit soft in the beginning of the month of December, but by the end of the year should start turning around. I anticipate that we are close to a major trend change in the Australian dollar and a move above the 200 day EMA would certainly be the first major step in that direction. I anticipate that 2020 will be a relatively decent year for the Australian dollar with December being more base building. If you are a longer-term trader, it may be a good time to start building up your core position.