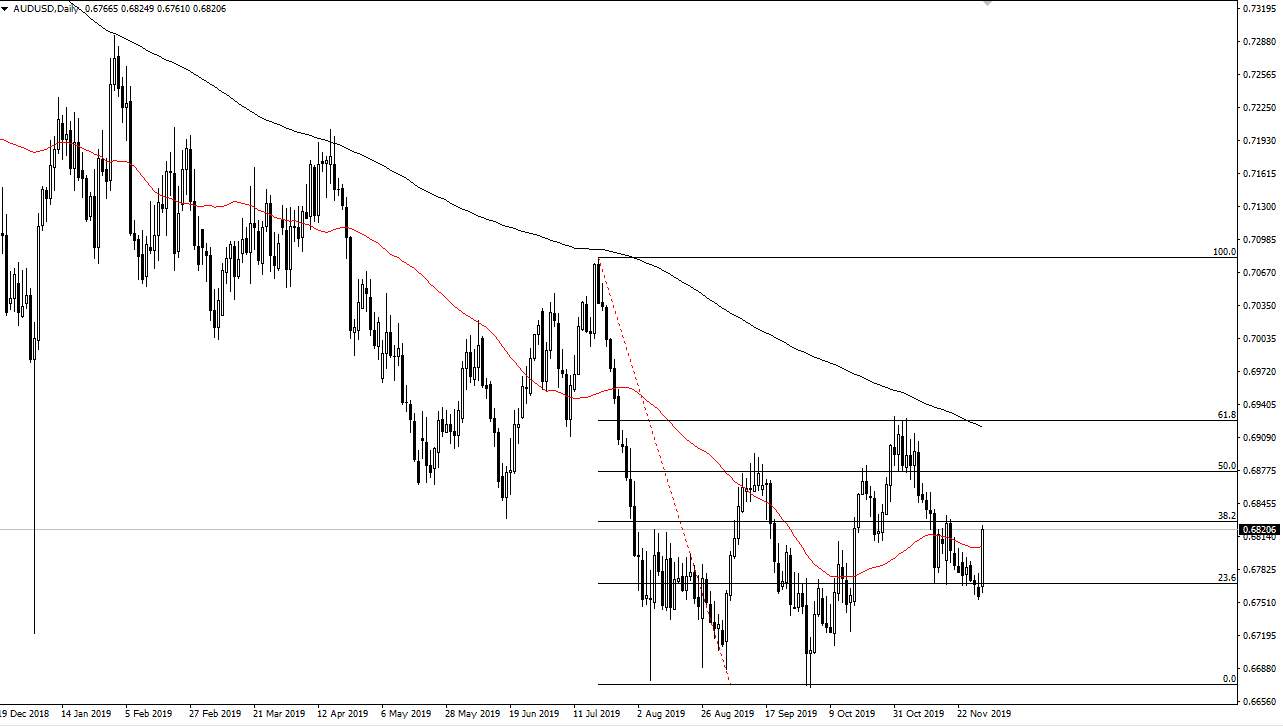

The Australian dollar exploded to the upside on Monday, as there are signs of hope coming out of China when it comes to manufacturing figures. Keep in mind that the Australian dollar is very sensitive to the Chinese economy, so it should not be a huge surprise at all. That being said though, we are testing a major short-term resistance barrier in the form of the 0.6825 level so it’ll be interesting to see if we can continue this move.

If we do break out above the 0.6850 level, then it’s likely we go looking towards the 200 day EMA. If we can break above the 200 day EMA, that might be the beginning of the end of the downtrend. While that is still about 80 pips above, I’m more than willing to wait for that to happen because I recognize it as a major trend change. At that point, it’s very likely that the market would continue to go higher for the longer-term. That being said, the RBA is likely to do a bit of quantitative easing, so it’s more than likely going to be a situation where that the Australian dollar completely ignores Australia itself.

Beyond that, even if the RBA was to do quantitative easing, the idea of better than anticipated Chinese numbers suggest that it’s only a matter of time before Australian commodities companies start to produce again for China, and in massive amounts. As China goes, so goes Australia. This is a very bullish candlestick, and it does in fact suggest that there is a certain amount of impulsivity to the move. However, we have seen this market gets quashed almost immediately due to the occasional headline, so I would be cautious about throwing too much of a position into the market right away. However, building up a small core position is also possible as well. Longer-term, I believe that once we break above the 200 day EMA, then it becomes more of a “buy-and-hold” scenario going forward. To the downside, the 0.67 level underneath is massive support, considering that it is the scene of a “double bottom” that we have seen. If we were to break down below there it’s likely that the Australian dollar goes down to the 0.65 handle, which is a large, round, psychologically signal and likely to cause another fight as well. Ultimately, this is a market that has just possibly formed a “higher lows”, but it’s still early days.