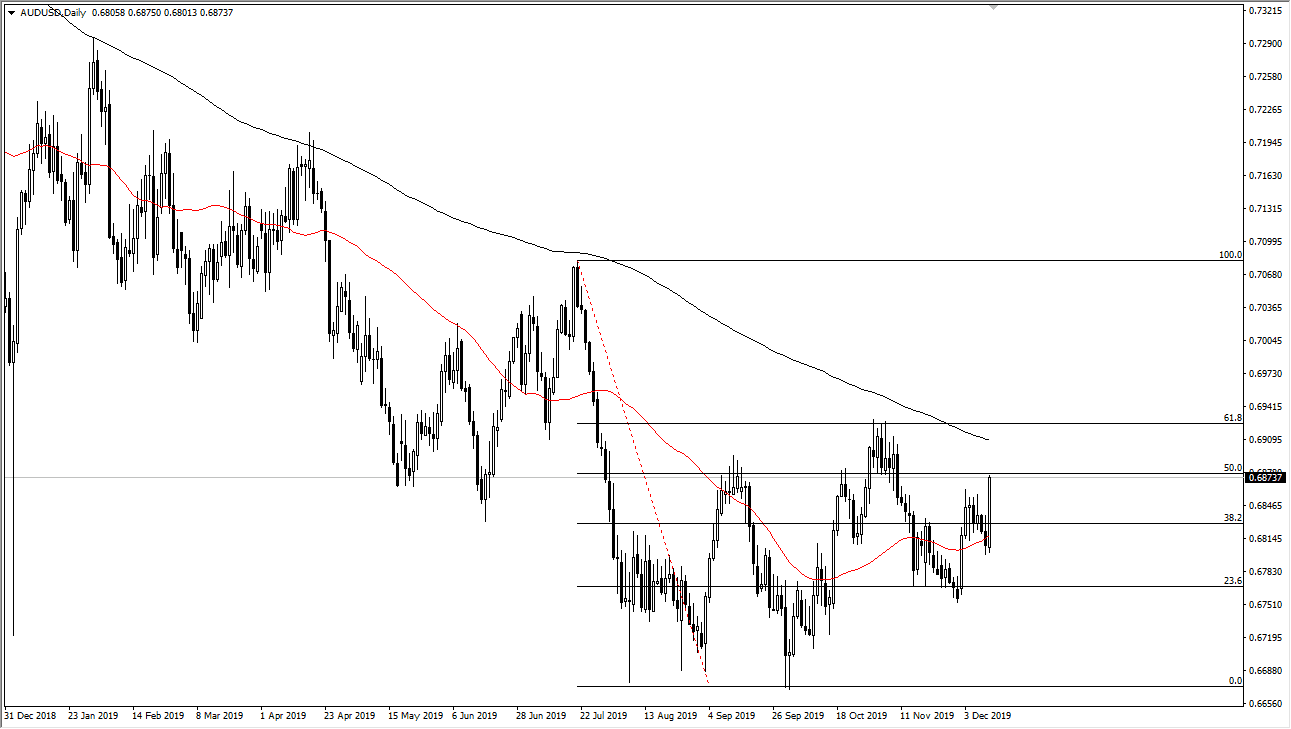

The Australian dollar has broken higher during the trading session on Wednesday, slicing through the short term resistance that has been a major thorn in the side of Australian buyers. That being said though, we still have the 200 day EMA just above that will continue to cause resistance. Furthermore, we have the 61.8% Fibonacci retracement level as well, and therefore it does look like we are trying to make a major breakout. However, this is a market that is highly sensitive to the US/China trade talks, and with the Sunday deadline past approaching, we could see a lot of back and forth. Ultimately, if the situation deteriorates, that will weigh upon the Australian dollar.

The Aussie got a bit of a bid due to the “risk on” type of situation, and of course the Federal Reserve suggesting that it was going to be a relatively high bar to cross for interest-rate hikes. This weight upon the greenback in general and therefore sent this pair higher. The 200 day EMA is just above though, and that of course will cause significant issues. I think at this point we are likely to sell off again, but one thing that I have noticed is that we continue to make “higher lows” and had recently made a bit of a “double bottom” at the 0.67 level. This could be the beginning of something rather bit but these trend changes tend to be very difficult and tend to be very noisy. I like the idea of going long on pullbacks, as long as we don’t make a “lower low.”

Ultimately, the 0.70 level will of course cause a lot of issues due to the fact that it is a large, round, psychologically significant figure. The 100% Fibonacci retracement level is just above there as well, so it’s likely that we will see a little bit of a pullback from there as well. At this point, it looks as if the Australian dollar is trying to make a stand and turn things around, but this is a process, not something that just happens overnight. I am cautiously optimistic but recognize that serious deterioration between the Americans and the Chinese will take everything off the table as far as bullish pressure in the Australian dollar is concerned. With that, I remain looking for short-term pullbacks in order to take advantage of, but I would also do this trade in small bits and pieces.