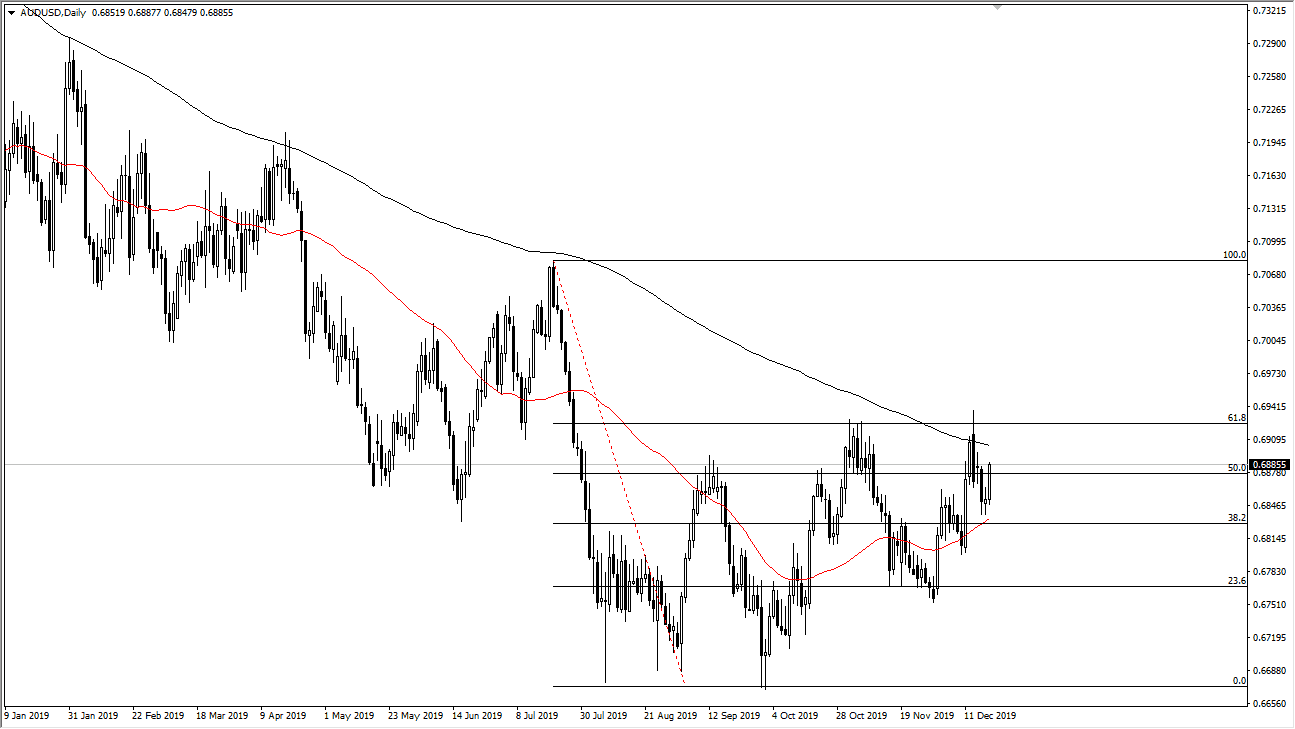

The Australian dollar has rallied quite nicely during the trading session on Thursday, as it looks like we are going to go hunting for the 200 day EMA. With that being the case is very likely that we will see sellers in that area, as the Australian economy has produced more jobs than anticipated. With that, and the possibility of a potential trade deal actually going through, that should continue to live the Australian dollar.

From a technical analysis standpoint, this is a market that is trying to break above that 200 day EMA and if and when it does, it’s very likely that we will continue higher over the longer term. The 61.8% Fibonacci retracement level being broken above is a very bullish sign, perhaps reaching towards the 0.71 area. To the downside I see the 50 day EMA as potential support, just as the 0.68 level should be as well. Overall, this is a market that should continue to cause a lot of back and forth and choppy behavior as we are in the holiday season and momentum and volume will continue to drop. That being said, it’s very likely that the markets will put traders to sleep between now and New Year’s Day. Having said that though, if the United States were China gives the markets some type of headline when it comes to the trade war, then we could get some momentum. The better the headline for growth, the better things will be for Australia.

I do believe that the market is trying to form some type of longer-term bottom, and it should continue to offer the opportunity for a longer-term trade, especially if we get good headlines coming out of the trade situation as mentioned previously. Once we do break above the 61.8% Fibonacci retracement level and perhaps even the 200 day EMA, it’s likely that we will have seen the bottom. We have made a series a “higher lows” lately, just as we have seen a double bottom underneath at the 0.67 handle. With all that being said I think it’s only a matter of time before we break higher. I have no interest in shorting the Australian dollar, lease not in the near term, but if we were to break down below the 0.67 handle, the market probably collapses to the 0.65 level next. All things being equal though I do think that we are going to go higher.