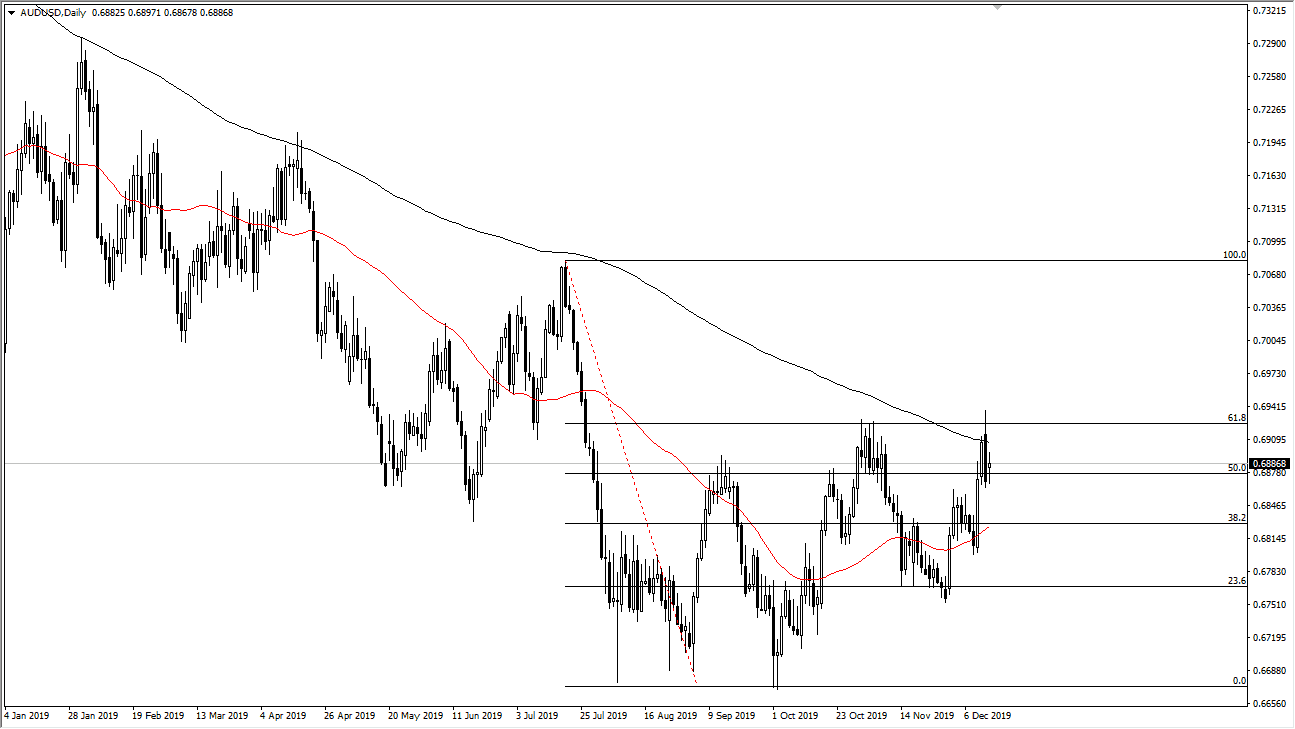

The Australian dollar is highly sensitive to the US/China trading situation, and as we reached the “phase 1 deal”, one would think that the Australian dollar would have shot higher in the air. Quite frankly, it’s been the exact opposite so therefore it is a bit interesting to watch this market. We had initially tried to rally but then turned around to break down significantly. The 200 day EMA has offered significant resistance, and as a result it looks like the longer-term trend is still intact for what we see. The market forming the bearish candle that it did on Friday was a bit telling. Monday had a gap higher, but we could not hang on to the gains. Ultimately, this is a market that looks very likely to be a bit soft going forward, or at the very least a bit sideways. The 0.6950 level above is significant resistance, and if we were to break above that we would officially break out of this little area. Otherwise, a pullback makes quite a bit of sense for a minor correction.

The 50 day EMA is trading at roughly 0.6820 and turning higher. As the 50 day EMA and the 200 day EMA converge, it’s very likely this market continues to chop based upon the most current headline. The Australian dollar is very likely to continue to be difficult to trade but as we have seen recently the 0.67 level has been a bit of a “double bottom”, but then rallied from there and has formed several “higher highs” since then. At this point, the 0.68 level offers support as well, so as long as we can stay above there then it’s likely that we will eventually break out. Short-term pullbacks might be buying opportunities but in the next couple of days it is very likely that this market is going to continue to go back and forth and make a lot of people miserable. Day trading might be the best way to go, but once we get above that 0.6950 level it becomes more of a “buy-and-hold” type of strategy, recognizing that building a core position is probably the best way to go. At that point I would be more than willing to add to my position as time goes on and the market moves of my favorite. At this point, look for value but don’t use huge positions.