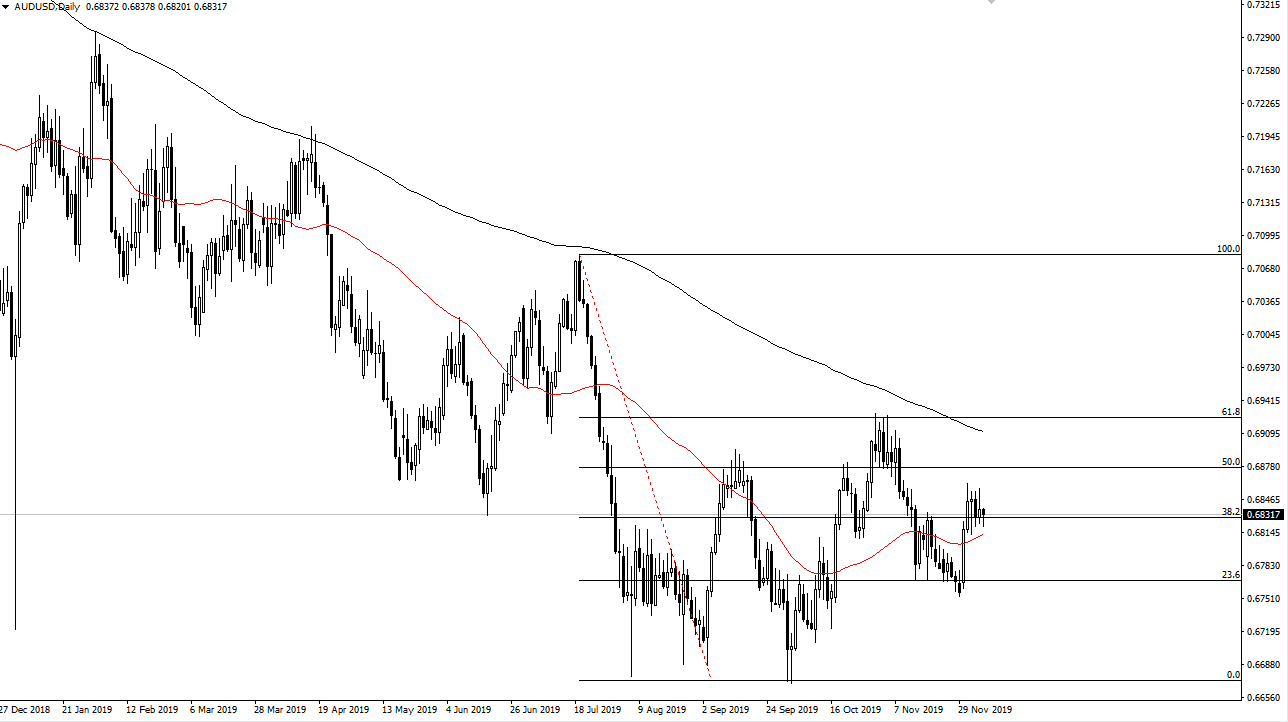

The Australian dollar initially fell during the trading session on Monday but continues to find support underneath at the 50 day EMA. This is an area that has offered to support and resistance more than once, and it’s likely that we will continue to go back and forth as uncertainty is a major concern. The Australian dollar has been very choppy waiting on the Americans and the Chinese to get it together, but right now looks as if nobody is ready to blink an eye. That being said, there have been at least hints of positivity coming out of this conversation, and it’s likely that the markets are trying to price that in but are going to be very hesitant.

If we were to break down below the 50 day EMA, then it’s likely that the market should go down to the 0.6775 level. That is the most recent low, and it is higher than the previous one. Alternately, if we can break above the 0.6875 handle, the market probably goes looking towards the 200 day EMA. If we were to break above there, then the trend change is in fact done, and it’s a “buy on the dips” type of experience that you can expect going forward. This doesn’t mean that there will be a lot of headlines that cause volatility, but the Australian dollar is extraordinarily cheap from a historical perspective, especially if trade starts to pick up globally.

Chinese numbers have been all over the place, but at the start to pick up it may not even be a need with the Chinese trade war cooling-off, rather it could be a scenario where people are simply paying attention to economic numbers picking up around the world as far as exports are concerned. We have seen the Japanese Q3 GDP come out twice as strong as anticipated, and this of course is highly due to exports. While they are benefiting a bit from the Chinese trade war, the reality is that we are also starting to see signs of life in Germany as well. This means it’s only a matter of time before people start to take on more risk, and therefore could send the Aussie higher in general. If we were to break below the most recent low, then it’s likely we could go down to the 0.67 handle where we have had a double bottom.