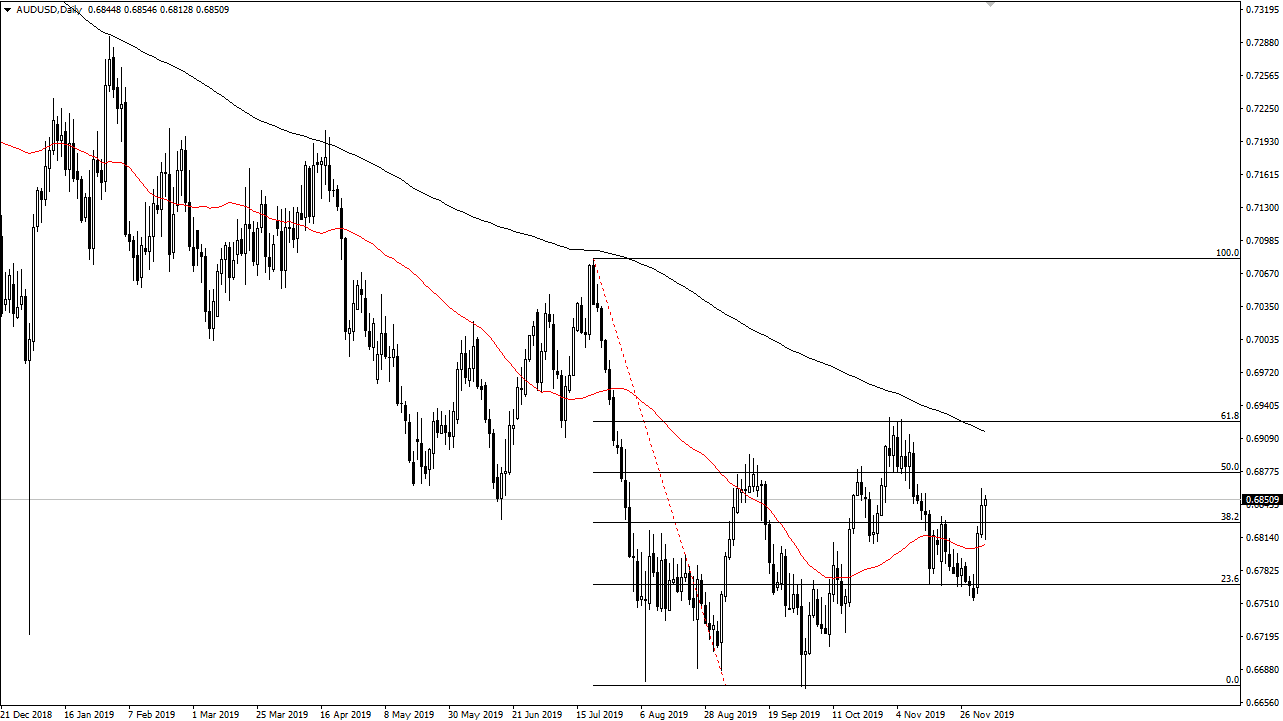

The Australian dollar pulled back a bit during the trading session on Wednesday, reaching down towards the 50 day EMA. However, we have found enough support there to turn things around and bounced enough to form a hammer. This suggests that there is going to continue to be a strong currency, as it looks like we are trying to turn the whole thing around. We recently formed a “higher low”, which is the first sign of a potential trend change.

At this point, the market looks as if it is trying to turn things around like I said, but it is going to take a significant amount of effort to finally break things to the upside. Pullbacks at this point continue to attract a lot of attention, and unless we get some type of massive negative headline coming out of the US/China trade situation, is very likely that the Australian dollar will continue to attract a lot of attention. The Australian economy isn’t exactly humming along, but at this point it’s likely that the traders around the world will be paying a more attention to the Chinese economy and trading the Australian dollar based upon it.

Overall, this is a market that continues to find buyers on dips, and I think that the 0.68 level, the 0.6775 level, and even the 0.67 level offer opportunities to buy the Australian dollar “on the cheap” again. All things being equal, if the market were to break down below the 0.67 level then it would break down rather significantly, perhaps reaching down to the 0.65 level. To the upside, the 200 day EMA is going to be significant resistance, and if we can break above there would be a good sign. Beyond that, if we can break above the 61.8% Fibonacci retracement level at the 0.6950 handle, then it’s a new high that allows the market to continue to go much higher. This would be the beginning of the overall trend change and begin more of a “buy-and-hold” type of scenario. I anticipate that if we get some type of trade deal between the Americans and the Chinese, this is the first place money will start to go to, as the market will continue to see a lot of value in the historically cheap levels that we are trading at right now. Quite frankly, if the Chinese economy starts to pick up again, and it is showing signs of stability, that should be a good sign for Australia as well.